Best Gold IRA Rollover - with American Hartford Gold

Many Professionals like Doctors, Lawyers and Financial Advisors are moving their 401k to gold

Professionals like Doctors and Lawyers are moving as much as 15% of their wealth into gold and other precious metal investment accounts to help them hedge against the soaring inflation, price rises and worldwide vital shortages together with the rapid decline of the value of the dollar that is decimating their retirement savings. The WGC indicates that world events like the Ukraine invasion and soaring inflation continue to drive gold demand.

Gold & silver IRAs become popular for a new generation of investors

As early as 2020 nearly 11% of U.S. adults held gold in their investment portfolios, with Millennial-age investors and entrepreneurs with fast-growing wealth increasingly turning to historical hedges like gold and silver. That is a big increase from an estimated 3% of Americans in June 2017, just 3 years before. Since then, gold companies are experiencing robust investment from a new and younger generation of investors.

But still there are many investors that are not aware that you can actually put gold and silver into your retirement account, and how easy this is possible by simply doing a rollover of a 401(k) or IRA to a self-directed IRA. This type of IRA allows you to manage your own investments, while also investing in different asset classes besides stocks.

Retirees of all ages flock to open self-directed precious metals IRAs to help preserve and grow their wealth

There is not just retirees and early retirees today – there is also a fast-growing “Retire Young” movement of savvy investors who are diversifying to create passive income so they can retire with their families by 30 or 40 years old; there are many people from all walks of life in their 50’s and 60’s who are actively preparing to retire in an extremely volatile economy, as well as people already retired who are looking to protect their lifetime of savings.

Is a Gold IRA a good idea?

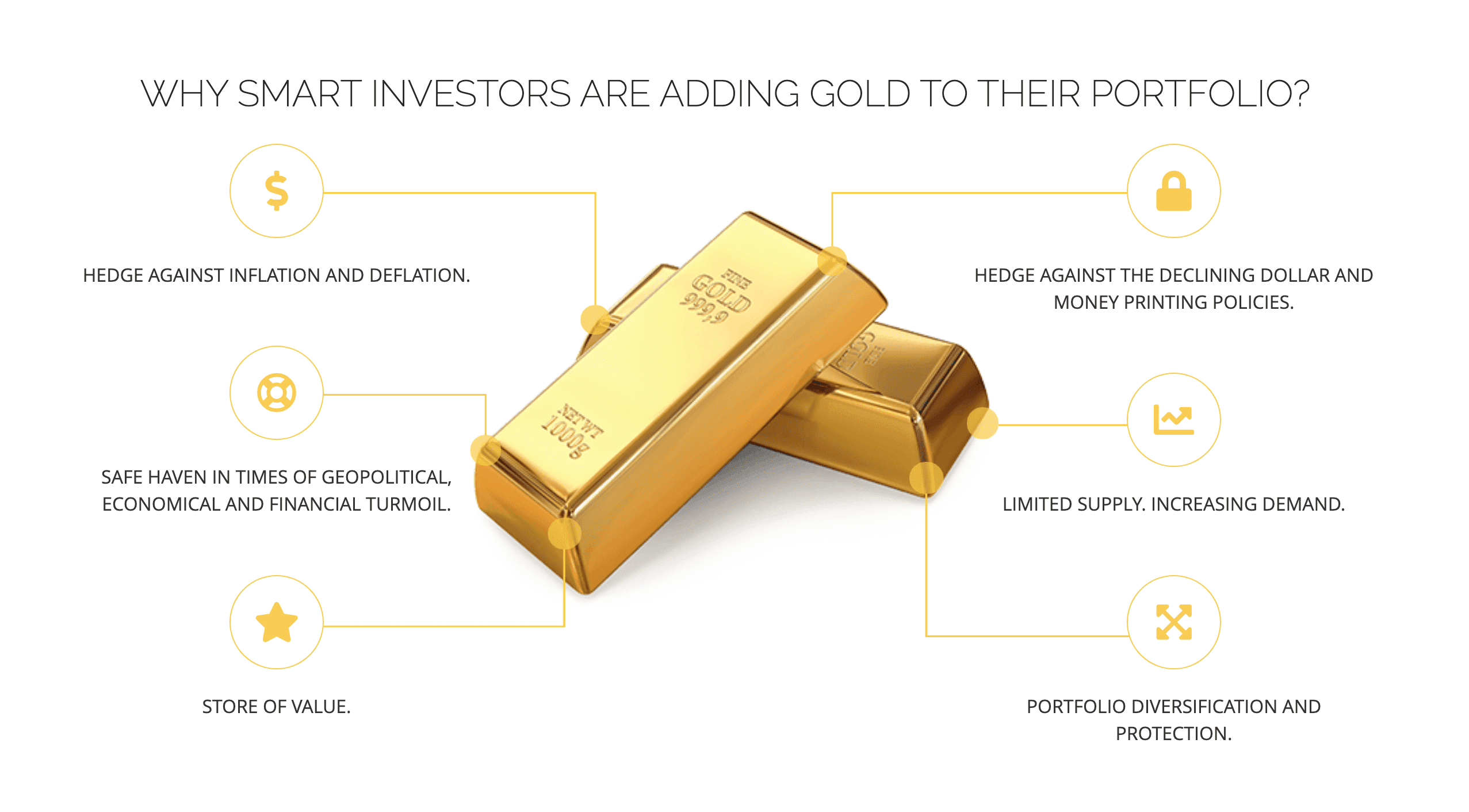

Why invest in gold bullion?

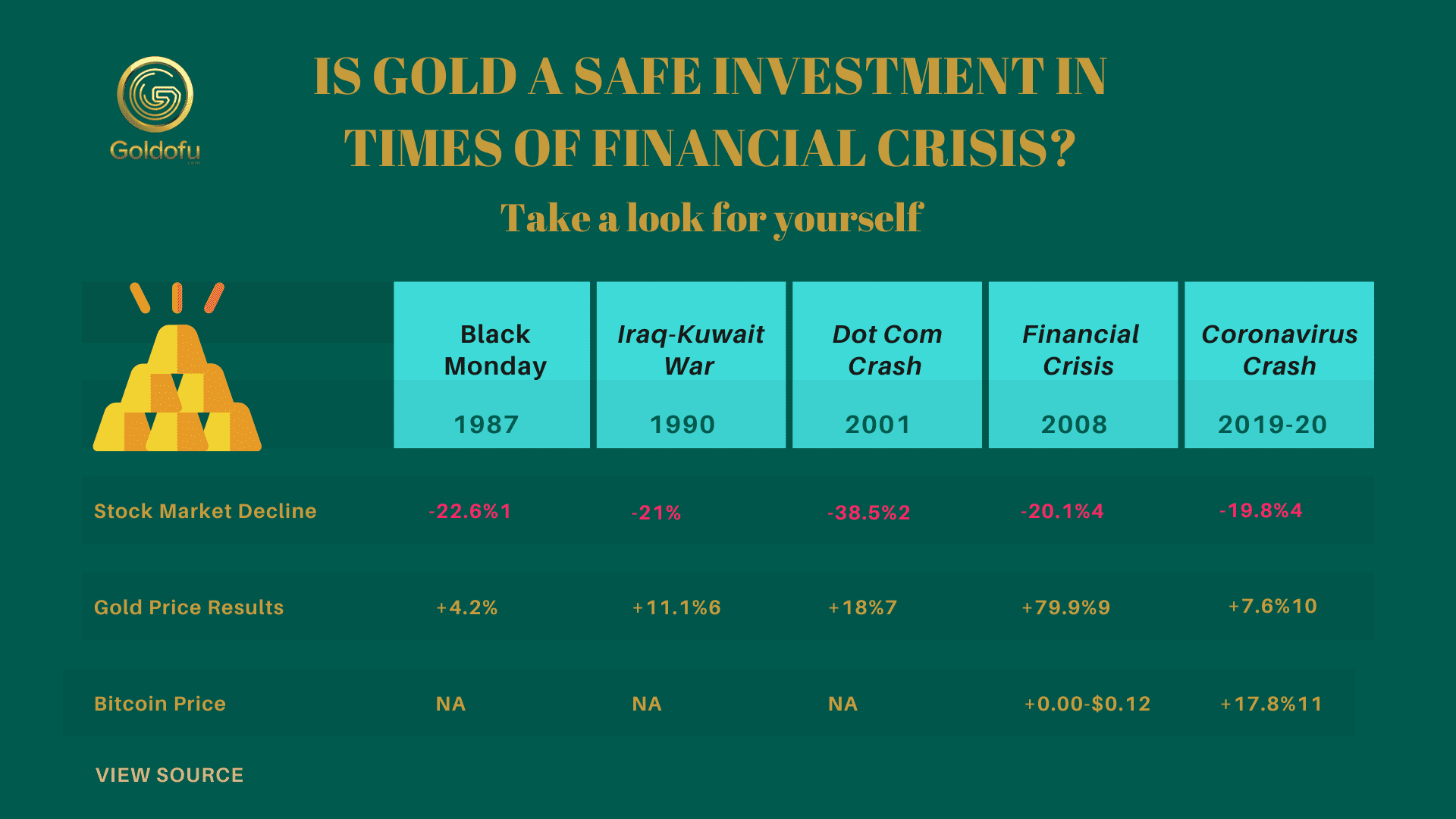

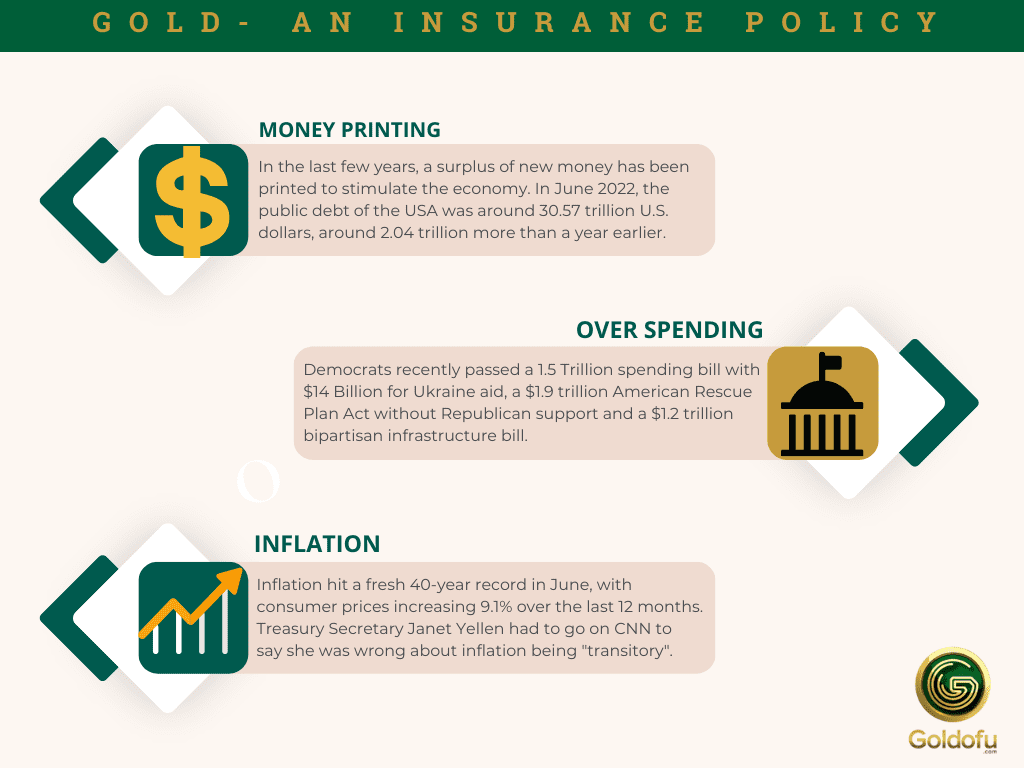

People like you, of all ages and from all walks of life, are looking at the same unstoppable events and nightmare statistics of huge debt and market manipulations in the economies around the world. Those who are concerned about the dwindling value of their IRA 401ks are adding gold, being the only physical substance of constant value, to their portfolios as a hedge against hyper-inflation and one of the few means of protecting their families in fragile future scenarios.

The price of gold today is most undervalued among the financial asset categories, and it may shoot past its lifetime high at any time due to the unpredictability and fragility built into the structure so many market sectors by massive debt.

The trend of purchasing gold has continued to rise in recent years; in 2018, the investor demand for gold in the United States grew by 4%, due to trade wars between the US and China. In the United Kingdom in 2018, due to the continued uncertainty of Brexit, the investor demand outstretched that of the US, with 12% of investors demanding the ability to invest in gold.

According to a study by the World Gold Council and using data since 1971, gold has returned 15% per annum on average when inflation has been higher than 3%, compared to just over 6% per annum when inflation has been sub-3%.

Now is the time to add gold to your Individual Retirement Account before the U.S. and global dollar-based economy fall off the financial precipice they are tottering on into worldwide economic collapse.

What determines gold value?

Gold prices are driven by supply and demand and remains valuable because of limited supplies and increased demand especially as gold mining has leveled off since 2016. According to the World Gold Council (WGC), there was a demand for 4282 tons of gold per year between 2008-2017:

- 52% jewelry (2233 tonnes)

- 27% bars and coins (1177 tonnes)

- 9% technology (384 tonnes)

- 8% central banks (341 tonnes)

- 3% ETFs and similar products (147 tonnes)

What Is a Precious Metals IRA?

A gold IRA is an Individual Retirement Account (IRA), essentially a self-directed IRA that includes gold or other precious metals like silver in its portfolio. It works exactly the same way as a traditional IRA. To own gold, you will need a self-directed gold IRA that includes physical precious IRS-approved metal bullion coins or bars instead of publicly-traded securities.

Conventional brokerage firms don’t offer gold IRAs, and the IRS will not let you store your gold IRA in your home without early withdrawal taxation penalties. So, you will need to find a precious metals IRA custodian. Using an IRS-approved gold IRA company ensures that you’re meeting IRS storage requirements without accruing penalties for withdrawal.

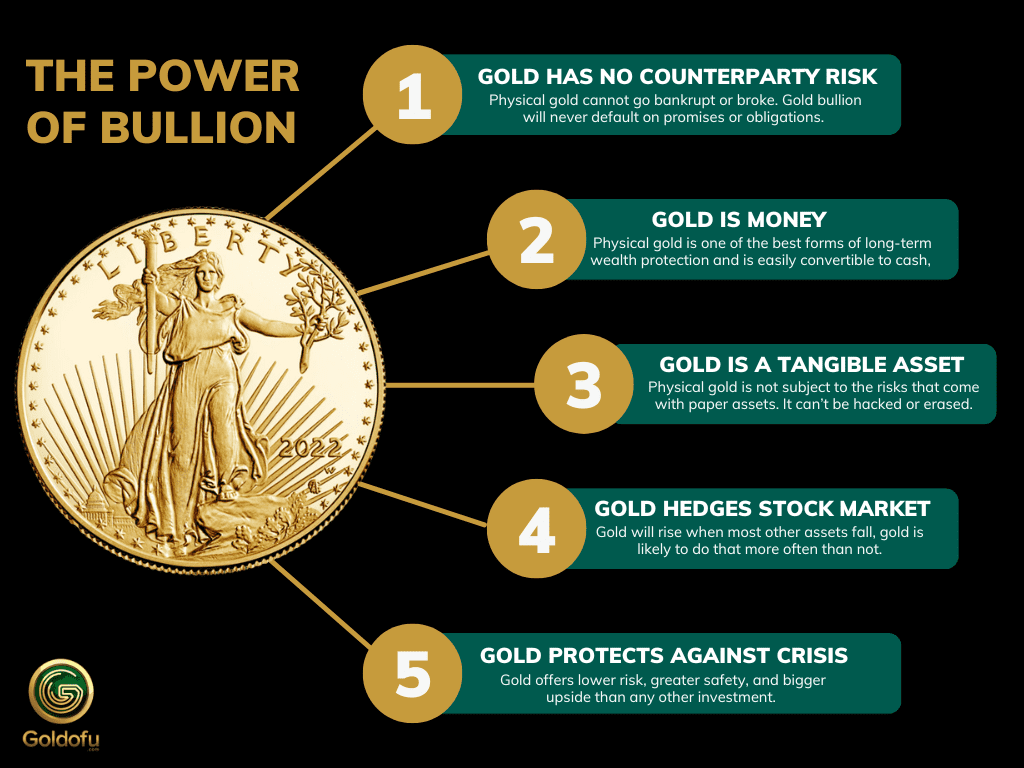

Regardless of your traditional investment preferences, tangible assets like gold and silver can help make the profitability and safety of your retirement portfolio far more attainable while mitigating risks from uncertain geopolitical landscapes. Including gold within an existing portfolio could improve investment performance by either increasing returns without increasing risk, or by reducing risk without adversely affecting returns.

Can you transfer or rollover your existing IRA?

If you have an existing precious metals IRA and want to add additional gold to it, you will need to use your custodian to help you purchase gold from the dealer, so the dealer can move it to the depository for you.

The following accounts are eligible to be rolled over into a precious metals IRA:

- Traditional IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

- Eligible 401(k), 403(b), 457, TSP, and more

TRANSFER: Your first alternative is a "transfer." This is something you can do at any time with your existing retirement plan as long as the assets go “from custodian to custodian.” and transfers may be made as often as you want.

ROLLOVER: The second alternative is a "rollover." A rollover occurs when you receive the distribution from your existing retirement account and then deposit it in another retirement plan custodial account. In this case you would need to re-deposit the funds into the new retirement plan account within 60 days.

If the 60 day time period is exceeded, you would be liable for taxes and penalties on the money withdrawn. You may roll over the same money only once every 12 months to preserve the tax-deferred status of your retirement savings.

After opening your gold IRA account, you can only contribute up to the approved IRS limit. For 2023, that limit was $6500 of income for those under 50 and $7500 for 50+.

How to open a gold IRA

How to set up a precious metals IRA is little different than a conventional IRA account. Here are the steps:

- Choose a custodian: You’ll need to choose an IRS-approved custodian to manage your IRA account for you. They will be your middle man and manage your precious metals according to IRS regulations

- Choose a dealer: A precious metals dealer will supply the gold you need for your gold IRA. The custodian will be your go-between with the dealer and may be able to help you find a dealer. If choosing your own, look for a dealer who belongs to ANA, ICTA, or PNG.

- Decide on your investment: Decide what type of products you want to buy from your dealer. U.S.-mint-issued American Eagle Bullion Coins or Canadian Maple Leafs are a common choice that meet the requirement of having a 99.5% fineness level.

- Choose a depository: You need to store any precious metals you want to add to your self-directed IRA in an IRS-approved depository. Your custodian can help you find one that meets IRS requirements.

- Complete the transaction: Completing the transaction involves the IRA custodian handling the payments and the dealer shipping your precious metals to a depository.

What is IRA approved gold?

You cannot just purchase any precious metal to be included in your Metals IRA. The United States government, through the IRS, has laid out some strict rules when it comes to what coins and bars qualify for such accounts. The precious metals eligible for placement within an IRA have proven track records over thousands of years. These are the metals that transcend government influence they are tangible and cannot be printed like paper money or stored as a number on a computer file.

Gold, silver, platinum and palladium — these precious metals are popular for use in self-directed IRAs because of their long-term investment track record:

- Gold — a highly prized symbol of wealth since the earliest records of history

- Silver — used for thousands of years in coinage, jewelry, tableware, and more

- Platinum & Palladium — similar histories to gold and silver, these two precious metals are known for their catalytic properties and are still heavily used in industrial processes.

Here is a detailed look at each metal’s current eligibility rules on what you can specifically invest in:

Precious metal purity standards

To qualify as IRA allowable precious metals, the following minimum fineness requirements must be met:

- Gold must be .9950 (24 karats) pure

- Bullion bars should be fabricated by NYMEX, COMEX, or any other ISO 9000 approved refiner.

- Proof coins should be presented with a certificate of authenticity and must be in their original mint packaging.

- All bullion must be in an uncirculated, first-rate condition.

Should you diversify your IRA as a hedge against inflation?

You already know that the economy has been in serious trouble for some time now. You are witnessing the effects of a global pandemic and worldwide vital shortages due to the war in Europe. You are feeling the fear of an uncertain future and doubting that the government or anyone else is going to be there to help you and your family survive the even tougher times ahead.

You already know you need to diversify how you are holding your nest egg so it doesn’t sit in a bank or a fund deteriorating at 5% or more a year. To be reading this page, you’ve been searching online for answers to questions like, “Are we in a recession?” “Is Social Security running out?” “How can I protect my retirement savings?” “Is it smart to invest in gold?”

There is an old proverb (from Spanish or Italian origins): “Don’t put all your eggs in one basket.” No matter the context, this phrase means don’t risk losing everything by only having one plan or idea and then depending on that one thing entirely for your success. This is particularly true when it comes to saving for retirement.

Is Leverage a safe-haven approach?

According to Forbes, “buying metals represents a safe-haven approach to diversification.” These additional investment “baskets” provide diversity and act as a shield against an unpredictable stock market, the fluctuations in the value of the U.S. dollar, and other economic uncertainties.

Gold can be used to diversify several categories of investments, including equities, bonds, and cash, like the U.S. dollar and It can be used to hedge against currency devaluation or inflation.

Who is best suited for gold IRAs?

Whether you’re an entrepreneur, working professional, investor, business owner, or retiree, you can benefit from a gold IRA. Anyone who has at least $20,000-$50,000 to roll over in a gold IRA should do so. Stock market conditions can change drastically, bringing your investments with it. As we move toward a higher inflation rate and continuing economic upsets, your 401k is more vulnerable than ever. Thus, more and more people are doing a gold 401k rollover or IRA rollover to keep their 401k funds and IRAs safe.

If you’ve already seen your retirement funds and stock portfolio values drop and are worried about how much money will be left in it when you retire, you’re the perfect person to invest in a gold IRA, don’t wait until it goes down even more.

Precious metals hold their value and even become more valuable during times of economic turmoil. So, if you’re worried about the value of the dollar as prices soar, choosing a gold IRA can give you peace of mind concerning the security of your retirement savings.

Tax Benefits of a Gold IRA

When you buy gold or silver for your self-directed IRA, you can avoid capital gains taxes by taking a tax deduction on top of deferring taxes until a later date.

Investing in precious metals through your self-directed IRA is an efficient and legal way to profit from price increases while benefiting from tax savings.

These are three main tax benefits of Gold IRAs

-

Inheritance Tax

Relief from Inheritance Taxes. Following the death of the asset holder, some Self-Directed IRAs allow assets to be passed along to beneficiaries with few or no tax implications. Side-stepping certain inheritance taxes could be a huge financial relief for anyone you designate as a beneficiary for your Gold IRA.

-

Saver’s Tax Credit

The IRS says you might be able to take a tax credit for making eligible contributions to your Gold IRA. It’s known as the Retirement Savings Contributions Credit, or saver’s credit.

You may be eligible for this tax credit—up to 50% of your contributions!

-

Tax Deferment

Fortunately, just as with other types of IRAs, taxes are deferred until you take distributions with a Traditional Gold IRA. Contributions of gold coins and bullion to a Gold IRA are made on a pre-tax basis.

However, if gold assets are held in a Roth IRA, contributions are made on a post-tax basis, meaning withdrawals are tax-free.

According to the Journal of Accountancy, a Traditional Gold IRA can yield better after-tax returns than gold kept in a Roth Gold IRA, but both options should be considered to help diversify your portfolio and create a safe haven for some of your assets.

American Hartford Gold IRA Review

American Hartford Gold is a great option for those who aren't too keen on investing in rare or collectible coins, but simply want to invest in pure precious metals. This company is an investment firm and stands out for its diversity of offerings, apart from Gold and Silver, it also includes palladium and platinum bars and coins.

They are based at 11900 W. Olympic Blvd #780 | Los Angeles, CA 90064 United States and were founded back in 2015 by Sanford Mann, the current CEO.

AHG has a long standing tradition of responsible and trustworthy business practices demonstrated by the AA rating with the BCA (Business Consumer Alliance). Over $1 billion of precious metals delivered and many years of combined experience in the precious metals industry, the AHG team of specialists work for you. From buying and selling Gold Bullion and Gold Coins to giving advice on setting up a long term tax deferred retirement plan, commonly called a Gold IRA.

You can be assured that AHG always has the right investment for you. As your premiere precious metals firm, AHG takes pride in aligning itself with exceptional customer service, security, grading and knowledge and it promises transparency with its fees and commissions.

American Hartford Gold - Key Features

Any silver or gold IRA provider is only as good as its customer reviews and endorsements but AHG claim to have one of the "highest rating profiles" in the industry for its almost ten-year history,

- Best Service Options with lowest price guarantee & no buy-back fees

- Up to $10,000 in free silver on qualified orders

- A Family owned and operated business

- Exclusively recommended by Bill O'Reilly, Rick Harrison and Others.

- They have a AA rating with the BCA (Business Consumer Alliance)

- 5-star rating on TrustLink and 4.9/5 on Google

- Segregated vault storage

- No-Cost consultation with a Precious Metals Specialist

- Annual maintenance fees typically do not exceed $180 but the rate is not guaranteed. American Hartford Gold will cover all fees for the first year, In some cases, they may even cover fees for up to the first three years

- Low min Investment of $10,000 for Gold IRA Rollover and for Cash deal’s minimum is $5000.

- Provide other precious metals as well as gold & silver

- Named #1 Gold Company by the prestigious Inc. 5000’s 2021 and 2022 list of America’s fastest-growing private companies

- 1,000+ 5-star customer ratings and reviews.

Cons:

- No online pricing for precious metals

- Fee structure not publicly listed

- Does not ship outside USA

How does an American Hartford Gold IRA work?

AHG lets you buy precious metals and other investment products for use in its proprietary IRA or home delivery.

If you’re buying precious metals for an IRA, the company gives you the option to have your metals delivered directly to an IRS-approved depository, including its own storage option. AHG has third-party insurance to protect your investment while in transit.

You can get segregated precious metal storage worldwide at a low cost (no shared ownership), fully insured assets, as well as the right to have gold bullion delivered to your front door anywhere in the world since affiliated vaults are located in various worldwide cities.

How to invest in an American Hartford Gold Gold IRA

A Gold IRA is remarkably easy to set up. There is no need to sell your assets from your current 401(k) or IRA to invest in gold. Instead, you can simply rollover or transfer funds from your existing retirement account. Best of all, these rollovers are tax free and penalty free. You will have protected the value of your assets without having to invest any additional money.

With American Hartford Gold, you can establish your Gold IRA in just three simple steps:

- Complete the form on our website: following the link below to the AMG website where you can claim your FREE Gold Kit, your answers will be collected securely and privately. You will then be contacted by an IRA specialist. If you have any questions or need assistance, you can rest assured you will get all the help you need.

- Fund your account: In as little as 3 days, your new IRA will have funds transferred from your existing IRA. Usually there is no need to call your current custodian. Once your new IRA has funded, you can select which precious metals best suit your criteria, whether it be gold, silver or a bit of both.

- Purchase your Precious Metals: Your IRA-eligible precious metals can be securely stored at one of various IRA-approved vaults across the country, including the DDSC in Delaware and various Brinks depository vaults. Multiple Locations.

ELIGIBLE ACCOUNTS

- Traditional IRA

- Roth IRA

- Thrift Savings Plan (TSP)

- 401(k)

- 403(b)

- 457

- Custodian and Depository Information

American Hartford Gold - Overview

There’s no need to continue to worry about how much money you maybe losing from your retirement accounts through your current portfolio. Now is the best time to roll over your 401k or traditional IRA into a gold IRA. The value of the dollar is up, making gold more affordable than ever.

When choosing a custodian for your gold IRA, you will want to notice how long they’ve been established in business, their fees, and their customer satisfaction ratings. Whether you want to maximise your retirement savings with precious metals or buy them directly, you can’t go wrong with American Hartford Gold.

American Hartford Gold is one of the top 5 gold IRA companies on the market and a shining example of what a precious metals IRA company should be. They have an outstanding reputation with companies like the BBB & BCA, and excellent reviews from past customers.

They have many qualifications: from comprehensive educational materials, a great buy-back program, & competitive pricing, American Hartford Gold is an excellent choice for both first-time investors and veteran investors alike. They offer several benefits for clients but what truly sets them apart from the competition is its price match guarantee. American Hartford Gold promises that it will match any competitors’ prices for gold, silver, and platinum.

Get gold you can hold and learn how it offers superior protection over paper assets by visiting their website and download the comprehensive FREE Gold IRA Kit below. If you have any questions then visit our FAQ page.

Many or all of the companies featured provide compensation to "Gold Options For You" and "Gold IRA Investment Guide". As financial publishers, commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site. While we endeavor to make sure all our content is accurate, the information we provide may not be neutral or independent and does not constitute financial advice. Further information can be found on our website disclaimer.