Best Gold IRA Investment Companies: Augusta Precious Metals and Noble Gold.

People like you, of all ages and from all walks of life, are looking at the same unstoppable events and nightmare statistics of huge debt and market manipulations in the economies around the world today.

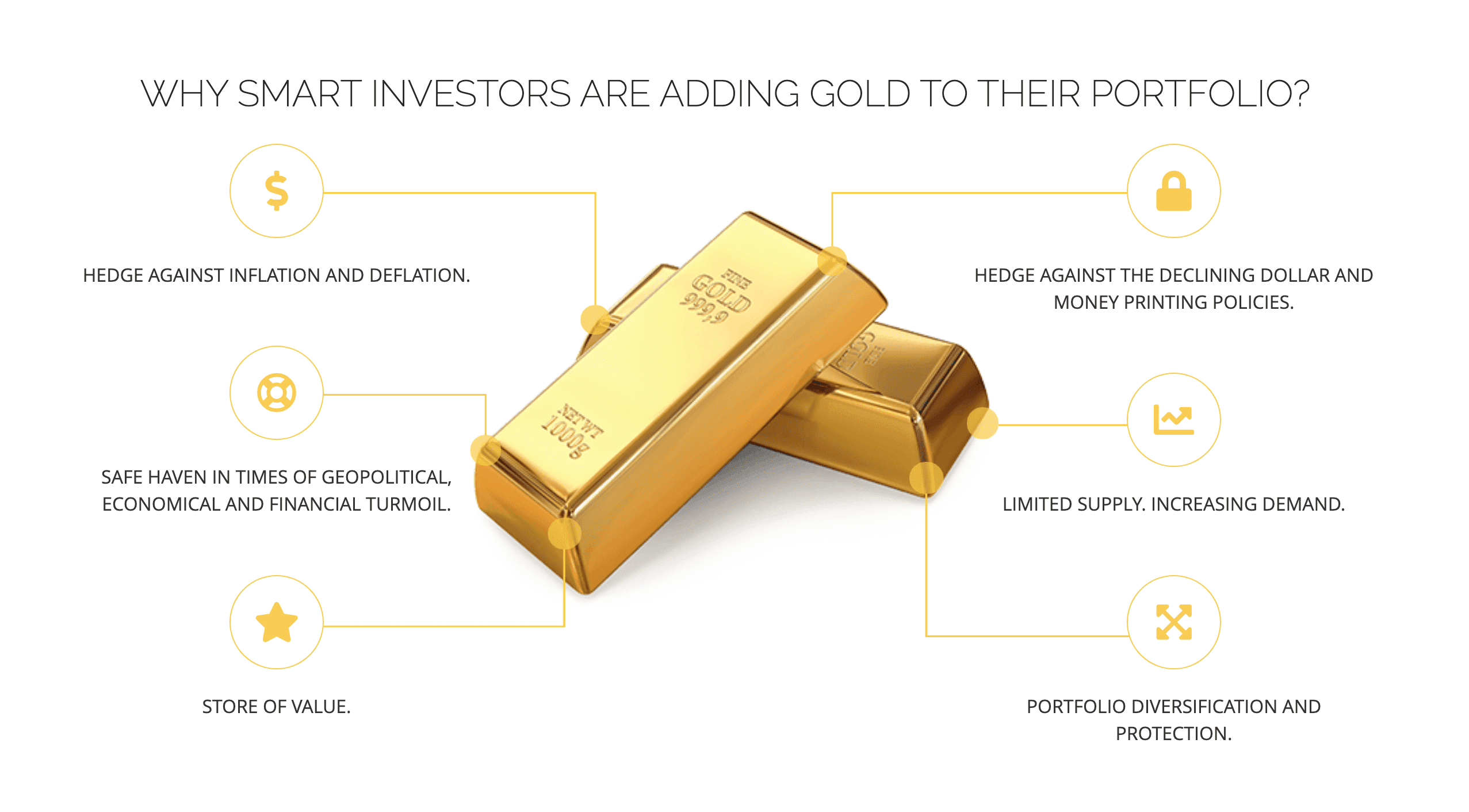

Those who are concerned about the decline in the value of their IRA 401ks are adding gold, being the only physical substance of constant value, to their portfolios as a hedge against hyper-inflation and one of the few means of protecting their families in fragile future scenarios. The WGC indicates that world events like the Ukraine invasion and soaring inflation continue to drive gold demand.

Gold & silver IRAs become popular for a new generation of investors.

As early as 2020 nearly 11% of U.S. adults held gold in their investment portfolios, with Millennial-age investors and entrepreneurs with fast-growing wealth increasingly turning to historical hedges like gold and silver. That is a big increase from an estimated 3% of Americans in June 2017, just 3 years before. Since then, gold companies are experiencing robust investment from a new and younger generation of investors.

But still there are many investors that are not aware that you can actually put gold and silver into your retirement account, and how easy this is possible by simply doing a rollover of a 401(k) or IRA to a Self-Directed IRA. This type of IRA allows you to manage your own investments, while also investing in different asset classes besides stocks.

Finding a gold IRA trustworthy custodian, identifying an authorized depository to keep your gold, and understanding the IRS tax regulations on gold IRA accounts can make setting up a gold IRA a challenging procedure. As a result of this, most investors are flocking to reliable gold IRA companies to handle these processes for them.

The top gold investment companies provide specialists in self-directed retirement savings who can help you with your account setup, precious metal acquisition, and navigating the procedures for tax code compliance.

In order to help you with your decision-making, we've compared side by side, two of the best Gold IRA Investment Companies in America, Augusta Precious Metals and Noble Gold. We assessed each gold IRA provider based on a variety of factors, including reputation, costs, the procedure for selecting precious metals, and feedback from previous clients.

FINRA recommends researching the background of any precious metals company that you invest with.

Augusta Precious Metals Review

Augusta Precious Metals was founded in 2012 by the CEO, Isaac Nuriani and has been one of the top precious metals brokers for years. He is a University of Los Angeles graduate and a member of ICTA (the Industry Council for Tangible Assets) and has a degree in Economics.

He is also an Ethics.net member and has been helping retirees with precious metal investments for more than 20 years. The satellite office of the company is located in Beverly Hills, California, and the corporate headquarters is in Casper Wyoming.

Augusta Educational Resources

The approach that Augusta Precious Metals prefers is an educational one to precious metal IRAs because they know investing in precious metals is not necessarily the best move for every investor. They realize this and also work on various partnerships for everybody involved in the process. Before enrolling you in a particular program they will talk about your requirements and ensure it is going to work for you.

What this means is the company will encourage you to watch educational webinars rather than attempt to sell products to you. This is a great approach because Augusta will take the time to make sure that gold investment is a good plan for you, so they can be sure you are going to be happy with the results.

While you can buy large amounts of gold or silver directly from Augusta Precious Metals, their specialty is gold IRA accounts. Augusta keeps the focus on your retirement plans and goals and what is best for you. If they feel that gold is a good fit, they will help you every step of the way. If, however they don’t they will be transparent and let you know.

Setting up an account with Augusta Precious Metals is easy and streamlined. The company is extremely transparent with its customers, operates with integrity, and provides excellent customer support. Thus, their customers remain loyal.

The minimum amount you need to open a gold IRA account with Augusta Precious Metals is $50,000, which is higher than with some competitors. Meanwhile, non-IRA transactions must be for $25,000 or more. Augusta Precious Metals pays liability insurance and precious metal shipping expenses, so you don’t have to worry about those.

Augusta fees

In contrast to most other providers of precious metal IRA, Augusta are totally transparent and exclusive nature of its offerings in precious metal investment. There are no hidden fees of any manner. In addition, the pricing for products and services related to precious metals is amongst the most competitive in the market.

- A one-time fee of $50 to setup your account

- An $80 custodian maintenance fee to be paid annually

- An annual fee of $100 for depository storage

- Non-IRA purchase of precious metals requires a minimum of $50,000 to be invested in the account

- Silver or gold IRA requires a minimum of $100,000 to be invested in the account

- Shipping and transit is free.

- The fluctuating costs of silver and gold coins and bullion are based on spot prices and market rates. There is a 5% markup cost for bullion coins.

1) Augusta Precious Metals

Tips

Get zero fees for up to 10 years - every customer qualifies.

Why We Chose It

Augusta Precious Metals is highly trusted and known for its transparency in the fee structure. It publishes all types of service fees on its website and holds a reputation for not receiving a single BBB or BCA complaint in it's near decade of trading.

Augusta provides secured storage with Delaware Depository and has depositories across the US. Customers can arrange a visit to any Augusta gold storage centers through the custodian. The gold and silver are protected by a $1 billion all-risk insurance policy by Lloyd’s of London.

Pros and Cons

Pros

1) Money magazine’s “Best Overall” Gold IRA Company in 2022

2) Augusta Precious Metals has been in business for almost a decade and holds a reputation for not receiving a single BBB or BCA complaint

3) Waiver of fees for up to 10 years.

Cons

1) High $50,000 Minimum Investment while Noble Gold is much lower at $20,000

2) Does not offer other precious metals like platinum and palladium unlike Noble Gold

Noble Gold IRA Review

Who are Nobel Gold?

Noble Gold Investments is a beloved IRA firm for its beginner-friendly (and quick) enrolment process and overall customer support. They are based in Pasadena, California and was formed over 20 years ago by current Chairman and CEO, Colin Plume. and Charles Thorngren

Collin had a brief spell in digital marketing before taking up the position of CEO at Noble Gold in 2016. Since April 2021, Collin is also CEO of My Digital Money. They have founded the company on one principle. This principle is putting the client’s needs first.

What Makes Noble Gold Unique?

They specialize in gold IRA and silver IRA planning, precious metals IRA rollover programs and have lots of ideas to get you on the right track to financial security. With Noble Gold you will be treated like an elite investor. Upon enrolling with Noble Gold, you will know who their CEO is and who you will be trusting your money to.

Noble Gold sells gold, but they provide great service to their customers too. Their first-class customer service provides each customer a live precious metals expert, who gives extensive knowledge of their products and will answer any of your questions.

They have helped thousands of clients from all walks of life to see precious metals in a new light. Noble Gold are dedicated to educating customers on the importance and impact of investing in a Gold IRA. They list benefits such as:

- No losses during a stock market crash

- Free investment kit

- Trusted advisors

- Get set up in just 5 minutes

- Gold Survival Packs

Noble Gold wants its clients to be well-informed and in control of their financial futures and are much more hands-on than many big-name financial firms.

Royal Survival Packs

The Royal Survival Packs from Noble Gold are among the most unique and desired features. And while you may think all gold is equal in quality, the survival packs provide customers with top-notch metals chosen by industry experts.

These packs are not traditional IRA investments. They are for use as currency in the event of an emergency or economic crisis. These enable survivalists preparing for a day when traditional banking collapses and world currencies become worthless to convert a portion of their savings into physical gold and silver coins.

You can't use gold or silver IRAs because of rules and limitations. Because of the simplicity of access, coin collectors and other specialty investors frequently choose this account.

Another advantage is that the Royal Survival Packs can be delivered to your home. Noble Gold collaborates with trustworthy self-governing depositories that provide specialized services. Because they are governed by international regulations, these depositories are not subject to US government laws.

Personally, we think these investment packs are worthwhile and beginner-friendly additions to precious metals IRAs as they include various levels of protection to customers. Packs range from $5,000 to $500,000 and become immediately available when needed. And, unlike the Noble Gold IRA, international buyers can purchase a Survival Pack.

Secure storage for your wealth

Noble Gold is the only company in Texas that stores precious metals and is one of Noble Gold's unique features. The business also maintains storage facilities in Canada and Delaware.

As per the IRS regulations you must keep your gold bullion secured in a secure and safe storage vault. Nobel Gold stores your precious metals in a registered secure depository facility – sometimes called a repository and they are based in Texas.

Why Texas?

Delaware (and by extension – New York) no longer have the monopoly on your gold IRA investment account precious metals storage. Your IRA gold and IRA silver can now be stored safely without it ever leaving the Republic.

Texas maintains its state rights fiercely – originally, the “six flags state” was not subject to the laws of the United States. Texas made its own laws, many of which are still in force today. This makes it the perfect location for a depository.

This is why Noble Gold is delighted to have secured a partnership with IDS (International Depository Services) in Dallas, they are the first and only, private secure gold depository facility in the south for your precious metal IRA storage needs. Up until now you had only one choice with Noble Gold in the US – the depository in Delaware.

Noble Gold Fees

Setup Fee: $80

Annual Fee: $250

Minimum Investment: $20,000

There are no setup fees for new customers at Noble Gold, and no taxes when moving your IRA funds from one accredited custodian to another. You can move your money without a penalty as long as this is done within a 60-day window.

After opening your account, you pay a storage fee of between $80 and $150 per year. There is a $2000 minimum investment to join.

A portion of the storage fee goes toward insurance, which guarantees that your investments are stored apart from other people's precious metals. Their basic pricing structure is readily available in their FAQ section.

2) Noble Gold Investments

Tips

Speak to one of their no-hassle IRA experts and ask how you can get a FREE Gold Coin

Why We Chose It

‘Noble Gold was founded because we were tired of the unsavory practices in our industry. We never hard-sell.’ The company sets a high moral bar. This is easy to do in theory. But in practice? Investors will be pleased to learn that, barring 3 complaints in 3 years, 400+ customer reviews overwhelmingly bear out Noble Gold’s claim to be the good guys in the gold IRA industry. The firm’s no-quibble buyback program is evidence that Noble Gold offers an ethical service.

Pros and Cons

Pros

1) From a total of 403 reviews across 5 websites, Noble Gold achieves a perfect average rating of 5/5.

2) Reviewers consistently praise the quality of their customer service and the ease of setting up a Noble Gold IRA.

3) CEO Collin Plume puts a lot of emphasis on customer education

4) the one and only exclusive IRS-approved storage in Texas

5) They offer a "No-quibble" buyback policy

6) Low IRA account minimum of $2,000

7) Unique Royal Survival Packs with home delivery.

Cons

1) Young brand at only 6 years old

2) Only "A" rating from the BBB

3) They charge a higher premium on exclusive coins.

4) No overseas storage options: They only have storage locations in Texas and Delaware at the moment, but are looking on forming partnerships with international depositories soon.

Conclusion

Both companies tick most boxes, but they have some key differences.

Noble Gold offers a quick 5-minute set-up of your Gold Individual Retirement Account, and offer unique collectible coins.

Noble Gold also provides something most other precious metals brokers don't, the Royal Survival Packs which are very unique offering and offer options for all types of gold investors. Also, they have hundreds of reviews and provide a top-notch customer service.

Augusta Precious Metals offers a comprehensive life long customer service, free client education, and a great training experience. Augusta is endorsed by Quarterback Joe Montana and his financial team who chose Augusta over others.

They have a reputation for transparent business practices, dedication to serving customers.

Augusta Precious Metals are the winners of many awards including Investopedia’s “Most Transparent” Gold IRA Company in 2022 and number 1 choice for "Best Gold IRA Company for 2022" awarded by Money Magazine. Further which is attractive, they offer zero fees for up to 10 years.

What you ultimately require for your needs really determines which company you should choose. But because both companies have many years of providing client satisfaction and excellent reviews, we highly recommend both of them.

Gold Options For You

We recognise here at Gold Option for You, (Gold Retirement Accounts) that if you are thinking about diversifying your individual retirement account into precious metals, it is not a decision to be taken lightly. If you need further information then please read our full reviews on both companies here:

Augusta Precious Metals Review: https://goldofu.com/best-gold-ira-company-review-2022/

Noble Gold Review: https://goldofu.com/top-rated-gold-ira-companies/