Many or all of the companies featured provide compensation to Goldofu.Com and "Gold Retirement Accounts". Commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site. Further information can be found on our website disclaimer.

4Best Gold IRA Company Review 2025 revised

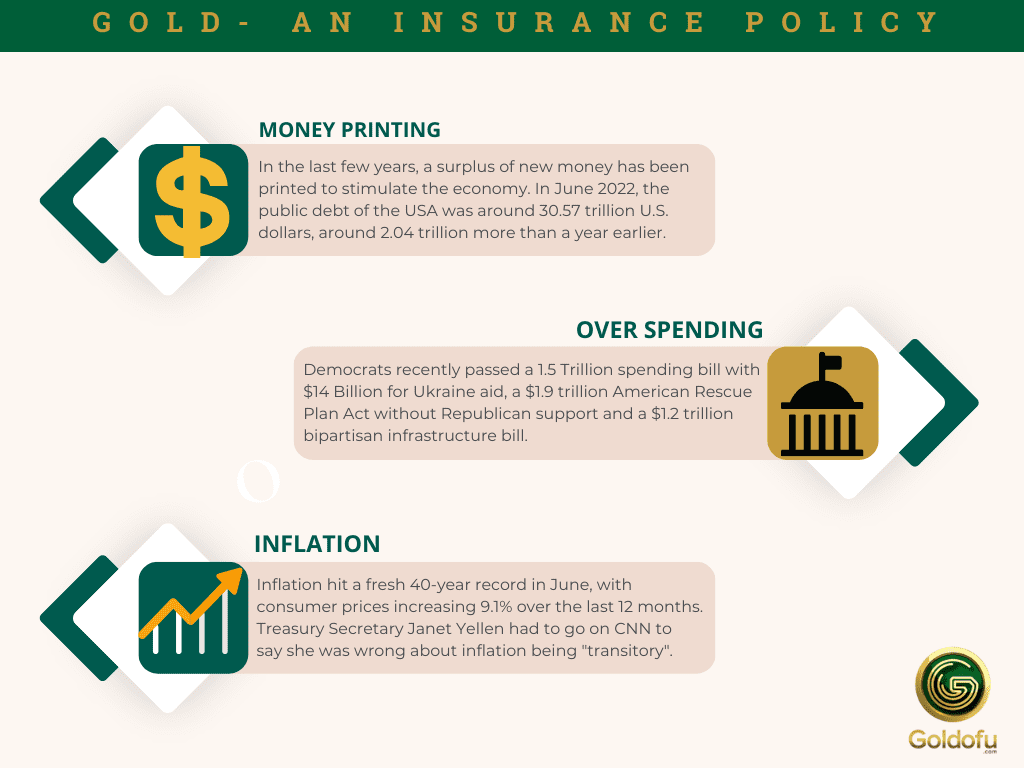

The last few years have been a roller coaster for people who have depended on traditional investment portfolios for retirement. The pandemic and war in Europe have created the perfect storm, with world economies reeling from vital supply shortages and soaring inflation.

Most of us are worried about how world political and economic events are going to affect our retirement in the long term. Many of us are seeing dwindling 401ks, and some of us may have even had to borrow from our retirement funds to stay afloat with temporary layoffs.

Luckily, in our Best Gold Company IRA Review, we show you how and why your 401ks and traditional IRAs rolled over into a gold IRA is a safe and profitable option no matter what is happening in the world.

Is gold a good retirement investment?

If you are looking for a way to balance your investment portfolio, the easiest and smartest way is to invest in gold bullion. The sheer mention of its name screams wealth and it has been found time and time again to be a safe way for investors, it increases in value when paper bought stocks and bonds decrease.

In simple terms, when other assets values drop in price, gold often rises. In the economic crashes of 2008 and 2018, many investors in the USA purchased gold to protect against the currency decline of the dollar.

This form of investment is known as ‘hedging’ and the smartest investors know that as currency value falls, inflation occurs, also causing higher prices on imports and the value of their other stocks to decrease. The value of gold, however, is rarely affected by such economic trends and is therefore the best investment against inflation.

In fact, it’s one of the best retirement investments you can make to withstand economic turmoil, inflation, and catastrophic world events. Further, the United States Securities and Exchange Commission advises diversified retirement investments as being a safe way to manage financial risks and attain financial security after retirement. If you are looking to invest in precious metals, your IRA can assist you in securing a comfortable retired life by offering tax benefits, enhancing purchasing power, and diversifying financial and other assets.

Should you invest in Gold Bullion?

The trend of purchasing gold has continued to rise in recent years; in 2018, the investor demand for gold in the United States grew by 4%, due to trade wars between the US and China. In the United Kingdom in 2018, due to the continued uncertainty of Brexit, the investor demand outstretched that of the US, with 12% of investors demanding the ability to invest in gold.

Gold performance in times of crisis

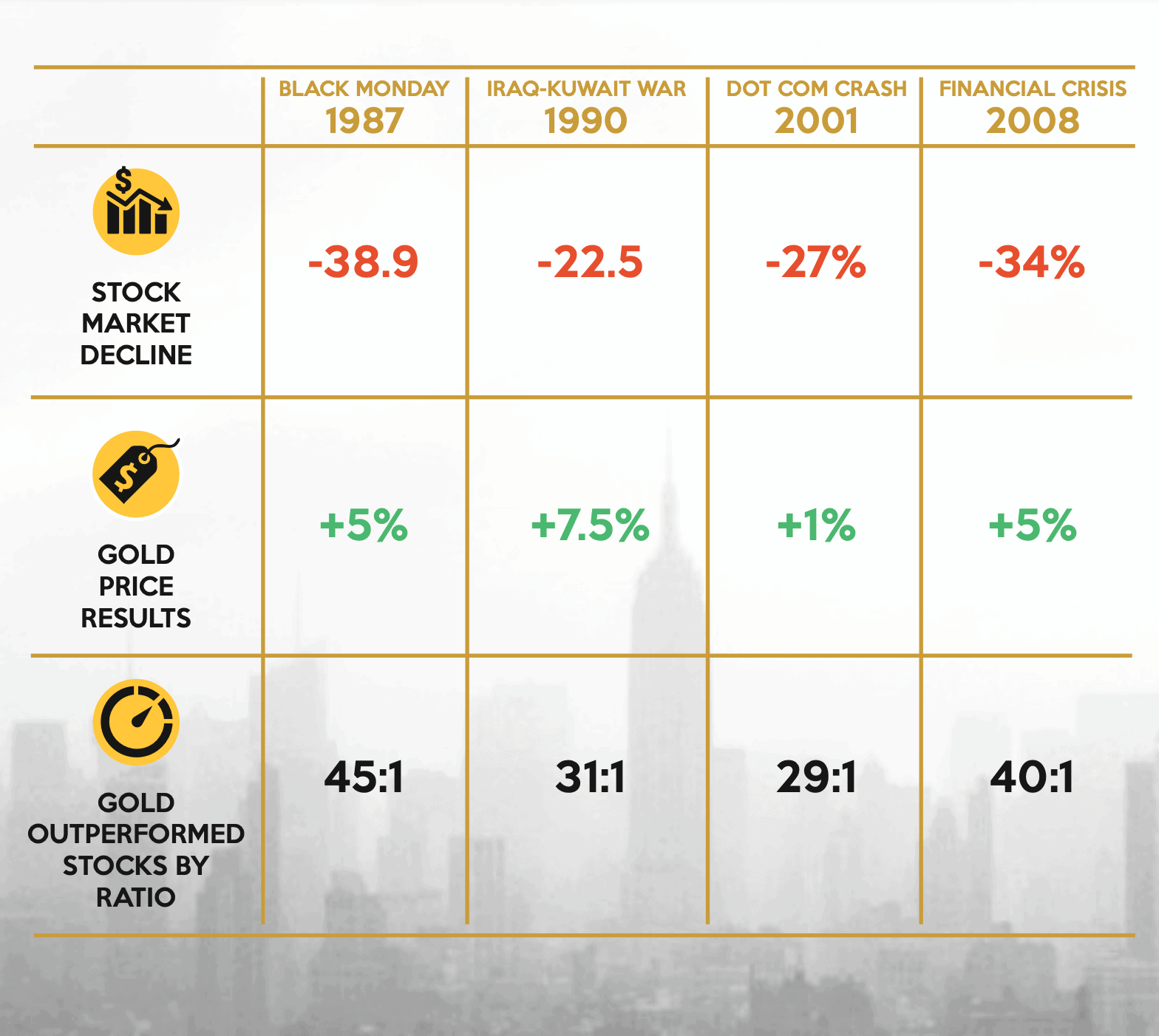

Precious metals are the ONLY asset class that has consistently performed well in times of economic and political turmoil. For thousands of years, gold has been the go-to asset for wealth protection in times of crisis.

From 2007 to 2009, the U.S. stock market faced one of its worst crashes ever, dealing a massive blow to as much as 60% of some Americans’ retirement savings. But while the S&P 500 continued to crash, gold’s price rose—and effectively rewarded anyone who had diversified their portfolio.

See the table below showing how gold outperformed stocks during some of the most recent crises:

What Is a Precious Metals IRA?

A gold IRA is an Individual Retirement Account (IRA), essentially a self-directed IRA that includes gold or other precious metals like silver in its portfolio. It works exactly the same way as a traditional IRA. To own gold, you will need a self-directed gold IRA that includes physical precious IRS-approved metal bullion coins or bars instead of publicly-traded securities.

Conventional brokerage firms don’t offer gold IRAs, and the IRS will not let you store your gold IRA in your home without early withdrawal taxation penalties. So, you will need to find a precious metals IRA custodian. Using an IRS-approved gold IRA company ensures that you’re meeting IRS storage requirements without accruing penalties for withdrawal.

Regardless of your traditional investment preferences, tangible assets like gold and silver can help make the profitability and safety of your retirement portfolio far more attainable while mitigating risks from uncertain geopolitical landscapes. Including gold within an existing portfolio could improve investment performance by either increasing returns without increasing risk, or by reducing risk without adversely affecting returns.

How to Open a Gold IRA

If you’re curious about how to set up a precious metals IRA, it is a little different than a conventional IRA account. Here are the steps:

- Choose a custodian: You’ll need to choose an IRS-approved custodian to manage your IRA account for you. They will be your middle man and manage your precious metals according to IRS regulations

- Choose a dealer: A precious metals dealer will supply the gold you need for your gold IRA. The custodian will be your go-between with the dealer and may be able to help you find a dealer. If choosing your own, look for a dealer who belongs to ANA, ICTA, or PNG.

- Decide on your investment: Decide what type of products you want to buy from your dealer. U.S.-mint-issued American Eagle Bullion Coins or Canadian Maple Leafs are a common choice that meet the requirement of having a 99.5% fineness level.

- Choose a depository: You need to store any precious metals you want to add to your self-directed IRA in an IRS-approved depository. Your custodian can help you find one that meets IRS requirements.

- Complete the transaction: Completing the transaction involves the IRA custodian handling the payments and the dealer shipping your precious metals to a depository.

Should I transfer or rollover from my existing retirement plan?

If you have an existing precious metals IRA and want to add additional gold to it, you will need to use your custodian to help you purchase gold from the dealer, so the dealer can move it to the depository for you.

TRANSFER: Your first alternative is a "transfer." This is something you can do at any time with your existing retirement plan as long as the assets go “from custodian to custodian.” and transfers may be made as often as you want.

ROLLOVER: The second alternative is a "rollover." A rollover occurs when you receive the distribution from your existing retirement account and then deposit it in another retirement plan custodial account. In this case you would need to re-deposit the funds into the new retirement plan account within 60 days. If the 60 day time period is exceeded, you would be liable for taxes and penalties on the money withdrawn. You may roll over the same money only once every 12 months to preserve the tax-deferred status of your retirement savings.

After opening your gold IRA account, you can only contribute up to the approved IRS limit. For 2025, that limit was $7,000 of income for those under 50 and $7500 for 50+.

Eligible precious metals for IRA investing

You cannot just purchase any precious metal to be included in your Metals IRA. The United States government, through the IRS, has laid out some strict rules when it comes to what coins and bars qualify for such accounts. The precious metals eligible for placement within an IRA have proven track records over thousands of years. These are the metals that transcend government influence they are tangible and cannot be printed like paper money or stored as a number on a computer file.

Gold, silver, platinum and palladium — these precious metals are popular for use in self-directed IRAs because of their long-term investment track record:

- Gold — a highly prized symbol of wealth since the earliest records of history

- Silver — used for thousands of years in coinage, jewelry, tableware, and more

- Platinum & Palladium — similar histories to gold and silver, these two precious metals are known for their catalytic properties and are still heavily used in industrial processes.

Here is a detailed look at each metal’s current eligibility rules on what you can specifically invest in:

Metal Purity Standards

To qualify as IRA allowable precious metals, the following minimum fineness requirements must be met:

- Gold must be .9950 (24 karats) pure

- Bullion bars should be fabricated by NYMEX, COMEX, or any other ISO 9000 approved refiner.

- Proof coins should be presented with a certificate of authenticity and must be in their original mint packaging.

- All bullion must be in an uncirculated, first-rate condition.

Are gold IRAs a good idea?

Below are several benefits of investing in a top precious metals IRA.

Gold Investments Provide Tax Benefits

There are several tax benefits to keep in mind related to adding precious metals to your IRA:

- Precious metals yield higher after-tax returns than Roth IRAs.

- You only have to pay taxes on gains from gold IRA investments after you cash out.

- The 28% collectible tax rate doesn’t apply to gold IRA investments. The marginal tax rate only applies to gains.

- Any taxes on withdrawals are based on your income bracket.

Gold Investments Diversify Assets

Investors have been diversifying their portfolios for years with a top-rated precious metals IRA. Owning gold in IRAs can help diversify your retirement portfolio and be a more holistic way to approach your overall investment strategy.

As the price of gold fluctuates, you’ll earn an income stream through regular dividends.

Are Gold Investments Safe?

As part of our Best Gold company review for 2023 we had to look at risks. Like all other investments, gold and silver IRAs have an element of risk. Buying gold for retirement historically has proven to be one of the safest investments you can make. During times of political instability, recessions, and economic uncertainty, people have turned to investments in gold as a safe option. It can be used to hedge against currency devaluation or inflation.

Gold Investments Have Long-Term Stability

The price of precious metals does fluctuate. However, they are stable over the long term. Unlike investing in companies and other assets, gold and silver will always be there and typically on an upward trend.

In fact, the price of precious metals has increased a great deal within the last 50 years.

Gold Value Is Driven by Supply and Demand

Gold remains valuable because of limited supplies and increased demand especially as gold mining has leveled off since 2016. According to the World Gold Council (WGC), there was a demand for 4282 tons of gold per year between 2008-2017:

- 52% jewelry (2233 tonnes)

- 27% bars and coins (1177 tonnes)

- 9% technology (384 tonnes)

- 8% central banks (341 tonnes)

- 3% ETFs and similar products (147 tonnes)

The gold market is only increasing as many central banks have been accumulating growing reserves of gold, bringing it nearly to a 30-year high.

WGC indicates that world events like the Ukraine invasion and soaring inflation continue to drive gold demand and price.

The U.S. dollar is no longer backed by gold or any other precious metal, and Federal Reserve notes have not been redeemable for gold since 1934. Not being tied to our currency actually makes it safer for investors.

In fact, gold tends to move opposite the value of the dollar, unlike fiat currencies, it doesn’t lose value every year. Based on recent trends, gold IRAs can outperform the Dow Jones and S&P 500.

Here are some factors which can affect the price of gold:

- Inflation- Inflation lowers the value of a currency, and this is why people rush to invest in gold and other precious metals when the inflation rate is high. The increased demand will raise the price of these precious metals.

- Interest rates- The price of gold will also rise when interest rates drop. With lower interest rates, you don’t get good returns on your deposits, and this will increase the demand for gold eventually leading to an increase in the price of gold.

- Central bank reserves- Since the US dropped the gold standard in 1971, central banks have been accumulating their gold reserves. As these banks purchase more gold, the price of the precious metal rises.

The value of the USD- In international markets, gold is traded with the USD, so any fluctuations in the value of the currency will affect the price of gold. A stronger USD will usually keep the price of gold low and stable.

When Should You Invest in Gold IRAs?

The economy is in chaos, we’re experiencing rising prices, and there’s a global recession. There’s so much uncertainty about what’s going to happen next as supply chain issues persist, the Covid-19 virus mutates and strikes again, and war threatens more European countries.

Gold investments during inflation are one of the smartest things you can do for your retirement portfolio. If you’re worried that current events will lead to more and more inflation and you could lose even more value from your retirement fund, now is the time to use gold to hedge your investments against loss.

The U.S. dollar is stronger than it has been in 20 years. Luckily, a strong U.S. dollar tends to keep the price of gold lower for purchasing purposes. Meanwhile, a weaker dollar tends to drive the price of gold higher because you can purchase more gold when the dollar is weaker.

Being able to purchase more when the dollar is weaker and sell it for more when the dollar is strong makes it a safe bet.

Investing in gold sooner rather than later ensures that you are buying gold at a low price and don’t lose even more from your retirement account as the market goes through periods of turmoil.

Who Is Best Suited for Gold IRAs?

Whether you’re an entrepreneur, working professional, investor, business owner, or retiree, you can benefit from a gold IRA. Anyone who has at least $20,000-$50,000 to roll over in a gold IRA should do so. Stock market conditions can change drastically, bringing your investments with it. As we move toward a higher inflation rate and continuing economic upsets, your 401k is more vulnerable than ever. Thus, more and more people are doing a gold 401k rollover or IRA rollover to keep their 401k funds and IRAs safe.

If you’ve already seen your retirement funds and stock portfolio values drop and are worried about how much money will be left in it when you retire, you’re the perfect person to invest in a gold IRA, don’t wait until it goes down even more.

Precious metals hold their value and even become more valuable during times of economic turmoil. So, if you’re worried about the value of the dollar as prices soar, choosing a gold IRA can give you peace of mind concerning the security of your retirement savings.

Goldco Precious Metals

Promotion

5% back on metals over $50k

Why We Chose It

Trevor Gerszt founded Goldco and it’s headquartered in Woodland Hills, California and follows the privacy laws of the state and their site operates in accordance with IRS guidelines. Inc. Magazine named it the third fastest-growing financial services company in the US in 2015. Further, the Los Angeles Business Journal named it the 17th fastest-growing company in the greater Los Angeles Area.

Goldco is a renowned precious metals firm specializing in IRAs (Individual Retirement Accounts). The company has made a name for itself for its service transparency, low yearly rates, and excellent customer service and is known among the investing community for its superior service and top-notch educational resources. The companies mission is to help Americans protect their retirement accounts from stock market volatility and inflation through the use of precious metals.

Services

Goldco offers two major service options: precious metal IRAs and precious metals direct purchases.

Precious Metal IRA's

So long as you have earned income and are under age 70½, you’re eligible for a traditional IRA. Goldco offers gold IRAs, silver IRAs, or a combination of both.

The company facilitates transferring funds from an existing 401(k), 403(b), 457, pension or Thrift Savings Plan (TSP) account to a self-directed gold IRA. Goldco can also offer Roth IRA rollovers or conversions, with this investment option, you will be able to roll all or part of your retirement savings into gold or silver bullion.

The process is simple and looks like this:

- You open a new Goldco Precious Metals IRA

- Your Goldco specialist helps you fund your account with your old IRA

- Once the money transfers, your specialist helps you select precious metals that suit your goals and needs.

- Your IRA Specialist guides you through every step of the rollover process, which typically takes about 10 business days.

Non-IRA Precious Metals

Any investor can buy precious metals through Goldco. You don’t have to be a certain age or have earned income.

When you purchase precious metals, you can either keep them in a secure vault or have them delivered to your home—whichever you prefer.

Goldco Fees For Precious Metal IRAs

- A one-time setup fee of $50 for Goldco IRA

- A $30 wire fee chargeable only once

- You need to pay $80 as annual maintenance fee

- Precious metal IRAs start out at $260 a year.

If you want an IRA with non-segregated storage the cost will be $260 your first year and $180 every year after that. However, if you prefer an IRA with segregated storage, it’s cost will be $50 more. You’ll pay $310 the first year and $230 in the following years.

Goldco Fees For Non-IRA Transactions

One-time set-up fees

$0

Annual maintenance fees

$0

Storage fees

$0

Goldco Investment Minimums

They are lower than many of their competitors. They charge a flat annual fee rather than a percentage of assets. Goldco does not publish fees on the website but mentions frequent fee refund promotions. However, the company uses a "as low as" fee model that aims to save their customers as much money as possible. The tables below break down fees for Goldco precious metal IRAs and non-IRA transactions.

Precious Metal IRAs

$20,000 to $25,000

Non-IRA Transactions

$3,500

Pros and Cons

Pros

1) White glove service for the lifetime of your investment

2) Multiple storage options depending on your preference

3) Free storage for non-IRA precious metals

5) First year fees waived on qualified orders over $50,000

6) Exceptional customer service

7) INC.Magazine named Goldco to its annual Inc. 5000 list for the third straight year in row for the fastest growing private companies in the United States.

8) 16 years of expertise handling precious metal retirement investments

Cons

1) Not the lowest IRA minimum, deposits start at $25,000

2) lack of transparency in the costs of products and services

3) No account set up available online

4) Possibly too expensive for new investors and does not offer custodial services

Comprehensive Educational Resources

Goldco has a broad and considerable education center on its website which aims to keep investors informed on the latest precious metals and IRA news.

There is an in-depth blog that covers a range of topics which includes news on recessions, trade wars and more.

There is a selection ebooks you can download, including The American IRA and 401(k) Crisis, 10 Reasons Why The Dollar Will Crash, and a 12-page gold IRA investment guide.

Goldco has a library of videos that goes deep into topics like retirement threats, dollar fluctuation, stock market crashes, the oil crisis, and more.

You can view live price trackers for gold, silver, platinum, and palladium directly on its website. And as always, customer support is happy to help you answer any questions or concerns you may have.

The latest state of the art storage options

As per the IRS regulations, Goldco stores IRA precious metals in a third-party, state-of-the-art vault.

Goldco uses the top storage providers in the industry to keep your precious metals safe. Each one uses state of the art security and technology.

What Precious Metal Storage Providers Do Goldco Use?

|

Storage providers |

Storage type |

Annual storage cost |

|

Non-segregated |

$100 |

|

|

Brinks Salt Lake City |

Non-segregated |

$100 |

|

Segregated |

$150 |

By default, Goldco will store your precious metals at Delaware Depository

This is a renowned and well established depository and has over 200 years of experience in precious metals, Class 3 vaults and state-of-the-art security systems.

If you prefer, you can request another storage facility if you’d like to keep your precious metals somewhere else.

Why should you consider Investing with Goldco?

If you’re ready to invest in precious metals be it through an IRA or a direct purchase, then Goldco may be right for you.

Goldco and it's customer laser-focused mission on serving its investors is evident through its stellar customer service, seamless account setup process, it's low fees, and educational resources.

IRA investors get direct access to their own specialist who takes care of the entire rollover process. Non-IRA investors get assigned an account executive who makes sure you receive your precious metals when you want them, and on time.

Overview

There’s no need to continue to worry about how much money you maybe losing from your retirement accounts through your current portfolio. Now is the best time to roll over your 401k or traditional IRA into a gold IRA. The value of the dollar is up, making gold more affordable than ever.

When choosing a custodian for your gold IRA, you will want to notice how long they’ve been established in business, their fees, and their customer satisfaction ratings. Whether you want to maximise your retirement savings with precious metals or buy them directly, you can’t go wrong with Goldco. Just visit their website and download the comprehensive IRA guide below, If you have any questions then visit our FAQ page.