Can BRICS shake the dollar dominance?

BRICS’ New Currency Backed by Precious Metals to Rival the US Dollar: Understanding the Durban Accords and Its Implications

Can BRICS shake the dollar dominance?

Who is behind the Durban Accords? The Durban Accords represent a significant development in the global financial landscape and are the brainchild of the BRICS nations – BRICS (an acronym for Brazil, Russia, India, China and South Africa) – the leaders of five nations representing 40% of the world’s population and one third of the world’s GDP. The matter is expected to be discussed at the bloc’s upcoming summit in South Africa in August. https://sputnikglobe.com/20230125/lavrov-brics-mulling-own-currency-1106693342.html

These emerging economies have been seeking ways to reduce their dependence on the US Dollar and challenge the long-standing dominance of the US-led financial system. The decision to create a new currency backed by precious metals came after years of discussions and strategic planning among the BRICS member states.

The BRICS nations have long felt the impact of the US Dollar’s hegemony on their economies and the nations are fed up with the dollar’s dominance for two main reasons: inflation and weaponization.

They have faced challenges such as financial vulnerability, exchange rate fluctuations, and susceptibility to external economic shocks. By collaborating and forming the Durban Accords, these countries aim to create a more balanced and resilient global financial system, offering an alternative to the US Dollar’s position as the world’s primary reserve currency.

What’s the purpose of the Durban Accords?

The primary purpose of the Durban Accords is to establish a new currency, let’s call it the BRICS Reserve Currency (BRC), which will serve as a credible alternative to the US Dollar. Unlike the Dollar, which is a fiat currency not backed by any physical asset, the BRC will be backed by precious metals like gold, silver, platinum, and others. This backing is intended to provide stability and intrinsic value to the new currency, reducing the susceptibility to inflation and other economic shocks.

Moreover, the Durban Accords aim to enhance economic cooperation among the BRICS nations. By creating a common currency, these countries can foster greater trade and investment within the bloc while reducing the impact of currency exchange rate fluctuations. Additionally, the accords will enable BRICS countries to strengthen their positions in the global financial and geopolitical arena, challenging the US-led financial dominance.

How does inflation work?

Before delving into the implications of the Durban Accords and the potential rivalry between the BRC and the US Dollar, it is crucial to understand how inflation operates. Inflation is the general increase in the prices of goods and services in an economy over time, it erodes the purchasing power of money, making each unit of currency buy fewer goods and services.

Various factors contribute to inflation, including excessive money supply, increased production costs, demand-pull, and cost-push factors. Central banks play a significant role in controlling inflation by adjusting interest rates and implementing monetary policies. When inflation is high, it erodes the value of fiat currencies like the US Dollar, making them less attractive to investors and reducing their buying power in global markets. Every new dollar printed by the Federal Reserve or created by deficit spending reduces the purchasing power of every other dollar in existence.

How the US Dollar has been used as USA dominance and weaponization

The US Dollar’s status as the world’s primary reserve currency has given the United States significant economic and geopolitical advantages. Being the main reserve currency means that central banks and governments worldwide hold substantial reserves of US Dollars, which provides the US with significant influence over global financial systems.

This dominance has allowed the US to wield the Dollar as a potent geopolitical weapon. For example, the US can impose economic sanctions on other countries by restricting their access to the US financial system. These sanctions can severely impact the targeted nations’ economies and international trade, as the majority of global trade is conducted in US Dollars.

The weaponization of the US Dollar has generated tensions in international relations and led to demands from various countries for an alternative reserve currency that would be less subject to political manipulation and economic sanctions.

What do the Durban Accords mean for Americans?

The Durban Accords and the emergence of the BRC as a potential rival to the US Dollar have significant implications for Americans. Firstly, as the US Dollar’s dominance faces a challenge, its value may be affected, potentially leading to higher inflation in the United States. A decrease in the Dollar’s value would mean higher prices for imported goods and services, affecting American consumers and businesses alike.

Moreover, the demand for the Dollar may decline as countries start diversifying their reserve holdings into the BRC and other currencies. This could result in a weaker Dollar in foreign exchange markets, making it more expensive for Americans to travel abroad and purchase foreign goods.

Additionally, the US’s ability to use economic sanctions as a diplomatic tool could diminish as countries find alternatives to the Dollar for conducting international trade. This may reduce the effectiveness of such measures and force the US to seek alternative means of exerting influence in global affairs.

How can Americans protect themselves from the consequences of the Durban Accords? Investing in gold

Given the potential repercussions of the Durban Accords and the shift in the global financial landscape, Americans may consider taking steps to safeguard their wealth and financial well-being. One popular strategy for hedging against currency devaluation and economic uncertainty is investing in precious metals, especially gold.

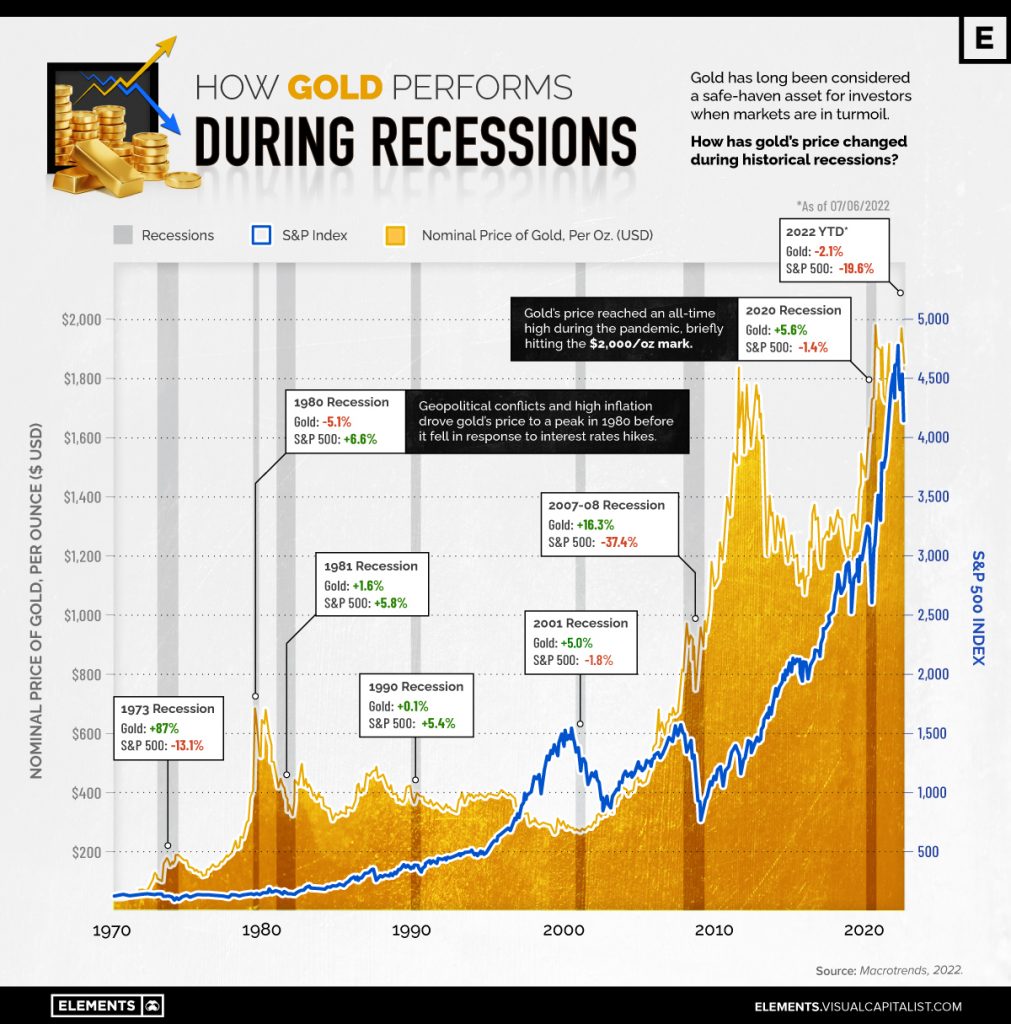

Gold has long been considered a safe-haven asset that retains its value during times of economic turmoil and currency fluctuations. Unlike fiat currencies, gold has intrinsic value and cannot be easily manipulated by governments or central banks. As a result, it has historically served as a hedge against inflation and economic instability.

Investing in gold can be done through various means, such as purchasing physical gold bars or coins, investing in gold-backed exchange-traded funds (ETFs), or buying shares in gold mining companies. However, as with any investment, it is essential for individuals to conduct thorough research, consider their risk tolerance, and seek advice from financial professionals before making any decisions.

In conclusion

the Durban Accords and the creation of a new currency backed by precious metals represent a significant step by the BRICS nations to challenge the dominance of the US Dollar in the global financial system. The purpose behind this initiative is to enhance economic cooperation among BRICS countries, reduce vulnerability to economic shocks, and offer an alternative reserve currency.

For Americans, the accords may have implications such as potential inflation, a weaker Dollar, and reduced leverage in international relations.

To protect themselves, individuals may consider diversifying their investments and exploring safe-haven assets like gold. However, as the situation unfolds, it is crucial for everyone to stay informed and adapt their financial strategies accordingly.

Discover Joe Montana’s Savings Secret

“I recommend the team at Augusta Precious Metals to my friends and family.”

– Joe Montana

Hall of Fame Quarterback,

Paid Ambassador and Superfan

Get your FREE Gold Pack while you can and learn why now more than at any time in the past, you should seriously look at protecting your future with Gold You Can hold: https://goldofu.com/go/retirement-diversifying-kit

Join Joe Montana for a free gold and silver web conference.