Many or all of the companies featured provide compensation to "Gold IRA Investment Guide". Commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site. Further information can be found on our website disclaimer.

Should you buy gold in a recession?

The 2023 Gold Rush: Russia - Ukraine war shocks precious metals markets.

Many investors, retirees and entrepreneurs are looking for ways to prepare for future uncertainties and further, the WGC indicates that world events like the Ukraine invasion and soaring inflation continue to drive gold demand and price.

To varying degrees, both precious metals could be used to hedge against currency devaluation as well as during any sustained periods of rising inflation. But understanding the difference between how these two metals are used, their economic sensitivities and technical characteristics can help you determine which metal may benefit your portfolio.

Many early retirees more than ever are choosing to invest precious metals, such as gold and silver into their Individual Retirement Account.

Most investors are not aware that you can actually put gold and silver into your retirement account but this is possible by doing a rollover of a 401(k) or IRA to a self-directed IRA. This type of IRA allows you to manage your own investments, while also investing in different asset classes besides stocks.

Does gold’s value increase during recessions?

Gold has been traditionally considered a safe-haven asset during times of political instability, recessions, and economic uncertainty with independent-minded investors, entrepreneurs and retirees have all turned to investments in gold and it can be used to hedge against currency devaluation or inflation.

Further, the United States Securities and Exchange Commission advises diversified retirement investments as being a safe way to manage financial risks and attain financial security after retirement.

How does gold hold up when the economy tumbles?

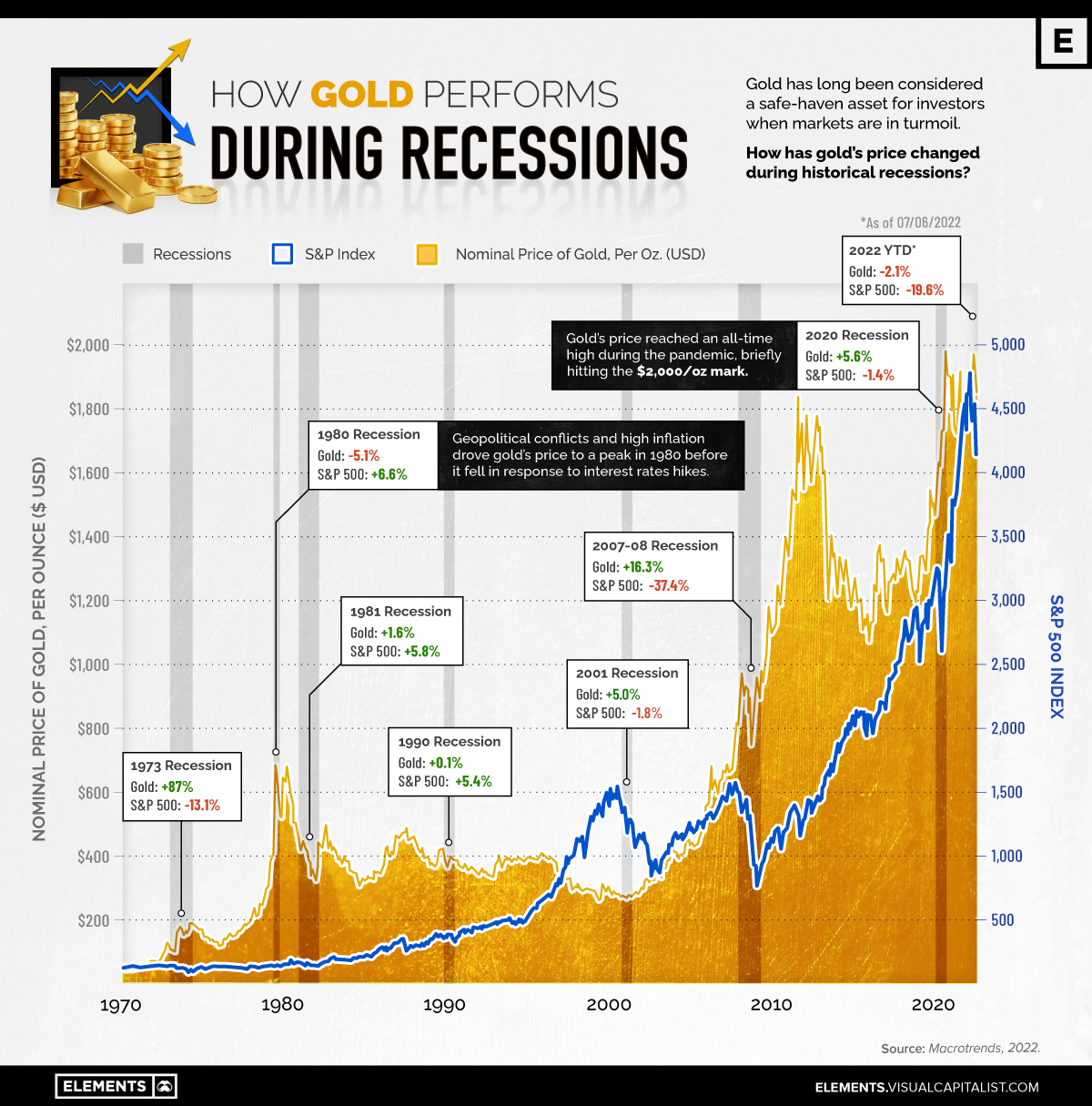

The graphic above uses data from Macrotrends to highlight gold’s price movements during recessions and compares it to changes in the S&P 500.

Gold vs. S&P 500 in historical recessions

Gold’s value comes from its scarcity and increased demand in addition to its long history as a stable medium of exchange, more so as gold mining has leveled off since 2016.

According to the World Gold Council (WGC), there was a demand for 4282 tons of gold per year between 2008-2017.

- 52% jewelry (2233 tonnes)

- 27% bars and coins (1177 tonnes)

- 9% technology (384 tonnes)

- 8% central banks (341 tonnes)

- 3% ETFs and similar products (147 tonnes)

Gold also has a low-to-negative correlation with the stock market, suggesting that changes in the price of gold are largely independent of how stocks are faring. As a result, gold is considered an effective diversification tool for investors who want to hedge their bets.

Here are the some factors that can effect the price of gold

- Inflation- Inflation lowers the value of a currency, and this is why people rush to invest in gold and other precious metals when the inflation rate is high. The increased demand will raise the price of these precious metals.

- Interest rates- The price of gold will also rise when interest rates drop. With lower interest rates, you don’t get good returns on your deposits, and this will increase the demand for gold eventually leading to an increase in the price of gold.

- Central bank reserves- Since the US dropped the gold standard in 1971, central banks have been accumulating growing reserves of gold, As these banks purchase more gold, the price of the precious metal rises.

The value of the USD- In international markets, gold is traded with the USD, so any fluctuations in the value of the currency will affect the price of gold. A stronger USD will usually keep the price of gold low and stable.

Has gold helped investors weather the storms in recent past times?

The gold standard was a monetary system where the participating countries fixed the value of their national currency in terms of a specific amount of gold.

This allowed a national currency to be easily and freely converted into gold at a fixed price. During the reign of the gold standard, gold coins circulated in the national economy as domestic currency in the same way that promissory notes, coins, and other metals did.

Since 1971, when the gold standard was abandoned, gold has largely seen positive price changes during recessions. And in the last three recessions since 2000, its performance has countered that of the S&P 500. While the increases in value haven’t been dramatic, they help cement gold’s position as a hedge against financial turmoil and as a store of value.

For example, during the 1970s, when the S&P 500 rose by just 22% – which is well below the rate of inflation for the decade – gold increased from an average price of $36 an ounce in 1970 to an average of $615 in 1980. That’s a gain of more than 1,700%! During the entire decade, which was marked by economic, financial, political, and geopolitical stress, gold reaffirmed its safe haven status.

But that was hardly the only episode. While the S&P 500 fell by more than 50% in the Financial Meltdown of 2007 – 2009, the price of gold increased from $640 at the beginning of 2007, nearly doubling to $1,120 by the end of 2009.

If your portfolio included a significant amount of gold in 2006 and 2007, your investments would have performed better than most during the financial meltdown. However, while gold’s price tends to rise during times of economic turmoil, it often stagnates or falls when the economy is healthy and investors seek riskier investments. As a result, it’s important for investors to consider the overall macroeconomic and geopolitical environment when looking at gold.

Is it time for gold to sparkle in 2023?

The global economy has been shaking with turbulence in 2023, with consumers facing high inflation and investors seeing dismal stock market returns.

While these market conditions typically point towards rising demand for gold, that hasn’t been the case so far this year, with prices down 2% year-to-date. This is partly because of rising interest rates, which increase the opportunity cost of holding gold as investors forgo the interest income they could earn from saving accounts or bonds.

But in fact, history shows that gold often outperforms U.S. stocks and the dollar following interest rate hikes, after underperforming in the lead-up to rate hikes. Additionally, high inflation is eroding the purchasing power of each dollar, incentivizing investment in a tangible asset like gold and other hard assets.

How is the Global inflation, rising prices and supply shortages going to effect your retirement investment with the decreasing value of the dollar?

See why Americans are finding a way to fight back from losing what they've built. Discover how you can too, read our Best Gold Company IRA Review and learn how to move your 401(k) to gold.

With geopolitical uncertainty at a high and the U.S. consumer sentiment at decade-lows, will gold prove its value as a safe-haven asset in 2023?

Go ahead and watch this video, it will ensure you navigate your way safely through the possible scams you may come across in your search for protecting you and your families future!

ANNUAL/SET UP FEES

$180/$50

ACCOUNT MINIMUM

$50,000

ANNUAL/SET UP FEES

$200+/$50

ACCOUNT MINIMUM

$10,000

![noble-gold-logo-450x90[1] noble-gold-logo-450x90[1]](https://goldofu.com/wp-content/uploads/2022/05/noble-gold-logo-450x901-1.png)

ANNUAL/SET UP FEES

$230/$ZERO

ACCOUNT MINIMUM

$5,000