IRA Gold Investments

A Beginners Guide

What is a gold IRA?

Our comprehensive guide to a IRA Gold Investments will help you with the basics of a gold Individual Retirement Account which allows retirees to invest in physical gold. Gold IRAs are often used to diversify savings and create a hedge against inflation. Like other IRAs, these accounts offer valuable tax benefits as well.

Physical gold is considered an alternative investment, something that’s not allowed in a regular IRA. However, since gold IRAs are a type of self-directed IRA, they can hold alternative investments so long as they adhere to IRS rules.

For gold IRAs, the IRS regulations outline what type of gold can be held in the account and where it is to be stored. Fortunately, gold IRA companies make it easy to meet these requirements and incorporate precious metals into your retirement savings.

How does a gold IRA work?

A Gold IRA works exactly like any retirement account with the added benefit that it provides you more control over your investment to include physical gold coins and bars and other IRS approved silver, platinum and palladium metals.

Similar to any retirement account, with your Gold IRA or Precious Metals IRA, you will be investing your retirement funds based on specific tax treatment (pre-tax or after-tax) and then take distributions in future. With your Gold IRA, you will continue to have beneficiary (ies), receive quarterly statements and be able to log in to your account online to check your balances.

Disclosure: The owners of this website may be paid to recommend Gold Investment companies. The content on this website, including any positive reviews may not be neutral or independent.

Types of gold IRA accounts

Traditional gold IRA – these are the most common type of gold IRAs. When you contribute money to a traditional IRA, you can deduct that amount from your income when you file your taxes. This account type reduces your taxes in the year that you contribute. When you withdraw from a traditional IRA, you pay income tax on the full amount withdrawn.

After opening your gold IRA account, you can only contribute up to the approved IRS limit. For 2025, that limit was $7000 of income for those under 50 and $7500 for 50+.

Roth Gold IRA: Roth IRAs are the reverse of a traditional IRA. You pay taxes when you contribute money to a gold Roth IRA. Once you contribute to the account, the money grows tax-free. You don’t have to pay any taxes when you make a withdrawal. Roth IRAs also don’t restrict the withdrawal of contributions, while other IRAs do.

SEP Gold IRA: SEP gold IRAs are available to business owners and self-employed individuals. The SEP Gold IRA works similarly to a pre-tax traditional IRA, in that your contributions are not taxed, but it offers higher contribution limits. Instead of the $5,500 limit, you can contribute up to 25% of your income or $53,000, whichever is less.

Traditional Gold IRA guidelines

when opening a traditional gold IRA account, the IRS have guidelines you need to work with. For example, you can only contribute a certain amount. Currently, the limits on traditional IRAs are $6,000 in contributions each year if you’re 49 or younger and $7,000 per year if you’re at least 50.

These contributions are tax-deductible to a point. The exact deduction you can take is based on your annual modified adjusted gross income (AGI).

| Tax Filing Status | Modified AGI | Deduction |

| Single or head of household | $66,000 or less | Full contribution (up to contribution limit for your age group) |

| Single or head of household | $66,000 to $76,000 | Partial deduction |

| Single or head of household | $76,000 or higher | No deduction |

| Married filing jointly | $105,000 or less | Full contribution (up to contribution limit for your age group) |

| Married filing jointly | $105,000 to $125,000 | Partial deduction |

| Married filing jointly | $125,000 or more | No deduction |

| Married filing separately | $10,000 or less | Partial deduction |

| Married filing separately | $10,000 or more | No deduction |

You can continue making contributions to your traditional gold IRA account until you reach the age of 70.5. After that, only Roth IRA contributions are allowed. Withdrawals are also tied to your age. Though you can technically withdraw funds from your account at any time, doing so before age 59.5 will mean a 10% penalty. At age 72, you’ll also need to start taking required minimum distributions.

How to add precious metals to an IRA

Once you open a gold IRA account, you have to fund it. There are a few ways you can do this.

- Cash contributions – The easiest way to fund a gold IRA is to contribute cash directly to the account. Once you have your money in your IRA, you can use it to purchase gold and other precious metals.

- IRA Transfer – If you have another IRA, whether it holds gold, cash, or securities, you can transfer your assets to your new gold IRA . Once the assets arrive, you can liquidate them to purchase precious metals.

- Rollover – If you have a 401(k) or another retirement plan, you can roll the funds in the account into your gold IRA and use them to purchase precious metals.

Even though you’re opening a gold IRA, it’s important to note that you can’t directly fund your account with gold bullion or coins that you own. One reason for this is that the government restricts the types of coins and bars you can purchase.

This means you need to use assets already in your gold IRA to purchase precious metals. You also cannot take possession of the metals in your gold IRA until your retirement age. The metals must be stored at an approved depository.

Eligible precious metals for ira approval

Gold IRAs can hold more than just gold. There are four precious metals that you’re allowed to purchase and keep in your gold IRA:

- Silver

- Gold

- Platinum

- Palladium

The IRS places limits on the types of coins and bullion that investors can hold in gold IRAs. These limits are intended to make sure that investors buy high-quality metals with long-term value.

For example, gold IRAs can only hold gold that is 99.5% pure in forms such as:

- American Buffalo coins

- Chinese Panda coins

- Credit Suisse bars produced at an approved facility.

One exception to this rule is American Eagle coins. These coins are 91.67% pure and can be included within gold IRAs. Silver coins and bars must be 99.9% pure. Platinum and Palladium coins and bars must be 99.95% pure.

Your gold IRA provider can help you determine which coins, bars, and other forms of bullion meet the requirements to hold in a gold IRA.

Where is the gold stored?

A consideration for a gold IRA is where you will store your gold and other precious metals. Gold IRA rules prevent people from taking possession of precious metals in their IRAs, meaning you can’t keep your metals in a safe at home instead, your precious metals have to be stored as per the IRS regulations,

There are two primary types of storage for precious metals.

- Segregated – Segregated storage for your precious metals means that the depository will store your metals and keep them separate from other customers’ coins and bars. When you put coins and bars in the depository, that metal remains yours, and you’ll get the same coins and bars when you take them out of the depository for sale.

- Commingled – Commingled storage means that the depository stores your metals alongside other customers’ metals rather than separately. When you add metal to the storage, the depository notes the type, quality, and amount of metal you added. When you remove metal for sale, you won’t necessarily receive the same coins and bars. You’ll receive equivalent metal instead.

Both types of storage provide similar protection levels, so which you choose is a matter of personal taste. Keep in mind that you have to pay for storage and that segregated storage is often more costly due to the increased space requirements.

Other things to consider when choosing a place to store your gold include the security of the depository, the amount of insurance, and the cost of keeping your metals.

How to withdraw money from IRA without penalty

IRAs are designed for retirement savings. When you put money in an IRA to save for retirement, the government gives you tax benefits. It also places restrictions on how you can use the funds in your gold IRA.

With a traditional IRA, you cannot make withdrawals from the account until you turn 59 ½. After you reach retirement age, all withdrawals are counted as income and taxed accordingly. If you must make a withdrawal before you turn 59 ½, you have to pay an additional 10% penalty on the withdrawn funds.

Traditional IRAs also have required minimum distributions for those over 70 ½. These rules force you to withdraw a minimum amount from your IRA each year based on a formula, with penalties for people who fail to make the withdrawals.

With a Roth IRA, you can withdraw money that you’ve contributed to the IRA at any time without penalty. You can withdraw contributions and earnings without restriction once you turn 59½. In either case, you pay no taxes on withdrawals. You must pay income tax plus a 10% penalty on early withdrawals.

There are some exceptions to these rules. For example, you may make penalty-free early withdrawals for a first-time home purchase, qualified medical expenses, qualified educational expenses, or as part of a substantially equal periodic payment plan for early retirees.

Why Should You Invest in Gold?

The 2022 Gold Rush: Russia – Ukraine war shocks precious metals market with Retirees, Preppers and Investors rushing to open gold IRAs

In the last few decades, the world economy experienced a quantum leap in wealth accumulation and financial growth, unique in human history. However, after the COVID-19 pandemic in 2019, and currently owing to the adverse outcomes of the war in Europe with vital supply shortages and souring inflation, economies are taking a huge a hit. It seems that this golden era was transient, and the world economy is preparing to experience unclear and unpredictable changes.

Is the war in Europe effecting your investments?

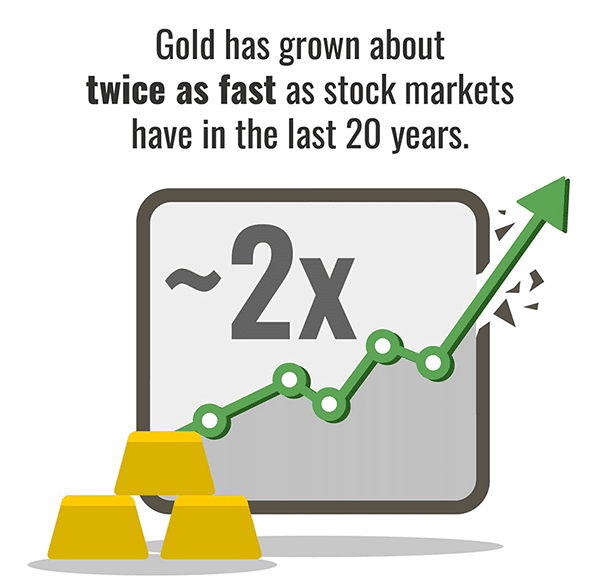

Everyone wants their retirement portfolios to perform, but there’s always the risk of huge losses. Successful investors are wise to protect their portfolios with smart investments and diversification, safeguarding their valuable retirement funds with more than just stocks and bonds. Further, WGC indicates that world events like the Ukraine invasion and soaring inflation continue to drive gold demand and price.

Is gold a good retirement investment?

Absolutely. In fact, it’s one of the best retirement investments you can make to withstand economic turmoil, inflation, and catastrophic world events. Further, the United States Securities and Exchange Commission advises diversified retirement investments as being a safe way to manage financial risks and attain financial security after retirement.

Protect your savings against inflation

One way to do that is by investing in a gold Individual Retirement Account. Gold and other precious metals have given investors security for centuries, and their value today continues to rise. With the same advantages as traditional IRAs, gold IRAs help investors protect their retirement from volatile markets.

For gold IRAs, government regulations outline what type of gold can be held in the account and where it is to be stored. Fortunately, gold IRA companies make it easy to meet these requirements and incorporate precious metals into your retirement savings.

Some of the primary reasons to consider adding physical gold to your portfolio include:

- Portfolio Diversification | Hedge Against Volatile Markets | Gold Holds Its Value

- Tax efficient | Global currency | Limited supply | No counter-party risk

Portfolio Diversification

Investors can diversify their portfolios with a variety of assets like stocks and bonds, mutual funds, and ETFs. But they can also invest in gold and other precious metals through a precious metals IRA.

Because there is a consistent demand for gold, investors flock to physical assets during uncertain financial times, which causes the price of gold to fluctuate inversely to the stock market. Make sure you’re building a well-diversified portfolio that gives you the stability you need.

Hedge Against Volatile Markets

During times of political instability, recessions, and economic uncertainty, independent-minded investors, entrepreneurs, retirees and business owners have turned to investments in gold as a safe option. It can be used to hedge against currency devaluation or inflation.

We’re living in unprecedented times, which can cause market volatility that affects your investments and retirement. But a volatile market doesn’t mean you have to give up investing and protecting your assets.

In fact, by investing in gold or performing a 401(k) rollover, you may be able to avoid the ups and downs that come with a fluctuating market.

Gold Holds Its Value

The U.S. dollar is no longer backed by gold or any other precious metal, and Federal Reserve notes have not been redeemable for gold since 1934. Not being tied to our currency actually makes it safer for investors. Luckily, a strong U.S. dollar tends to keep the price of gold lower for purchasing purposes. Meanwhile, a weaker dollar tends to drive the price of gold higher because you can purchase more gold when the dollar is weaker.

The gold market is only increasing as many central banks have been accumulating growing reserves of gold, bringing it nearly to a 30-year high. Gold is certainly a solid choice as evidenced by the way investors flock to it, particularly in times of economic uncertainty, when it often outperforms other investments. If you’re looking for a long-term investing strategy that will protect your assets from the unknowns, consider investing in a gold IRA.

Tax efficient

A traditional gold IRA is a tax-deferred retirement savings account and works just like pre-tax traditional IRAs when it comes to taxes. Your contributions and any gains will not be taxed and, in most cases, contributions are tax deductible as well. Gold IRAs are one of the most tax efficient investment options available. Our experts can advise you further on how to get your tax breaks.

Global currency

Gold is the only currency that’s accepted around the world. Throughout the ages, gold has served as the quintessential monetary medium. It is scarce, durable, fungible and has universal utility.

Sea shells, glass beads, and even gigantic rai stones have all served as the basis of monetary systems before but gold turned out to be the best form of money out of all tangible goods that had previously been tried.

Gold is in limited supply

With gold having been in use since the dawn of history and new mining still occurring, it may seem strange to think of a day when there is no more gold extracted from the ground. Nevertheless, like any other limited natural resource, there is a finite supply of gold in the world.

The USGS reports that about 18,000 tonnes of gold remain undiscovered in the U.S., with another 15,000 tonnes having been identified but not mined. All the supply in the world can only fill two olympic-sized pools.

No counter-party risk

There’s one asset that is considered almost completely safe when being purchased in the right way – Gold. Historically, gold has been used for centuries as a primary currency, a store of value, a medium of exchange, and for other purposes such as jewelry, decoration, and medical properties.

These days, there are many forms in which an investor can buy gold, however, the only way that an investor can really buy gold and at the same time avoid the counter-party risk is by buying gold physically. Gold and silver are real, tangible assets, which can be touched and have a known market price. Precious metals cannot default on payments or go bankrupt and are not subject to many manipulations that other investments can be.

The risk associated with any investment is also a factor of the counter-party risk, which can simply be described as the likelihood that one of those involved in a financial contract might not be able to meet its obligations. In simple terms, the counter-party risk is the risk of potential expected losses that might arise for the investor from the other side of the transaction, which could be the broker, another investor, and even the government.

Which gold IRA company is the best?

There are many gold IRA investment companies out there that have their own happy clients. But, to get the most out of your gold IRA investment, you have to look for the winning companies that offer the best services to their clients and have earned dozens of 5-star reviews and near-perfect ratings.

Although we have written and published expert reviews of the top 5 Gold Investment companies across America, we have put two of them side by side for comparison. Here you can read everything you will ever need to know about IRA Gold Investments

Learn About the Advantages

of a Gold IRA

If you’ve been considering gold as an investment, we hope our IRA Gold Investments beginners guide, together with our expert side by side review of Augusta Precious Metals AND Noble Gold has helped as we know there’s a lot to learn. If you want to read answers to our common questions, visit our FAQ section.