Best ways to invest in Gold

How to invest in gold for beginners

Best ways to invest in Gold – If you are considering investing in Gold then here is a brief introduction. The truth it is, this is one commodity that is poised to increase in value even as the outlook for most other assets remains uncertain. Best of all, it’s never been easier to learn how you can save A LOT OF MONEY on a product that could play a central role in helping you live comfortably now and retire securely down the road. If you miss out on the chance to invest now, you might be kicking yourself later upon seeing its inflated cost.

Gold Bullion

One of the most straightforward ways to invest into your future is with a Gold IRA and purchasing physical gold bullion. Gold bullion, in the form of bars or coins, is valued primarily for its gold content and is recognized worldwide for its purity and weight. It can be stored in a secure depository, and owning physical gold provides tangible ownership and a sense of security. However, it’s important to consider factors such as storage fees, authenticity verification, and potential liquidity challenges when investing in gold bullion for a Gold IRA.

Gold ETFs

Gold Exchange-Traded Funds (ETFs) are another popular option for investing in a Gold IRA. Gold ETFs are investment funds that trade on stock exchanges and track the price of gold. They provide a convenient and cost-effective way to invest in gold without having to deal with physical ownership or storage. Gold ETFs also offer liquidity, as they can be easily bought or sold on stock exchanges like regular stocks. However, it’s essential to understand the fees, tracking methods, and potential counterparty risks associated with gold ETFs.

Gold Mining Stocks

Investing in gold mining stocks is another way to gain exposure to gold in a Gold IRA. Gold mining stocks are shares of gold mining companies that may potentially benefit from the price appreciation of gold, as well as the potential profitability of the mining company. However, investing in gold mining stocks comes with risks such as operational challenges, geopolitical risks, and stock market volatility. It’s crucial to carefully research and evaluate gold mining stocks before including them in your Gold IRA.

Gold Bullion and Numismatic Coins

Similar to investing in gold bullion for a Gold IRA, gold bullion and numismatic coins are another form of physical gold investment. Bullion coins are minted by government mints and are valued primarily for their gold content, while numismatic coins are valued for their rarity and historical significance. It’s important to note that there are specific rules and restrictions when it comes to including numismatic coins in a Gold IRA, and it requires knowledge of the market and potential risks.

What is a Gold IRA?

A Gold IRA, or Individual Retirement Account, is a self-directed IRA that allows you to invest in physical gold and other precious metals as a way to diversify your retirement portfolio. As a hedge against inflation and economic uncertainties, gold has long been considered a safe-haven asset, making it a popular choice for retirement planning. In this comprehensive guide, we will explore the best ways to invest in a Gold IRA, including various investment options, their benefits, and considerations to help you make informed investment decisions.

Investing in Gold and Silver

We get it. You’ve probably already heard that gold and silver can help diversify your portfolio and protect against market volatility. Maybe you’ve also heard that gold in particular holds intrinsic value and, unlike paper currency, it won’t become worthless regardless of who is in office or what the next international crisis might be. Perhaps you’re even familiar with gold’s historical trend of outperforming the stock market and are still undecided if you should invest in a physical asset.

Are Gold Investments Safe?

During times of political instability, recessions, and economic uncertainty, independent-minded investors, entrepreneurs, retirees and business owners have turned to investments in gold as a safe option. It can be used to hedge against currency devaluation or inflation.

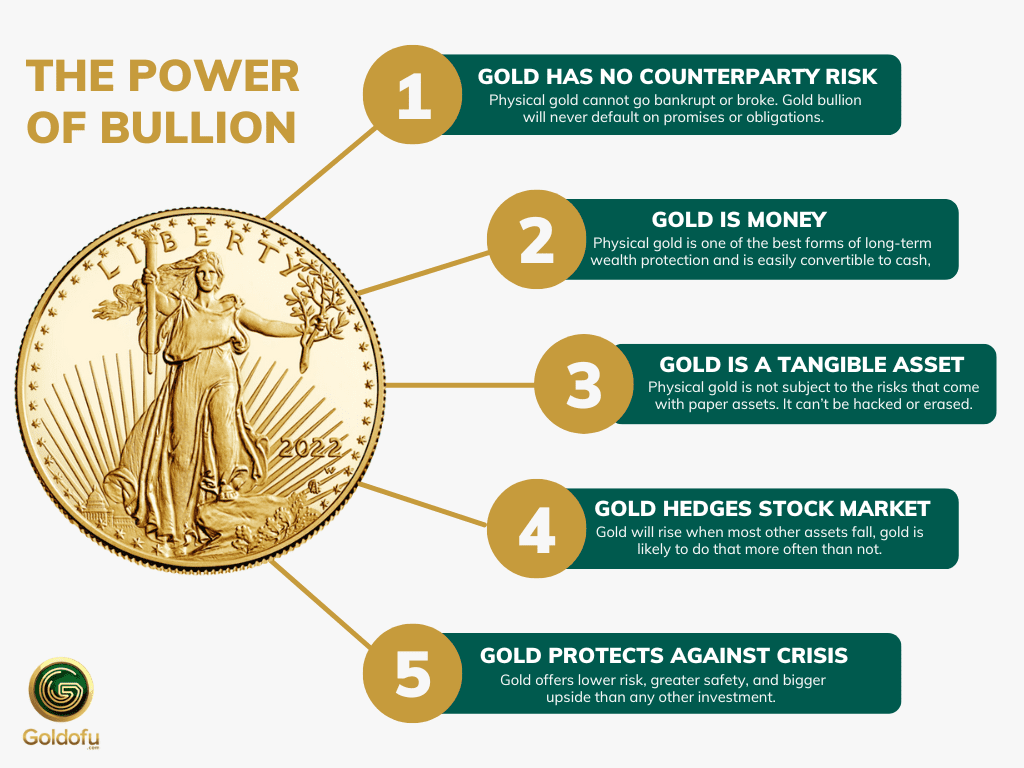

The Power of Bullion

So why invest now? For starters, the world economy isn’t in great shape – and that’s putting it mildly.

We’re all experiencing the impact of inflation on the price of gas, food, and other essential

purchases. And rampant spending by the federal government is only making matters worse.

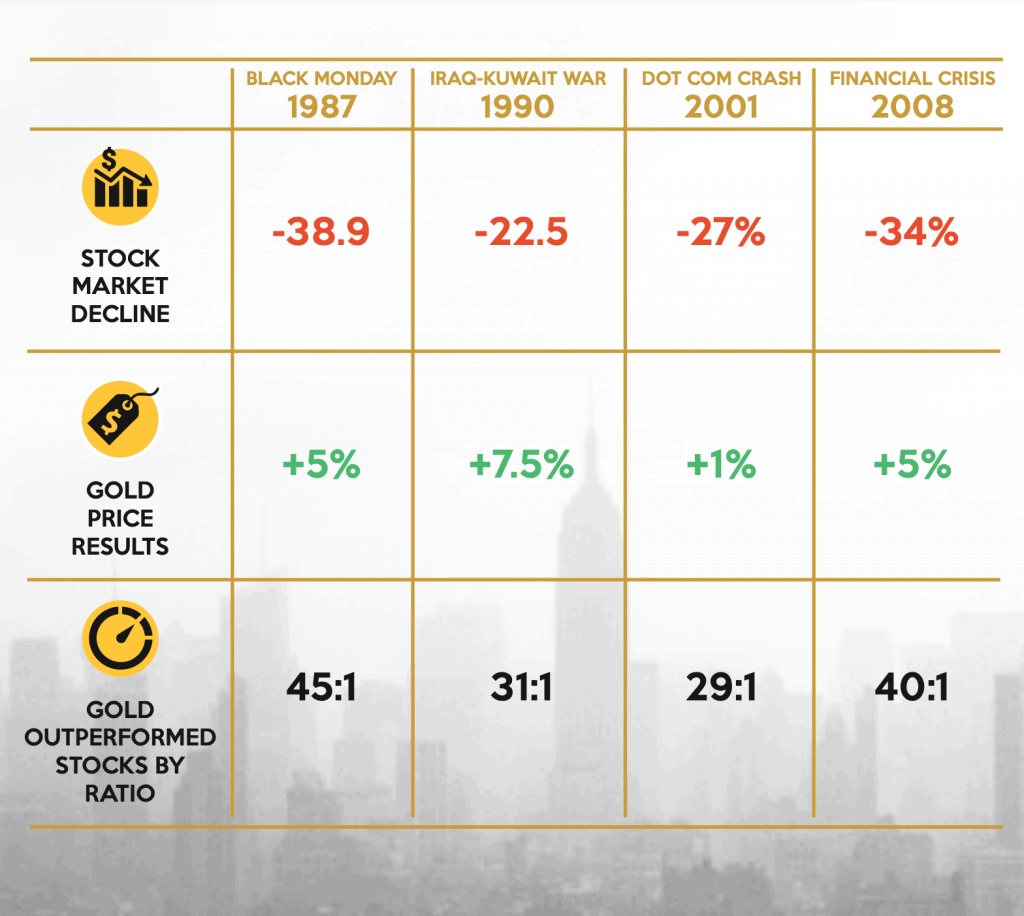

Here’s a brief history lesson: “When the economy tumbles, gold prices spike“

Is it too late to invest in gold?

The latest example of this trend came in response to the great recession of 2008, but similar

increases can be tracked in the aftermath of previous economic downturns. Over the course of just four years, the cost of gold DOUBLED from around $1,000 an ounce in 2008 to over $2,000 an ounce in

2014! (Source: Investopedia) In times of uncertainty, you can count on gold prices to rise.

Right now, the U.S. economy seems to be teetering on the brink of another serious recession –

or worse.

On a global scale, there is ongoing turmoil in Ukraine, provocations by China, threats from North

Korea, and unrest in various other nations that only contribute to the fears many Americans

have about the near future. All of this is leading more and more people to consider turning to the relative security that comes along with owning a stable asset like gold.

The law of supply and demand is clear: As more people seek a product or service, its price invariably increases. Sure, you might not be able to purchase gold for what it cost a decade ago. By the same token, today’s prices are sure to look like a bargain after its value continues to climb.

Don’t be paralyzed by fear of the unknown.

Investment Gold | Is it a good investment?

Absolutely. In fact, it’s one of the best retirement investments you can make to withstand economic turmoil, inflation, and catastrophic world events. Further, the United States Securities and Exchange Commission advises diversified retirement investments as being a safe way to manage financial risks and attain financial security after retirement.

Conclusion

A Gold IRA can be a valuable addition to your retirement portfolio, providing diversification and potential protection against economic uncertainties. The best ways to invest in a Gold IRA depend on your investment goals, risk tolerance, and financial situation. Whether you choose physical gold bullion, gold ETFs, gold mining stocks, gold bullion or numismatic coins, or work with a Gold IRA custodian, it’s important to carefully consider your options, do your research, and seek professional advice if needed.

Are you looking to invest in a Gold and Silver IRA in 2023? With the right approach, investing in a Gold IRA can help you safeguard your retirement savings and achieve your financial goals. With so many companies out there offering these services, it can be hard to know which ones are the best. That’s why we’ve compiled a list of the top 3 best Gold and Silver IRA companies for 2025 based on our expert reviews on each of them.

Read our expert reviews on the top 3 Gold Investment companies below…

Top 5 Best Gold and Silver IRA Companies for 2025 | Expert Reviews

To learn more about Physical Gold and Silver IRA Investments you can read our Noble Gold expert review here.

Learn everything you need to know about Gold and Silver IRA Storage Options and Gold and Silver IRA Tax Implications by reading our Birch Gold Group in-depth review here.

You can learn more about Gold and Silver IRA investment strategies and the benefits of having a gold and silver IRA by reading our comprehensive insider guide on AHG here.

If you are looking at buying Gold and Silver for Investment then now is the right time, take action today to help protect yourself and your loved ones in the future, you owe it to yourself and your loved ones to take advantage of it RIGHT NOW.

For just a brief summary of our top 3, visit our overview here.