Top rated Gold IRA Companies

With the world economies reeling from the war in Ukraine, bringing vital shortages and soaring inflation, you may be asking yourself how this is going to effect your retirement savings? Many of us are seeing dwindling 401ks, and some of us may have even had to borrow from our retirement funds to stay afloat with temporary layoffs.

Luckily, in our Top rated Gold IRA Companies Review, we show you how and why your 401ks and traditional Individual Retirement Account to Gold rolled over into a gold IRA is a safe and profitable option no matter what is happening in the world. We’ll also reveal our pick for the best gold IRA company that you can trust to keep your retirement investments safe, and why we chose them.

Is gold a good retirement investment?

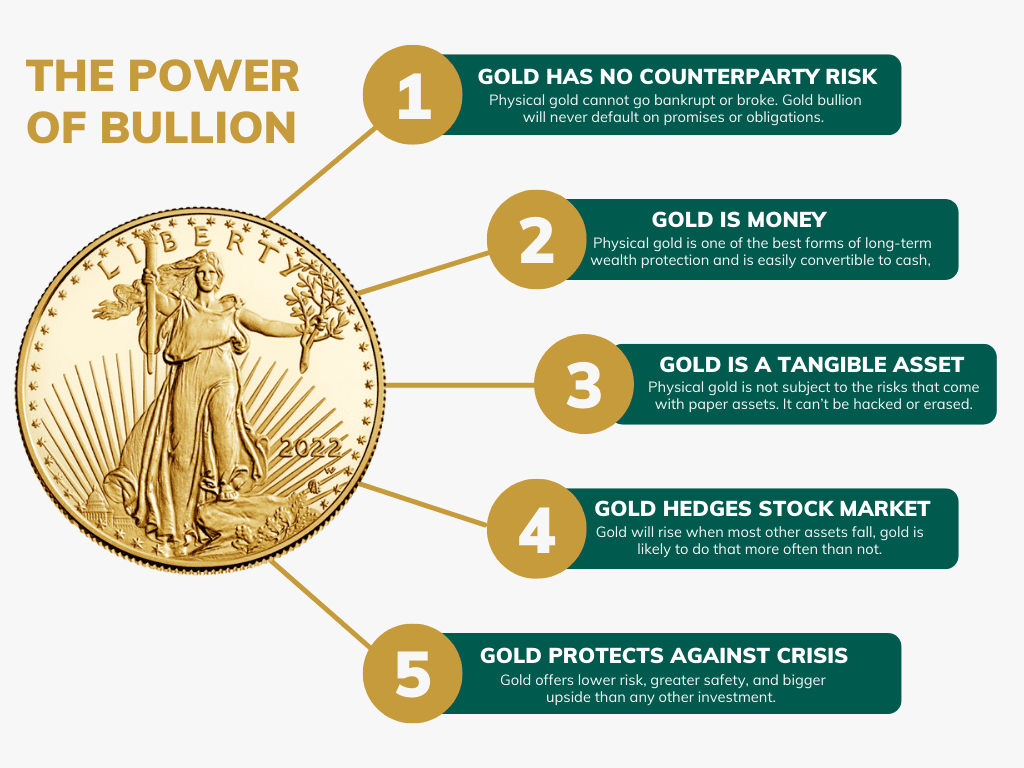

During times of political instability, recessions, and economic uncertainty, investors have turned to investments in gold as a safe option. It can be used to hedge against currency devaluation or inflation. In fact, it’s one of the best retirement investments you can make to withstand economic turmoil, inflation, and catastrophic world events.

Further, the United States Securities and Exchange Commission advises diversified retirement investments as being a safe way to manage financial risks and attain financial security after retirement. If you are looking to invest in precious metals, your IRA can assist you in securing a comfortable retired life by offering tax benefits, enhancing purchasing power, and diversifying financial and other assets.

For more information then read our article "how gold performs during recessions"

Gold values are driven by supply and demand

Gold remains valuable because of limited supplies and increased demand especially as gold mining has leveled off since 2016. According to the World Gold Council (WGC), there was a demand for 4282 tons of gold per year between 2008-2017:

- 52% jewelry (2233 tonnes)

- 27% bars and coins (1177 tonnes)

- 9% technology (384 tonnes)

- 8% central banks (341 tonnes)

- 3% ETFs and similar products (147 tonnes)

The gold market is only increasing as many central banks have been accumulating growing reserves of gold, bringing it nearly to a 30-year high. Indeed, WGC indicates that world events like the Ukraine invasion and soaring inflation continue to drive gold demand and price.

The US dollar is stronger than it has been in 20 years

The U.S. dollar is no longer backed by gold or any other precious metal, and Federal Reserve notes have not been redeemable for gold since 1934. Not being tied to our currency actually makes it safer for investors.

Luckily, a strong U.S. dollar tends to keep the price of gold lower for purchasing purposes. Meanwhile, a weaker dollar tends to drive the price of gold higher because you can purchase more gold when the dollar is weaker.

Investing in Precious Metals with your IRA

For years only gold and silver U.S. coins were allowed as IRA investments under federal guidelines. Now you can invest in most types of gold, silver, platinum and palladium through a self-directed IRA, making it easier than ever to create a truly diversified portfolio.

Precious metals like gold, silver, platinum and palladium can be an important part of a well-diversified retirement portfolio, giving you the option to invest in something tangible that can weather a financial crisis. Not only can you purchase, hold and sell precious metals with a tax-advantaged self-directed IRA account, you can also withdraw your bullion or coins and take direct physical possession of them.

What Is a Gold IRA and How Does It Work?

A gold IRA is an Individual Retirement Account (IRA) that includes gold or other precious metals like silver in its portfolio. It works exactly the same way as a traditional IRA. To own gold, you will need a self-directed gold IRA that includes physical precious IRS-approved metal bullion coins or bars instead of publicly-traded securities.

Conventional brokerage firms don’t offer gold IRAs, and the IRS will not let you store your gold IRA in your home without early withdrawal taxation penalties. So, you will need to find a precious metals IRA custodian. Using an IRS-approved gold IRA company ensures that you’re meeting IRS storage requirements without accruing penalties for withdrawal.

Know more about a self-directed gold IRA (self-storage gold IRA)

In addition to a traditional IRA, Americans can possess a self-directed IRA to invest in different assets. Under SDIRA, you can have complete control over your alternative, non-paper investment.

A precious metal Individual Retirement Account (IRA), also known as a gold IRA, allows you to invest in precious metals such as gold, silver, palladium, and platinum. Under a gold IRA investment, you must include a fraction of IRS-approved coins or bars stored in an IRS-approved depository.

You can continue making contributions to your traditional gold IRA account until you reach the age of 70.5. After that, only Roth IRA contributions are allowed. Withdrawals are also tied to your age. Though you can technically withdraw funds from your account at any time, doing so before age 59.5 will mean a 10% penalty. At age 72, you’ll also need to start taking required minimum distributions.

What are gold IRA tax rules and benefits?

After opening your gold IRA account, you can only contribute up to the approved IRS limit but a gold IRA has remarkable tax advantages.

You can buy precious metals such as gold using your pre-tax dollars, which will only be taxed upon distribution. You can also use your after-tax dollars to invest in precious metals, which their gained values will not be taxed, nor will they be taxed on withdrawal. Moreover, unlike any other financial products and central banking that hold just a percent of deposits in their vaults, you can keep the total amount available to you by purchasing precious metals.

In the last few years, the process of opening a self-directed IRA account has been dramatically improved. Now, you can contact two or more companies you have targeted, and their experienced IRA consultants will walk you through the whole process of rolling over from your current IRA.

They will also help you purchase coins or bars and handle the shipment of precious metals to an IRS-approved depository, which the whole process may take only two to three weeks to complete.

IRS Approved Gold Coins

You can invest in the following gold coins for your gold-backed IRA from Noble Gold. One ounce, one half, one quarter, and one tenth ounce gold coins are allowed as per the IRS regulations, learn in more detail below.

IRS Approved Silver Coins

- America the Beautiful bullion (no proofs)

- American Eagle bullion and proof

- Australian Kookaburra

- Austrian Philharmonic

- Canadian Maple Leaf

- Mexican Libertad

IRS Approved Platinum Coins

- American Eagle bullion and proof

- Australian Koala

- Canadian Maple Leaf

- Isle of Man Noble

Metal Purity Standards

To qualify as IRA allowable precious metals, the following minimum fineness requirements must be met:

- Gold must be .9950 (24 karats) pure

- Bullion bars should be fabricated by NYMEX, COMEX, or any other ISO 9000 approved refiner.

- Proof coins should be presented with a certificate of authenticity and must be in their original mint packaging.

- All bullion must be in an uncirculated, first-rate condition.

Precious Metals storage options

In compliance with IRS rules, you may not hold precious metals yourself while owned in an IRA, instead you will be required to select a third-party depository location for the physical storage of your IRA-owned precious metals.

You may select commingled or segregated storage of your metals and you will be responsible for any storage-related fees. Note: All Silver will be held in commingled storage and segregated storage is not an option.

What is commingled storage?

If you select commingled storage, your precious metals will be held in a segregated storage area but will be commingled with other customers within the storage area. When you later decide to sell, exchange or take an in-kind distribution of your precious metals, you will receive “like for like” precious metals (not the exact metals that you initially purchased).

What is segregated storage?

If you select segregated storage, your precious metals will be held in a segregated storage area and will be segregated, marked and stored with your name and IRA account number. When you later decide to sell, exchange or take an in-kind distribution of your precious metals, you will receive the exact metals that you initially purchased.

How to open a Gold IRA

If you want to know how to set up a precious metals IRA, it is a little different than a conventional IRA account. Here are the steps:

- Choose a custodian: You’ll need to choose an IRS-approved custodian to manage your IRA account for you. They will be your middle man and manage your precious metals according to IRS regulations

- Choose a dealer: A precious metals dealer will supply the gold you need for your gold IRA. The custodian will be your go-between with the dealer and may be able to help you find a dealer. If choosing your own, look for a dealer who belongs to ANA, ICTA, or PNG.

- Decide on your investment: Decide what type of products you want to buy from your dealer. U.S.-mint-issued American Eagle Bullion Coins or Canadian Maple Leafs are a common choice that meet the requirement of having a 99.5% fineness level.

- Choose a depository: You need to store any precious metals you want to add to your self-directed IRA in an IRS-approved depository. Your custodian can help you find one that meets IRS requirements.

- Complete the transaction: Completing the transaction involves the IRA custodian handling the payments and the dealer shipping your precious metals to a depository.

How to add Gold to an IRA

If you have an existing precious metals IRA and want to add additional gold to it, you will need to use your custodian to help you purchase gold from the dealer, so the dealer can move it to the depository for you.

After opening your gold IRA account, you can only contribute up to the approved IRS limit. For 2022, that limit was $6000 of income for those under 50 and $7000 for 50+.

Noble Gold Investments

Who are Nobel Gold?

Noble Gold Investments is a beloved IRA firm for its beginner-friendly (and quick) enrollment process and overall customer support. They are based in Pasadena, California and was formed over 20 years ago by current Chairman and CEO, Colin Plume. and Charles Thorngren They have founded the company on one principle. This principle is putting the client’s needs first.

What Makes Noble Gold Unique?

They specialize in gold IRA and silver IRA planning, precious metals IRA rollover programs and have lots of ideas to get you on the right track to financial security. With Noble Gold you will be treated like an elite investor. Upon enrolling with Noble Gold, you will know who their CEO is and who you will be handing your money to.

Noble Gold sells gold, but they provide great service to their customers too. Their first-class customer service provides each customer a live precious metals expert, who gives extensive knowledge of their products and will answer any of your questions. They have helped thousands of clients from all walks of life to see precious metals in a new light. Noble Gold are dedicated to educating customers on the importance and impact of investing in a Gold IRA. They list benefits such as:

- No losses during a stock market crash

- Free investment kit

- Trusted advisors

- Get set up in just 5 minutes

- Gold Survival Packs

Noble Gold wants its clients to be well-informed and in control of their financial futures and are much more hands-on than many big-name financial firms.

Royal Survival Packs

The Royal Survival Packs from Noble Gold are among the most unique and desired features. And while you may think all gold is equal in quality, the survival packs provide customers with top-notch metals chosen by industry experts.

These packs are not traditional IRA investments. They are for use as currency in the event of an emergency or economic crisis. Packs range from $5,000 to $500,000 and become immediately available when needed. And, unlike the Noble Gold IRA, international buyers can purchase a Survival Pack.

How does a Noble Gold IRA Work?

Setting up your Noble Gold IRA is relatively simple. First, all customers must fill out an application online or call the firm to complete registration on the phone. The application requests information regarding your identity, address, and retirement logistics.

Next, Noble Gold walks you through the process of choosing IRS-friendly gold. Some gold formulations are taxable and result in a penalty if you put them on your tax returns, but working with Noble Gold ensures your investment remains with you and saves tax dollars (it is entirely legal).

After deciding which type of gold best suits your needs, you can decide if you want to fund your investment with cash or use a previous IRA using a rollover. Noble Gold can also assist you with making this decision after researching your financial status.

Your gold is then stored in an International Depository Services-approved location and insured by Lloyd’s of London. And, although your gold is corporeally on another site, you can always access it online - 24/7, 365.

Secure storage for your wealth

As per the IRS regulations, you must keep your gold bullion secured in a secure and safe storage vault. Nobel Gold stores your precious metals in a registered secure depository facility – sometimes called a repository and they are based in Texas.

Why Texas?

Delaware (and by extension – New York) no longer have the monopoly on your gold IRA investment account precious metals storage. Your IRA gold and IRA silver can now be stored safely without it ever leaving the Republic.

Texas maintains its state rights fiercely – originally, the “six flags state” was not subject to the laws of the United States. Texas made its own laws, many of which are still in force today. This makes it the perfect location for a depository.

This is why Noble Gold is delighted to have secured a partnership with IDS (International Depository Services) in Dallas, they are the first and only, private secure gold depository facility in the south for your precious metal IRA storage needs. Up until now you had only one choice with Noble Gold in the US – the depository in Delaware.

Five - Star Endorsements

Tips

Special: FREE 5 oz silver on sign up of Precious Metals IRA

Conclusion - Why We Chose Noble Gold

With TX State protected segregated storage, gold survival packs with home delivery, easy website navigation, low minimums, Nobel Gold is perfect for Entrepreneurs, Business Owners, Early Retirees, and Texans of course!

Join the gold rush today and start protecting your savings from inflation by requesting your FREE IRA protection guide that shows you how to turn your 401k into Gold

Pros and Cons

Pros

1) Get a free guide that teaches you how to protect your assets, by rolling over a 401k

2) Annual Fees: $230

3) Simple Five-minute application and enrollment

4) Royal Gold Survival Packs

5) Best for customer education

6) Minimum Investment: $5,000.

Cons

1) A new company (less than 30 years old) but with an active and highly experienced CEO

2) Highly liquid exchange.

Gold Options For You

A self-directed IRA in precious metals can be a rock solid investment prospect for many investors, but it’s important to learn all the facts before opening an account, therefore, we encourage you to do your own due diligence to protect your retirement savings.