Many or all of the companies featured provide compensation to "Gold IRA Investment Guide". Commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site. Further information can be found on our website disclaimer.

Best Gold IRA Company Review 2025.

What is the best Gold IRA company review in 2025 to help you protect your retirement savings against losing buying power?

As we edge toward a post-pandemic world, many investors are looking for ways to prepare for future uncertainties. In the last few decades, the world economy experienced a quantum leap in wealth accumulation and financial growth, unique in human history. However, after the COVID-19 pandemic in 2019, and currently owing to the adverse outcomes of the war in Europe, it seems that this golden era was transient, and the world economy is preparing to experience unclear and unpredictable changes.

If you are close to retirement, you are probably worried about losing what you have saved in these many years of hard work for your post-retirement. But in reality, due to currency devaluation and inflation we are experiencing now, your regular IRA is losing its buying power before your very eyes. Many other factors that are out of your control can worsen this situation. But, it is no time to panic, and you have to take some actions to protect your portfolio against these adverse negative movements. Having a futuristic retirement plan in place lets you live a stress-free and comfortable life into your senior years and prepare for any unwanted and uncontrollable upheaval in the financial markets.

In this article, we are going to show you how you can protect your investments against any unpredictable disastrous circumstances, such as inflation, war, pandemics, recession, and any other geopolitical crisis. We will show you how to protect your wealth by diversifying your retirement portfolio from traditional IRA accounts, even though the financial markets are turbulent and global uncertainty may make you feel vulnerable.

Know more about a self-directed gold IRA (self-storage gold IRA)

In addition to their traditional IRA, Americans can possess a self-directed IRA to invest in different assets. Under SDIRA, you can have complete control over your alternative, non-paper investment.

A precious metal individual retirement account (IRA), also known as a gold IRA, allows you to invest in precious metals such as gold, silver, palladium, and platinum. Under a gold IRA investment, you must include a fraction of IRS-approved coins or bars stored in an IRS-approved depository.

Are Gold Investments Safe?

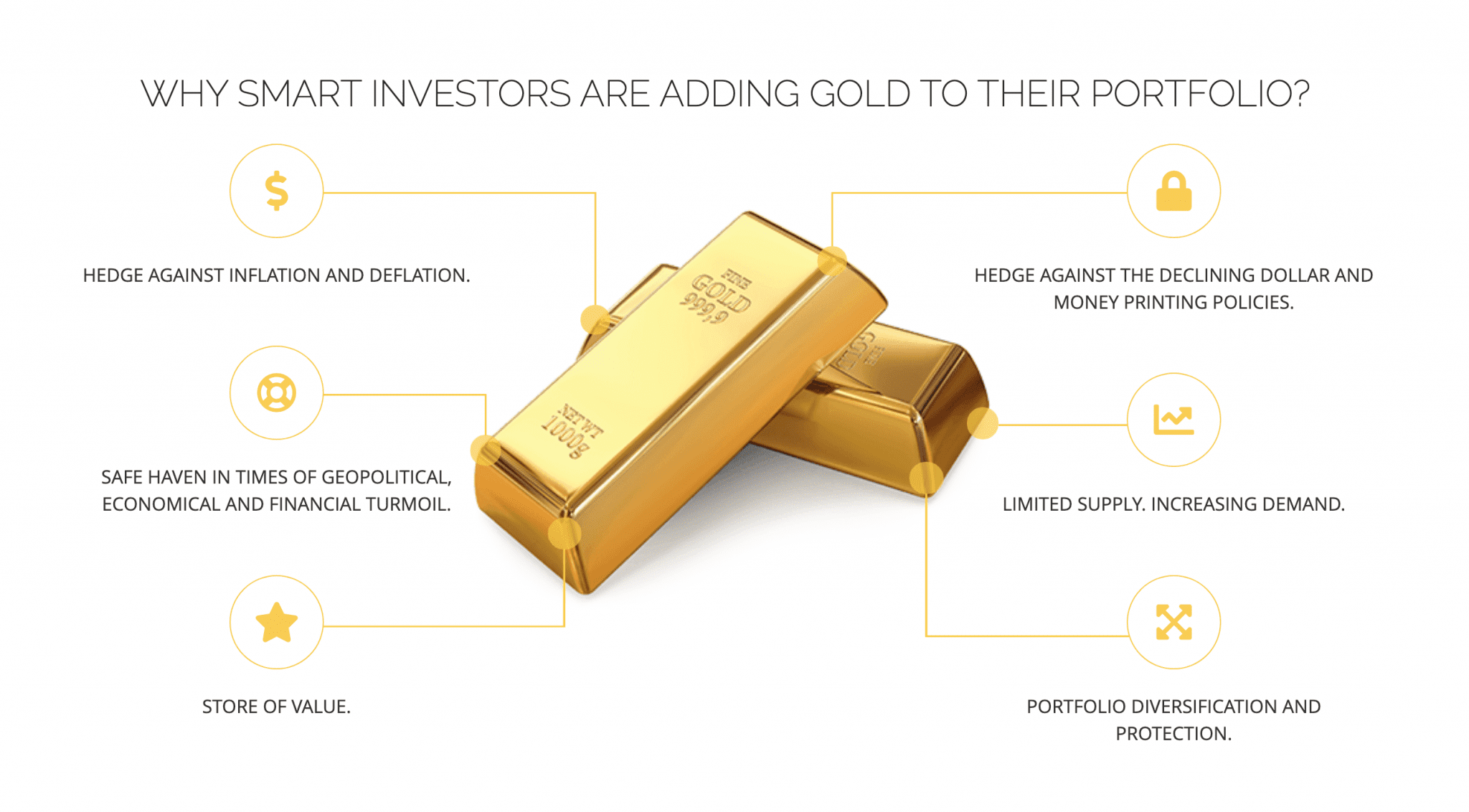

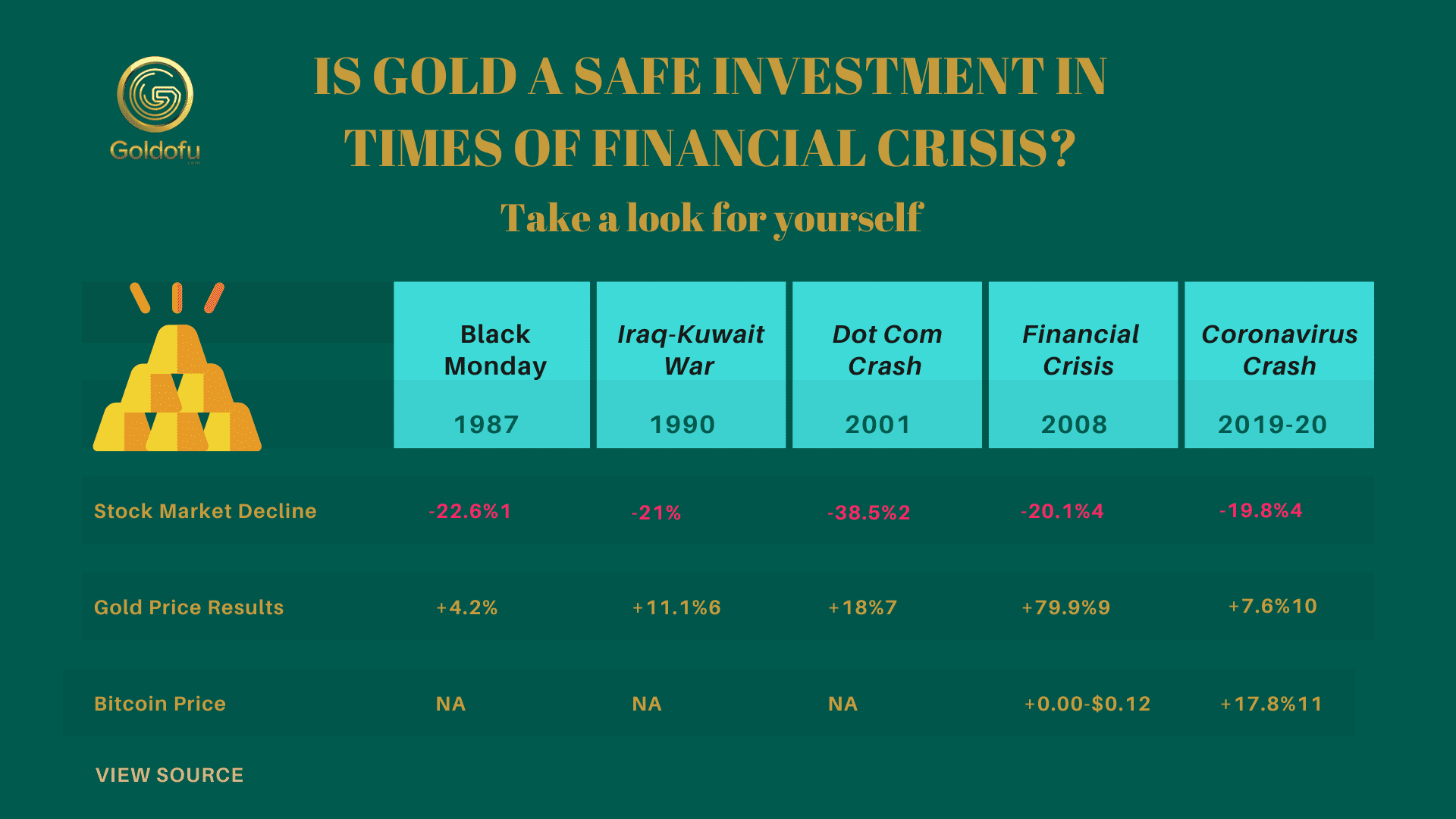

During times of political instability, recessions, and economic uncertainty, people have turned to investments in gold as a safe option. It can be used to hedge against currency devaluation or inflation.

Gold values are driven by supply and demand

Gold remains valuable because of limited supplies and increased demand especially as gold mining has leveled off since 2016. According to the World Gold Council (WGC), there was a demand for 4282 tons of gold per year between 2008-2017:

The gold market is only increasing as many central banks have been accumulating growing reserves of gold, bringing it nearly to a 30-year high. Indeed, WGC indicates that world events like the Ukraine invasion and soaring inflation continue to drive gold demand and price.

The US dollar is stronger than it has been in 20 years

The U.S. dollar is no longer backed by gold or any other precious metal, and Federal Reserve notes have not been redeemable for gold since 1934. Not being tied to our currency actually makes it safer for investors.

Luckily, a strong U.S. dollar tends to keep the price of gold lower for purchasing purposes. Meanwhile, a weaker dollar tends to drive the price of gold higher because you can purchase more gold when the dollar is weaker.

What are gold IRA tax rules and benefits?

A gold IRA has remarkable tax advantages. You can buy precious metals such as gold using your pre-tax dollars, which will only be taxed upon distribution. You can also use your after-tax dollars to invest in precious metals, which their gained values will not be taxed, nor will they be taxed on withdrawal. Moreover, unlike any other financial products and central banking that hold just a percent of deposits in their vaults, you can keep the total amount available to you by purchasing precious metals.

In the last few years, the process of opening a self-directed IRA account has been dramatically improved. Now, you can contact two or more companies you have targeted, and their experienced IRA consultant will walk you through the whole process of rolling over from your current IRA.

They will also help you purchase coins or bars and handle the shipment of precious metals to an IRS-approved depository, which the whole process may take only two to three weeks to complete

Is the gold IRA a good return on your investment?

Gold IRA investment returns

The first and foremost incentive for investing 10 to 15 percent of your retirement funds in precious metals such as gold and silver is the peace of mind it gives. Having a silver or gold retirement portfolio helps you get through almost any unfavorable fluctuation in the financial markets, specifically during current inflation when the value of paper money and stocks decreases daily. The other significant benefits of investing in gold and silver are:

- By investing in precious metals, you are less worried about the ups and downs of the world's political situations, which directly and indirectly affect the financial markets and your retirement savings buying power.

- You can balance your retirement portfolio and protect your investment savings by purchasing a gold IRA.

- When you roll over 10-15% of your retirement savings to a precious metal IRA, you are vaccinated against deflation, inflation, and recession.

- With a gold IRA investment, you will protect your assets against shortages, financial market crashes, and other undesirable and worrisome market uncertainties.

- Owing to the high demand for alternative and more stable investments such as gold and silver, the precious metals value retains or, in most cases, increases when the interest rates rise or financial markets crash.

- With a precious metal IRA, you are protected during and after an income loss, natural disaster, or business closure.

- These types of investments are easy to liquidate due to their global stability in value and can be relocated during a war or political turmoil.

- A precious metal retirement account offers you an alternative strategy to manage your credit risk compared to solely having a stock-heavy or bond-heavy portfolio. Gold does not carry the over-exposure risk you will have in a stock-heavy portfolio or the interest risk you may face in a bond-heavy portfolio. It also protects your portfolio from the ups and downs during the years after your retirement.

Is a gold IRA a good investment for your retirement?

A brief overview of gold IRA benefits

Is gold a good retirement investment? Defiantly, it’s one of the best retirement investments you can make to withstand economic turmoil, inflation, and catastrophic world events and as such, the United States Securities and Exchange Commission advises diversified retirement investments as being a safe way to manage financial risks and attain financial security after retirement.

Elegible precious metals for IRA investing

With a gold IRA, you can diversify a portion of your retirement savings in different valuable assets by purchasing IRS-approved coins or bars.

The precious metals eligible for placement within an IRA have proven track records over thousands of years. These are the metals that transcend government influence they are tangible and cannot be printed like paper money or stored as a number on a computer file.

Gold, silver, platinum and palladium — these precious metals are popular for use in self-directed IRAs because of their long-term investment track record:

- Gold — a highly prized symbol of wealth since the earliest records of history

- Silver — used for thousands of years in coinage, jewelry, tableware, and more

- Platinum & Palladium — similar histories to gold and silver, these two precious metals are known for their catalytic properties and are still heavily used in industrial processes.

Gold is one of the rare commodities that, despite any unwanted economic, political or financial crisis, holds its value, or in many cases, its value even increases.

In response to any financial crisis and to control the turbulence in the financial markets, the central banks usually print more paper currencies to pay back their debts and prop up their government, making paper currencies less valuable and increasing inflation. On the other hand, because there is only a limited global supply of gold, the gold assets are automatically protected from devaluation, and gold prices usually move in the opposite direction of paper currency.

Thus, having an additional gold IRA or gold Roth IRA in your retirement portfolio protects you from inflation. This approach reduces your investment risk and helps protect your retirement savings in the long run.

In the last few years and due to the instability of financial markets, more and more new and experienced investors, professionals such as lawyers, physicians as well as baby boomers, and retirees have been shifted to invest in precious metals for their stability and constant growth. Thus, many investment firms have added gold IRAs to their investment packages to fulfil a more diverse crowd of investors. However, this diversity in gold companies that offer self-directed IRA investments has made it challenging for investors to find the best company that matches their investment needs and personal preferences.

You may wonder if it is safe to buy precious metals during inflation?

After the devastating outcomes of the covid-19 pandemic in 2020, a new frontier of professionals, retirees, doctors, lawyers, and other smart business people started to move 15-20% of their wealth to precious metal retirement accounts to protect it against the soaring decline in stock and paper currencies and ever-increasing inflation. It has been estimated that around 11% of U.S. adult investors hold gold in their retirement portfolios, which is sky-rocketing.

Purchasing and holding precious metals such as silver and gold is one of the most brilliant strategies for long-term wealth growth. According to World Gold Council, from a study dated back to the 80s, when inflation was around or higher than 6%, gold had a return of about 15% per annum, and when the inflation was less than 3%, it had a return of 6% per annum.

Asian families from India or China always rely on gold as an absolute measure of their wealth and protect them and their families through natural or civil disasters or political swings. It is worth noting that Indian families hold the largest reserve of gold globally, which has estimated to be around 24,000 metric tons.

According to the Chinese officials, the rate of gold accumulation among individuals and the government has increased unprecedentedly since 2020, intending to replace the dollar with the Chinese Yuan as the world's leading currency. Thus, the availability of gold for investment is diminishing rapidly, which means that the value of every gold bar or coin you own is increasing daily.

Entrepreneurs and family investors are also increasingly purchasing historical assets of silver and gold. Since 2017, more precious metal companies have been established owing to the high demand for buying silver and gold from the younger generation of precious metals investors. Moreover, retirees of all ages are shifting toward investing in self-directed metal IRAs to protect and grow their wealth.

If you are already retired or a pre-retiree in your 50s or 60s, you need to find a solution to protect your lifetime of savings. Opening a precious metal IRA account will give you this opportunity to hedge against any sort of future financial loss or inflation.

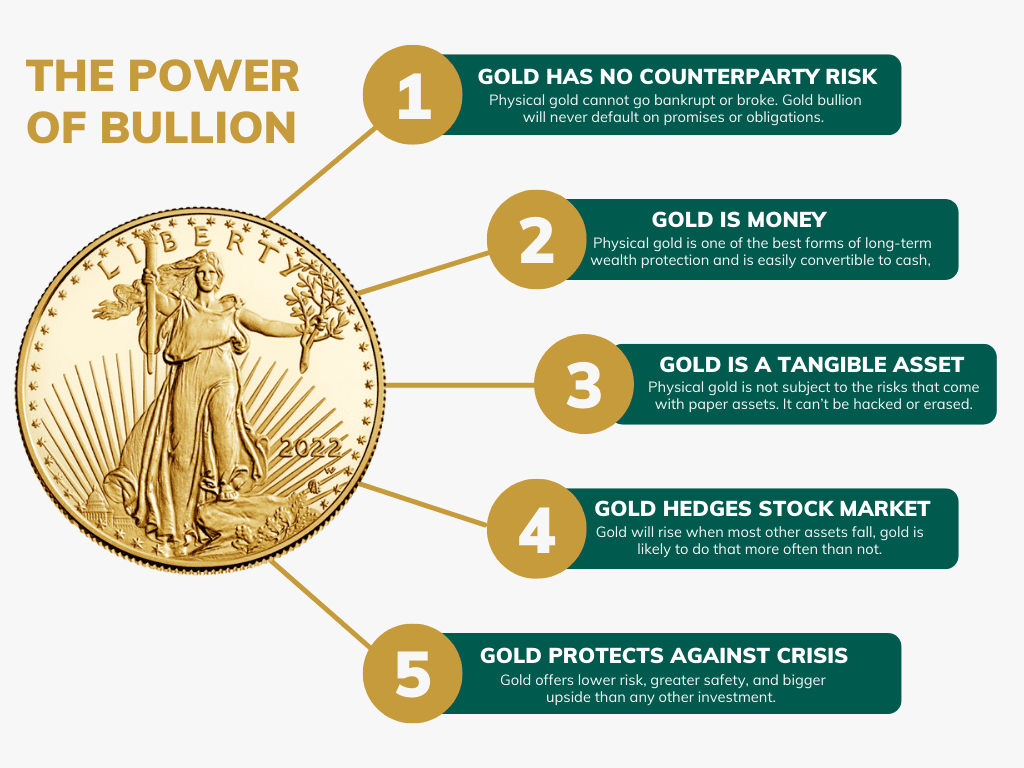

Should you invest in Gold Bullion?

The trend of purchasing gold has continued to rise in recent years; in 2018, the investor demand for gold in the United States grew by 4%, due to trade wars between the US and China. In the United Kingdom in 2018, due to the continued uncertainty of Brexit, the investor demand outstretched that of the US, with 12% of investors demanding the ability to invest in gold.

A gold IRA rollover guide – What is 401k to gold IRA rollover?

There are two main methods to fund your self-directed Individual Retirement Account

- In the first approach, you can transfer (rollover) funds from one or more of your existing traditional 401K, 403B, IRA, or TSP accounts (for government employees and military members) to your gold IRA account.

- In the second method, you can make contributions to your gold IRA account based on the limits approved by IRS. Based on IRS 2025 guidelines, the total annual contributions to your SD-IRA can not be more than $7000 of your income. If you are 50 or older, you can contribute $7500 to your account.

IRA gold tax

Gold Roth IRA rules

Gold IRA contribution limits

After opening your gold IRA account, you can only contribute up to the approved IRS limit.

As mentioned before, there are two different types of gold IRA. For a traditional gold IRA, you don't need to pay tax until you take a distribution or make a withdrawal. On the other hand, a Roth gold IRA will not be taxed upon withdrawal and is funded with pre-taxed money. Any gains in value or capital growth are also not taxed. Thus, choosing a suitable gold IRA depends on your contribution plan, the status of your existing IRA, your income and employment status, your age, and most importantly, your desired goals.

Should I buy Gold or Silver?

Purchasing gold bars and gold coins are the most popular options to initiate a gold IRA investment. However, the buying options are not limited to gold, and you can purchase bullions, bars, or coins made from silver, platinum, and palladium.

Compared to gold coins, billions are made of more pure gold and hold a higher value. However, It is often recommended to buy gold in 1 oz. bars or coins, so in the case of an emergency, you can sell smaller amounts each time. More popular gold coins such as Canadian Maple Leaf or American Eagle are the best choices owing to their popularity and ease of trading.

What is an IRA-approved gold?

The IRA or U.S. Internal Revenue Service only allows specific types of precious metals such as silver, gold, platinum, and palladium to be kept in a gold IRA account. The fineness and purity of the IRS-approved precious metals are listed below:

- Gold -> 0.9950

- Silver -> 0.9990

- Platinum -> 0.9995

- Palladium -> 0.9995

What are IRA-approved Gold Coins and Bars?

The precious metals eligible for placement within an IRA have proven track records over thousands of years. These are the metals that transcend government influence they are tangible and cannot be printed like paper money or stored as a number on a computer file.

Gold, silver, platinum and palladium — these precious metals are popular for use in self-directed IRAs because of their long-term investment track record:

- Gold — a highly prized symbol of wealth since the earliest records of history

- Silver — used for thousands of years in coinage, jewelry, tableware, and more

- Platinum & Palladium — similar histories to gold and silver, these two precious metals are known for their catalytic properties and are still heavily used in industrial processes

Here is a detailed look at each metal’s current eligibility rules on what you can specifically invest in:

Gold (.995 minimum fineness, except for the American Eagle |

Silver (.999 minimum fineness) |

The reputable gold IRA companies often have a list of IRS-approved bullions and coins that can be obtained by ordering their free-of-charge gold IRA catalogs and kits. These companies also offer flexible policies and favorable prices and can handle ordering and shipment of your precious metal purchases within 24 hours.

Platinum (.9995 minimum fineness) |

Palladium (.9995 minimum fineness) |

Best Gold IRA Company Review

In recent years, there are a number of gold companies that have entered the precious metals investments market. This has made it challenging for interested investors to seek out the best and most trustworthy companies. Nonetheless, a handful of proven and reliable providers stand out that offer world-class services in the domain of precious metals investing.

In our opinion and through our own independent research, we decided to review Augusta Precious Metals. They are IRS-approved and fully accredited by an independent monitoring group and comply with regulations that help protect investors’ interests. They provide excellent customer service, are reliable, provide safe and secure transactions, and are highly regarded by their customers.

Our best gold IRA company review outlines what to expect and provides you with customer satisfaction ratings.

Augusta Precious Metals review

Augusta Precious Metals was founded in 2012 by the CEO, Isaac Nuriani and has been one of the top precious metals brokers for years. He is a University of Los Angeles graduate and a member of ICTA (the Industry Council for Tangible Assets) and has a degree in Economics. He is also an Ethics.net member and has been helping retirees with precious metal investments for more than 20 years. The satellite office of the company is located in Beverly Hills, California, and the corporate headquarters is in Casper Wyoming.

Augusta Educational Resources

The approach that Augusta Precious Metals prefers is an educational one to precious metal IRAs because they know investing in precious metals is not necessarily the best move for every investor. They realize this and also work on various partnerships for everybody involved in the process. Before enrolling you in a particular program they will talk about your requirements and ensure it is going to work for you.

What this means is the company will encourage you to watch educational webinars rather than attempt to sell products to you. This is a great approach because Augusta will take the time to make sure that gold investment is a good plan for you, so they can be sure you are going to be happy with the results.

While you can buy large amounts of gold or silver directly from Augusta Precious Metals, their specialty is gold IRA accounts. Augusta keeps the focus on your retirement plans and goals and what is best for you. If they feel that gold is a good fit, they will help you every step of the way. If, however they don’t they will be transparent and let you know.

Setting up an account with Augusta Precious Metals is easy and streamlined. The company is extremely transparent with its customers, operates with integrity, and provides excellent customer support. Thus, their customers remain loyal.

The minimum amount you need to open a gold IRA account with Augusta Precious Metals is $50,000, which is higher than with some competitors. Meanwhile, non-IRA transactions must be for $25,000 or more. Augusta Precious Metals pays liability insurance and precious metal shipping expenses, so you don’t have to worry about those.

Augusta fees

In contrast to most other providers of precious metal IRA, Augusta are totally transparent and exclusive nature of its offerings in precious metal investment. There are no hidden fees of any manner. In addition, the pricing for products and services related to precious metals is amongst the most competitive in the market.

- A one-time fee of $50 to setup your account

- An $80 custodian maintenance fee to be paid annually

- An annual fee of $100 for depository storage

- Non-IRA purchase of precious metals requires a minimum of $50,000 to be invested in the account

- Silver or gold IRA requires a minimum of $100,000 to be invested in the account

- Shipping and transit is free.

- The fluctuating costs of silver and gold coins and bullion are based on spot prices and market rates. There is a 5% markup cost for bullion coins.

1) Augusta Precious Metals Rating

Top 3 Augusta Gold IRA Perks:

Fast. Only 15 minutes to get started.

Easy. Just 3 simple steps, their streamlined process takes care of 95% of the paperwork.

Reliable. Account lifetime support. Named best gold IRA company.

Pros and Cons

Pros

1) Easy, quick and very transparent account opening process for gold IRAs

2) The top motivation for precious metal investing according to many gold IRA investors is capital preservation as well as retirement security. Augusta Precious Metals has no online complaints at all, and their high ratings show they are one of the best precious metals IRA companies to use

3) Consistent 5 out of 5 customer service ratings

4) Free reviews of gold and silver portfolios and web conferencing with a Harvard-trained education director and the department

5) Joe Montana actively sought out this company to be an ambassador after their operation was vetted by his team, so you can enjoy the knowledge that you are part of an excellent company with an elite customer tier.

Cons

1) No palladium or platinum offered

2) Minimum Investment is $50,000

3) Doesn’t offer small quantities of coins and bars.

Conclusion

There’s no need to continue to worry about how much money you’re losing from your retirement accounts through your current portfolio. Now is the best time to roll over your 401k or traditional IRA into a gold IRA. The value of the dollar is up, making gold more affordable than ever. When choosing a custodian for your gold IRA, you will want to notice how long they’ve been established in business, their fees, and their customer satisfaction ratings.

Augusta Precious Metals stand out as a company that builds life long trust with its clients and are a highly rated, reputable company which can assist you setting up self-directed IRAs and send out IRS-approved silver and gold to depositories. Outside of a Gold IRA, the firm can also deliver cash purchases of physical precious metals investment if you prefer home delivery. Augusta is dedicated to educating clients and enjoying mutual success.

Customers get educational information on the Augusta website including videos, market news and a calculator for required minimum distribution, or RMD. Augusta’s reputation is hard to beat, their prices are fair, and they are completely transparent. It’s little wonder their customers have such great things to say about them.

Augusta Precious Metals guides investors through important decisions you have to make, the rules surrounding precious metals IRAs and IRS-approved investment options. Augusta offers many years of experience with the precious metals market and silver and gold IRAs. Consumer reviews frequently mention the level of customer service Augusta provides throughout establishing a precious metals IRA.

If you’re looking to diversify your investments with gold and silver, then Augusta Precious Metals is a great choice.

Author - Alireza Basiri

Answers to common questions

If you still have questions about Gold IRAs, take a look at our answers to common questions.