De-dollarization Will Increase Demand for Owning Gold

World economies reel from vital supply shortages and soaring inflation from war in Europe

PUBLISHED BY JULIEN CHEVALIER | APRIL 01, 2023

“Accelerated De-dollarization Will Increase Demand for Owning Gold”. At the Bretton Woods conference in the United States in July 1944, the two protagonists, John Maynard Keynes and Harry Dexter White, one British, the other American, prepared the construction of the international monetary system.

While Keynes advocated the creation of an international currency – the bancor – White defended the idea of a gold standard system in which all currencies were indexed to the dollar.

As the United States possessed the bulk of the yellow metal reserves, this system allowed Uncle Sam to impose the American currency as the world’s reference currency. At the end of the summit, White’s proposal was accepted. For more than half a century, the United States has thus established its domination and subjected many countries to its policies and those of its central bank.

While history shows that the United States is prepared to do anything to defend its monetary supremacy, several events have given rise to a de-dollarization movement that continues to grow. But where are we headed with this new monetary system? Any significant movement will not happen overnight.

The 2022 Gold Rush: Ukraine war shocks precious metals market

While the “de-dollarization of the world” began several years ago, the US dollar is stronger than it has been in 20 years and the U.S. currency remains dominant. However, WGC indicates that world events like the Ukraine invasion and soaring inflation continue to drive gold demand and price.

The war in Ukraine seems to be a gas pedal of trends. In addition to pitting Russian armed forces against Ukrainian, American and European forces, this conflict is also giving rise to the construction of two distinct blocs: that of the West and the dollar on the one hand, and that of the countries seeking a new international monetary system, mostly located in the East, on the other.

The Almighty Power of the American Currency

By succeeding in imposing the dollar as the international reserve currency, the United States has succeeded in imposing monetary hegemony and thus in incurring massive debt, with the privilege that this debt will always be bought up by foreign investors. By doing so, the country can afford to continually increase its deficit without its currency depreciating.

This is a considerable advantage that contributes greatly to making the United States the world’s leading economic power.

Although this privilege was difficult to maintain under the gold standard system, because the United States had to constantly increase its stock of yellow metal in order to be able to go into debt and thus finance, among other things, the “Great Society” project and the Vietnam War, the end of the Bretton Woods Agreement in 1971, followed by the Jamaica Accords in 1976, enabled it to maintain this supremacy.

Thanks to the removal of limits on money creation and the development of floating exchange rates, the United States was able to continue the policy it had pursued since 1945 and even intensify it. John Connally – then U.S. Secretary of the Treasury under the Nixon administration – declared: “The dollar is our currency, but it’s your problem.”

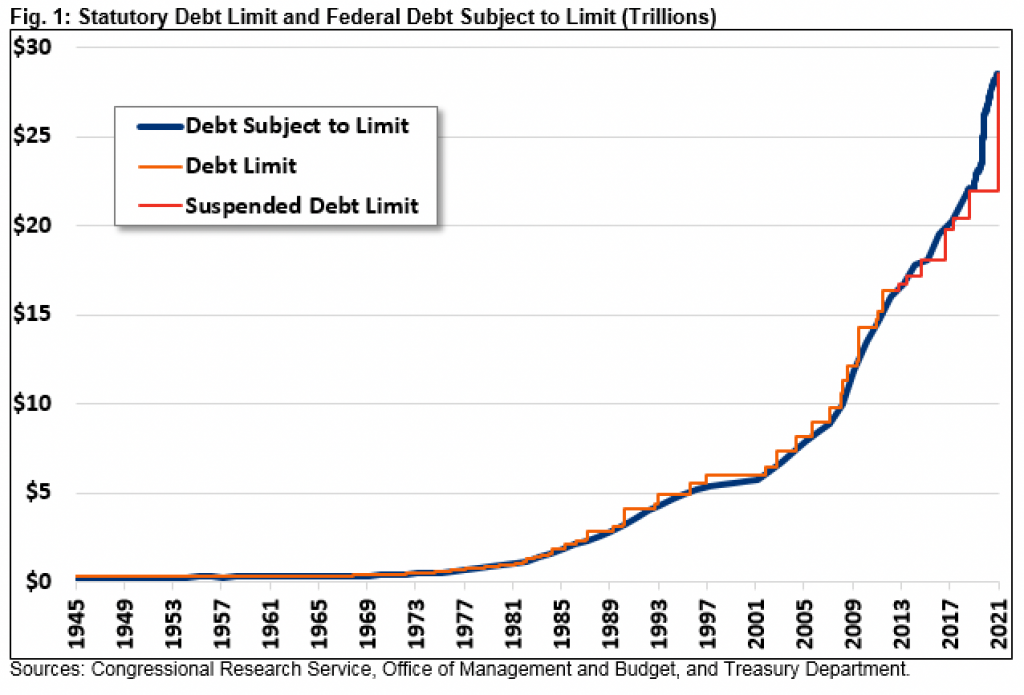

For more than 40 years, despite the ceilings established by Congress, the U.S. debt has continued to grow. In 1971, it was about $450 billion. Today, it is $30 trillion. If the reign of the dollar continues, it is also thanks to what is known as the “petrodollar.”

Due to the ignorance of the British about the presence of oil in the Arab subsoil, but also the reluctance of the countries of the Persian Gulf in the face of the interference of the United Kingdom in the region following the fall of the Ottoman Empire in 1922, the United States succeeded in getting closer to the countries of the Gulf by signing a strategic agreement with Saudi Arabia in the Quincy Pact on February 14, 1945.

The Saudi King Ibn Saud and the American President Franklin D. Roosevelt agreed on an alliance aiming at giving the United States access to Saudi oil fields in exchange for military protection in the region.

But in 1973 the first oil shock occurred. Due to the peak of oil production in the United States and the depreciation of the dollar – on which oil prices are based – the price of black gold collapsed. To make up for the accumulated losses, OPEC members agreed to increase the price per barrel by 70%.

Understanding the importance of oil as the world’s primary source of energy at a time when the decline in production on American soil was only just beginning, the great American negotiator Henry Kissinger – then Secretary of State under President Nixon – concluded a new agreement with Saudi Arabia based on the Quincy Pact.

With the promise of a strong dollar, permanent arms sales, and increased military support in the Persian Gulf region, the United States was able to ensure that every barrel of oil would be traded in dollars. As a result, the majority of commodity trade was conducted in US currency. In other words, it became essential to have dollars – and therefore to finance the American debt – to acquire these vital resources.

After Several Strategic Mistakes, the Wind Changes

The increased use of the extraterritoriality of U.S. law – particularly the Foreign Corrupt Practices Act of 1977 – has inevitably increased the reticence of foreign countries towards the United States.

The fact that the possession of dollars by a foreign company makes it immediately liable to investigation when it violates U.S. law has contributed to the fact that the U.S. currency is no longer just a tool for monetary domination, but also a legal lever for coercion that endangers the sovereignty of all economic agents. Many French, Chinese, Iranian, etc. companies have paid the price.

In addition to this, numerous embargoes have been put in place (Iran, Venezuela, Afghanistan, etc.), as well as the threat of exclusion of certain countries from the SWIFT interbank messaging system, a Western geopolitical tool now dominated by the Americans. By isolating a bank from this network, the transfer of payment orders stops, which amounts to making the financial institution virtually inert.

Iranian banks were notably excluded in 2012 as the country accelerated the development of its nuclear program. Two years later, the United States issued the possibility of suspending Russian banks from the network following the annexation of Crimea.

Entering the danger of dependence on the Western system, Russia creates its own Russian financial messaging system named SPFS in the aftermath.

For its part, China established a local network in 2015: the CIPS program. This system offers clearing and settlement services for cross-border trade in yuan. Four years later, European countries followed suit by establishing the INSTEX network following the unilateral withdrawal of the United States from the Vienna Convention on Iranian nuclear energy.

But President Trump quickly called them to order and threatened that those who used it would no longer be able to trade on American soil. While the European system is only marginally used, the Russian and Chinese systems are booming.

In addition to attracting numerous partners such as Iran, India and Turkey, they have succeeded in accelerating the de-dollarization movement, which is reflected in a decrease in dollar reserves worldwide. Thus, while the dollar represented 66% of global reserves in 2014, it now represents only 58.8% of reserves, to the benefit of the euro, the yuan and gold.

Although the leaders of this movement remain the “strategic rivals” of the Americans – i.e. China and Russia – several countries are beginning to turn their backs on the United States and the dollar in order to move towards China and the yuan.

This is notably the case of Israel, which recently announced that it was reducing its dollar reserves (by more than 5%) and adding yuan for the first time (in a still very small amount). This is also the case of Brazil, which has chosen to reduce its dollar reserves in 2021 (from 86.03% to 80.34%), in favor of the yuan (share evolving from 1.21% to 4.99%). Other countries, such as Nigeria and Iran, did the same a few years earlier.

In this context, if the war in Ukraine can be explained by multiple geopolitical reasons (energy, NATO enlargement, internal conflicts, etc.), the fact remains that the long strategy of de-dollarization of Russia remains a major source of tension between the United States and the Kremlin.

In 2013, 95% of Russia’s hydrocarbon sales to the BRICS were traded in US currency. In 2021, it was less than 10%. A radical change when we know that Russia is one of the main producers of oil in the world, that raw materials contribute to more than half of the country’s exports, but that they remain, above all for the United States, the means to maintain their monetary supremacy.

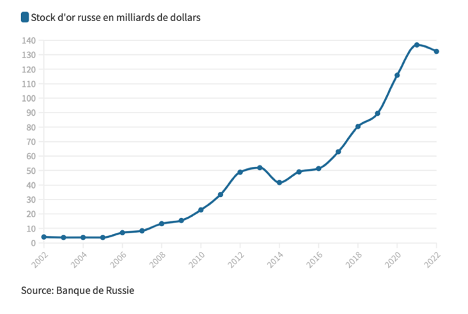

In addition, the Russian central bank has been steadily reducing its dollar reserves since 2014. Today, the US currency represents only 16.4% of its reserves. As for the euro, it constitutes 32.3% of reserves, gold, 21.7% (driven in particular by the purchase of 40 billion dollars of gold over the past five years) and the yuan, 13.1%.

A strategy that today allows to limit the effects of the recent economic sanctions taken by the West against Russia.

If the exclusion of Russian banks from the SWIFT system following Russia’s invasion of Ukraine was predictable, the freezing of the central bank’s assets was much less so. This decision risks increasing the mistrust of foreign countries towards Washington, much more than towards Europe, which does not have the monetary hegemony, but especially does not have the habit of using this type of measure.

According to to IMF Managing Director Gita Gopinath, these sanctions threaten to gradually “dilute the dominance of the U.S dollar” and result in “a more fragmented international monetary system.” In particular, she explains that this will result in “slow-moving trends toward other currencies playing a bigger role.”

Despite the Sino-Indian border conflicts, the Russia-China-India alliance, with a population of 2.8 billion – more than a third of the world’s population – is growing stronger with the conflict in Ukraine. Beyond the intensification of their trade since the beginning of the war, these countries are beginning to trade some of their raw materials in their national currencies.

With the idea of seeing the yuan go global, and in a bid to weaken the dollar, China paid for its recent coal deliveries to Russia in yuan. Russian oil sellers are proposing to do the same.

For its part, India is exploring the possibility of settling its trade with Russia in rupees.

At the same time, some countries are taking advantage of this situation to blackmail the Americans. Following the recent negotiations with Iran and President Biden’s multiple statements aimed at ending US support for the war in Yemen, Saudi Arabia says it is mulling the idea of trading its oil with China in yuan rather than dollars.

Since Riyadh plays a major role in the strength and durability of the U.S. currency, this threat could be a bombshell if adopted. But the Saudi prince is not alone in his desire to do so. Brazilian candidate and former president Lula da Silva, recently revealed that if elected in October, he would introduce a single currency in Latin America in order to “end US dollar dependency.”

The fact that many countries and major powers, such as India and China, are increasing their trade with Russia – which is responsible for the war in Ukraine – in their national currencies, is not only a sign of a marked desire on the part of these countries to put an end to the hegemony of the dollar, but also, and above all, of the powerlessness of the United States in the face of a movement that is now united.

In this respect, recent public statements by politicians and major banks mark a notable change in communication. While it was rare to hear about it before, the subject is increasingly being discussed these days.

At a time when democracy and the U.S. financial system seem to be under threat, the acquiescence of the U.S. to this situation invites us to reflect on the prospects for the continued growth of this anti-dollar movement.

The Emergence of a New Monetary System at the Dawn of a New Globalization?

In a research paper produced by Goldman Sachs, analysts point out that the U.S. currency is currently facing many of the same challenges as the British pound did in the early 20th century, when it held the status of international reserve currency.

Indeed, the deterioration of the net foreign asset position, the development of potentially adverse geopolitical conflicts, and the small share of global trade volumes relative to the currency’s dominance in international payments are challenges similar to those faced by the United Kingdom and the British pound prior to the Great Depression.

If the years that followed reshuffled the deck on a new international monetary system, there is every reason to believe that the decade ahead could be much the same.

Gold investments during inflation

The U.S. dollar is no longer backed by gold or any other precious metal, and Federal Reserve notes have not been redeemable for gold since 1934 and not being tied to our currency actually makes it safer for investors. Although the U.S. currency remains dominant for the time being, its hegemony is increasingly under attack and the power of certain payment methods is growing.

In addition to the rise of crypto-currencies giving rise to Central Bank Digital Currencies – projects that are being seriously considered by monetary institutions – the internationalization of the yuan and the increase in gold reserves around the world are signs that several currencies could eventually compete with the dollar.

While China has long resorted to currency devaluation to support its exports and continue its economic expansion.

The increase in China’s share of global GDP, its strong technological development, the country’s regional power, the liberalization of its exchange rate regime, the introduction of the digital yuan, the development of its own banking messaging system, the increase in the share of the Chinese currency in SDR, and the creation of a single financial regulator, are all factors that allow for the internationalization of the yuan.

However, the extension of this long-term strategy implies some sacrifices. China must invest massively and become a net exporter of assets or a trade deficit country. Capital controls must be abandoned and access to the yuan in the world must be unlimited. In view of the country’s economic policy in recent years, the development of the yuan therefore requires the implementation of structural reforms.

For its part, gold remains a strong competitor. The yellow metal is particularly popular with countries that want to de-dollarize. Central banks that bypass the dollar system of financing are the ones that have bought the most gold over the last twenty years.

China and Russia have massively invested in gold, as have Turkey, India and Kazakhstan. Gold now constitutes one-sixth of global central bank reserves, equivalent to nearly $2 trillion. The acceleration of de-dollarization will therefore inevitably lead to an increase in the demand for gold.

But the assumption of a multipolar monetary system implies a continued decline in the dollar’s importance and the rise of these competing currencies. Assuming that such a scenario occurs – which requires several years and many changes – the U.S. financial situation will be transformed.

The reduction of U.S. bond purchases around the world will inevitably lead to a depreciation of the dollar. To make up for this fall, the United States will have no choice but to raise its real interest rates to sufficiently high levels. This could have significant effects on the country’s consumption and growth.

This de-dollarization strategy is being implemented gradually, especially because a sudden depreciation of the U.S. currency would have devastating consequences for certain countries, particularly the United States’ main trading partners.

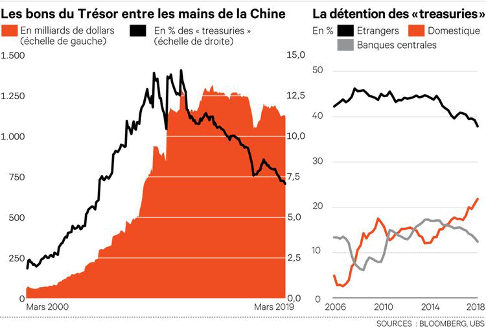

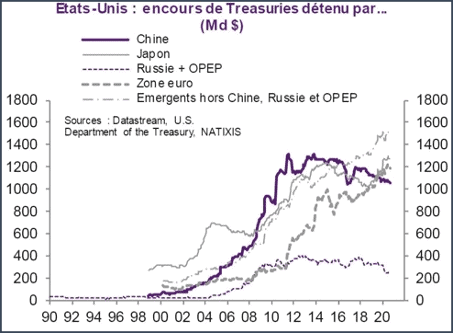

As part of its protectionist policy, China has massively purchased dollars in recent years. The country has about $1 trillion in U.S. bonds and more than $3 trillion in reserves. A sudden fall of the US currency would lead to colossal losses for the Middle Kingdom. China has therefore been gradually reducing its purchases of treasuries since 2014.

Europe, and Germany in particular, is continuing to buy US Treasury bonds, thereby financing the country’s deficit. The acceleration of de-dollarization could therefore strongly affect the value of assets held by European countries.

This scenario would also have serious consequences for certain emerging countries, as they continue to be net buyers of US bonds because of their financial vulnerability.

If the hegemony of the dollar persists, the acceleration of de-dollarization adds a new challenge to the US central bank, in a context of high inflation and declining financial markets in the country. At the same time, the slowdown in globalization and the increase in economic and geopolitical rivalries are evidence of a desire – on the part of many countries – to change the paradigm.

The growing desire to resort to monetary sovereignty is manifested by a gradual liberation from the use of the dollar in favor of other currencies. In this respect, and for other reasons, the war in Ukraine risks creating a bipolarization of the world that adds to the many elements of rupture.

But under what conditions would the United States accept to see the place of the dollar erode to the point of losing its dominance and living below its means after more than half a century of privilege? Beyond reflecting on the future of the international monetary system, this change of era could be an opportunity to think about a new form of monetary creation that would promote global stability.

Notes :

The gold standard is a monetary system in which the monetary unit is defined in reference to a fixed weight of gold. The amount of money issued by the central bank is strictly limited by its gold reserves. Since gold reserves are not infinite, countries could not, through their central bank, afford to create money as they wished

https://multipolarista.com/2022/05/04/brazil-lula-latin-america-currency-us-dollar

SDRs (Special Drawing Rights) are the currency that the IMF can issue. They are generally used to meet liquidity needs in the event that a country suffers a financial crisis. SDRs are based on five major international currencies: the dollar, the euro, the yen, the British pound and the yuan since 2016. The International Monetary Fund “creates money” by relying on the central banks of issuing countries.

When a country decides to borrow SDRs from the IMF, it gets the means to convert its SDRs into one of the currencies accepted by the IMF.