How to Buy Gold With Your 401(k)

How to Buy Gold With Your 401(k)? This is one of the questions that keeps popping up in the minds of retirees who are looking to add some sparkle to their retirement. Thanks to Tax Code exception, IRAs are allowed to own certain precious metal coins and bullion. Examples include American Gold Eagle coins; Canadian Gold Maple Leaf coins; American Silver Eagle coins; American Platinum Eagle coins; and gold, silver, platinum, and palladium bars (bullion) that meet applicable purity standards. For example, gold bars must be 99.5% pure or better and silver bars must be 99.9% pure or better.

For many investors, the allure of precious metals is hard to resist; most notably, gold. It is one of the most sought-after and popular investments in the world because it can offer lucrative returns in any investment portfolio. Gold is generally considered to be a safe investment and a hedge against inflation because the price of the metal goes up when the U.S. dollar goes down.

One thing investors need to consider is that most 401(k) retirement plans do not allow for the direct ownership of physical gold or gold derivatives such as futures or options contracts. However, there are some indirect ways to get your hands on some gold in your 401(k).

How to Buy Gold With Your 401(k)? The most common way to invest into physical gold is to open a Gold IRA. If you have a 401(k), you can roll a portion of that retirement savings account into a self-directed IRA, which lets diversify with physical precious metals.

What Is A Gold IRA?

In brief, a Gold Individual Retirement Account (RIA) allows you to invest in physical gold, and serves as a good hedge against inflation since gold prices generally move in the opposite direction of paper assets.

You can also defer your tax payments, or even skip paying tax on capital gains.

For a greater in depth look at what a Gold IRA is and all the benefits, read our Top 5 Best Gold and Silver IRA Companies for 2023 | Expert Reviews

Gold IRA contribution limits

After opening your gold IRA account, you can only contribute up to the approved IRS limit.

Why invest in Gold?

Diversification

Central banks and billionaires have gold in their portfolio as it increases the value of money and provides an added security through diversification of assets. During times of political instability, recessions, and economic uncertainty, single-minded investors, entrepreneurs, retirees and business owners have turned to investments in gold as a safe option. It can be used to hedge against currency devaluation or inflation.

Is gold a good retirement investment? Absolutely. In fact, it’s one of the best retirement investments you can make to withstand economic turmoil, inflation, and catastrophic world events. Further, the United States Securities and Exchange Commission advises diversified retirement investments as being a safe way to manage financial risks and attain financial security after retirement.

Tax efficient

Gold IRAs are one of the most tax efficient investment options available. Our experts can advise you further on how to get your tax breaks.

Stability

Gold has historically been a stable asset, increasing in value over time despite market fluctuations.

Global currency

Gold is the only currency that’s accepted around the world.

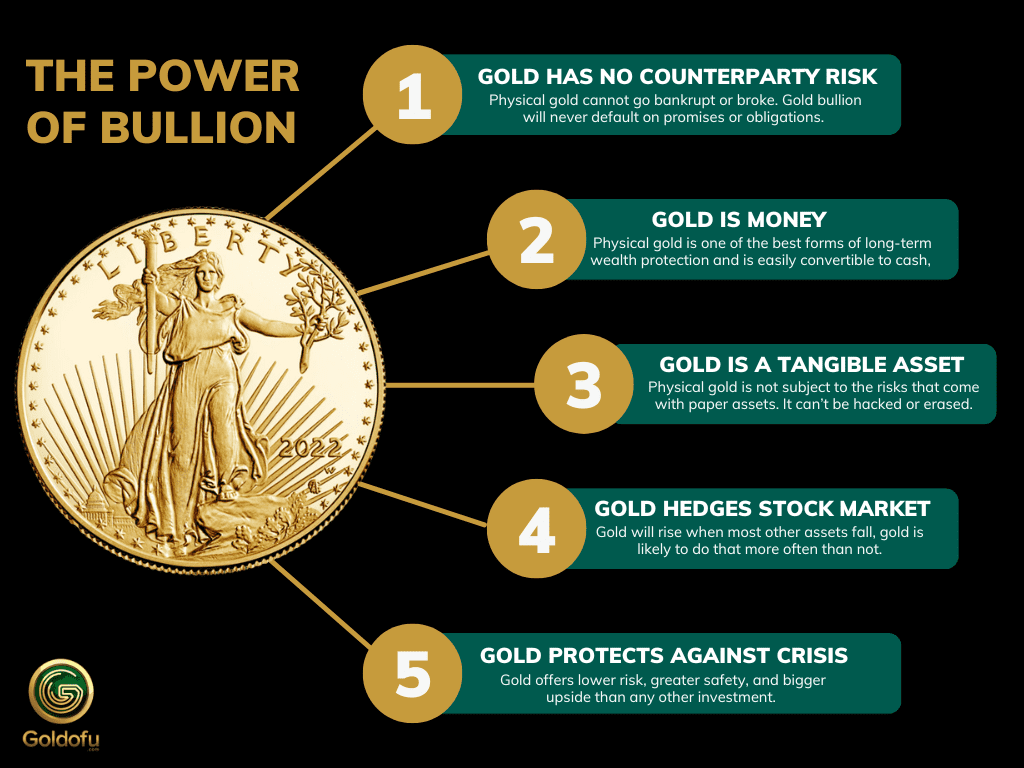

No counter-party risk

Unlike company stock, you don’t run the risk of gold going bankrupt.

Emerging industrial uses

Gold is currently being used in treating chronic diseases like cancer, making phones or computers, and producing oxygen in Mars.

Limited supply

Gold is rarer than diamonds. All the supply in the world can only fill two olympic-sized pools.

Gold Is A Great Hedge Against Inflation

Typically, when the value of the dollar declines, the value of gold increases. The money you invest in gold today would increase in value after a few years, giving you the opportunity to grow your net worth.

Metal Purity Standards

- Gold must be .9950 (24 karats) pure

- Bullion bars should be fabricated by NYMEX, COMEX, or any other ISO 9000 approved refiner.

- Proof coins should be presented with a certificate of authenticity and must be in their original mint packaging.

- All bullion must be in an uncirculated, first-rate condition.

Gold IRA vs Taxes

When you acquire gold through a Roth IRA (a Gold IRA), you pay taxes only on your contributions, not on the gains. With traditional IRA, you can defer paying your taxes until you liquidate so you can use that money to invest in something else.

IRS Approved Gold Coins

You can invest in the following gold coins for your gold-backed IRA. One ounce, one half, one quarter, and one tenth ounce gold coins are allowed by the Internal Revenue Service.

IRS Approved

American Gold Eagle Coins

Available in 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz. The American Gold Eagle is an official gold bullion coin of the US. It was first produced by the United States Mint in 1986.

IRS Approved

American Gold Eagle Proof Coins

Available in 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz. Proof coins are specially prepared and struck for an extra polished finish and quality.

IRS Approved

Canadian Gold Maple Leaf Coins

Available in 1/4 oz, 1/2 oz, and 1 oz. The Canadian Gold Maple Leaf is a gold bullion coin that is produced by the Royal Canadian Mint.

IRS Approved

Australian Gold Kangaroo Coins

Available in 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz. Proof coins are specially prepared and struck for an extra polished finish and quality.

IRS Approved

Austrian Gold Philharmonic Coins

Available in 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz. The gold Vienna Philharmonic was first offered on October 10, 1989.

IRS Approved

PAMP Suisse Lady Fortuna Gold Bars

Available in 2.5 gm, 5 gm, 20 gm, 50 gm, 5 oz and 10 oz The first decorative motif ever to embellish a precious metal bar.

Why roll a portion of your 401(k) over into a Gold IRA?

There are a multitude of benefits to rolling a portion of your 401(k) into a Gold IRA. When you consider what assets your 401(k) holds now, you’ll realize that your financial future depends almost entirely on the health of the stock market.

401k to Gold IRA Rollover Guide

Check out our benefits and 4-step guide below to learn the crucial basics you need to know about a 401k to gold rollover. Simply click on the accordion sections to expand about each topic and learn more.

1. Diversifying your portfolio outside of the stock market

It’s never a safe bet to put all of your eggs in one basket.

When you open a Gold IRA, you’re diversifying by taking a portion of your portfolio out of the stock market and putting it into physical gold. That’s another benefit of opening a Gold IRA — you actually own the gold you’re investing in.

2. Owning tangible assets is key

Owning physical gold gives you the added peace of mind that your gold cannot be hacked or digitally compromised.

3. Hedging against inflation

Over the last decade, the Fed has been increasing the money supply rapidly. The Covid crisis only made things worse. This all leads to one thing: inflation. As the money supply increases, it dilutes the value of the dollar, and you can watch rising prices on necessities like fuel and groceries.

Gold has long been a way to protect your purchasing power because it cannot be debased. Governments can’t print gold, and there is no way to replicate it. Gold must be discovered and mined. Many Americans are now turning to gold because they know that inflation is already here and it’s about to get even worse.

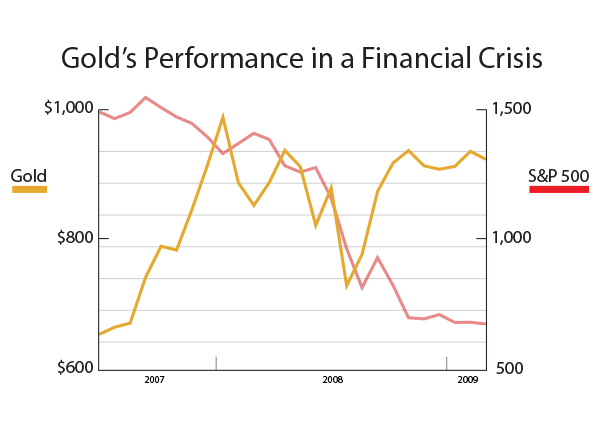

4. Hedging against other market crises

When the stock market is at an all-time high, you can expect one thing: a correction. It is anyone’s guess when the next crash will happen or how severe it’ll be, but gold has a history of hedging against any market crises.

Take a look at this chart showing how gold performs compared to the last six major market corrections.

Gold tends to work in opposition to the stock market. That means the portion of your 401(k) in the stock market might go down, but the portion that you have in your Gold IRA may go up, based on the history of gold compared to the stock market.

So, if gold is such a great investment, how can you buy gold with your 401(k)?

How to buy physical gold with your 401(k)

We’ve created an easy way for you understand how to roll over a portion of your 401(k) into a Gold IRA. It’s a simple 3-step process:

1. Open a self-directed IRA

Your current 401(k) only allows you to hold publicly traded stocks and bonds. When you open a self-directed IRA, you have more options available on what can be held inside of it. Read here our top 5 Best Gold and Silver IRA Companies for 2023 | Expert Reviews on Precious metals IRA and how they work as well as provide you everything you will ever need to know on how to open a self-directed IRA.

2. Fund your account

After your self-directed IRA is open, your dedicated Gold Alliance account executive will help you transfer a portion of your funds from your 401(k) to the self-directed IRA’s custodian account. This account will be in your name, giving you full ownership.

Our specialists will ensure that the whole transaction process goes smoothly.

3. Select gold and silver approved for IRA investment

Once your self-directed IRA is open and funded, the only thing left to do is to now add the Gold IRA with precious metals. We will help you choose the gold and silver coins or bars that best meet your needs and financial goals. We can then help connect you with a licensed and insured depository to store your precious metals.

Precious metals IRA custodian

Large, conventional brokerage firms don’t offer gold IRAs. Instead, you need to work with a custodian that specializes in administrating gold IRAs. Custodians help you manage the paperwork and tax reporting for your gold transactions to meet the IRS requirements for retirement planning.

More importantly, as per the IRS regulations, they manage the unique storage needs involved with holding physical gold bullion. The IRS does not allow you to personally store precious metals owned via a gold IRA at home. If you take personal control of the physical gold from a self-directed IRA, the IRS counts it as a withdrawal—making you potentially subject to taxation and early withdrawal penalties—and in some cases the IRS is empowered to shut down your entire account.

Gold IRA fees

A precious metals IRA trustee will usually charge a one-time account set-up fee (maybe $50 to $100), an annual account administrative or maintenance fee for sending account statements and so forth (maybe $50 to $300 or an amount based on the account value), and an annual fee for storage and insurance (maybe $100 to $300 or an amount based on the value of the stored assets). Additional fees may be charged for transactions including contributions, distributions, and commissions for precious metal purchases and sales (maybe 2% to 5%).

How can I transfer my 401k to gold without penalty?

If you are wondering how to move 401k without penalty, the answer is simple: complete your account transfer within 60 days, or better yet, do a 401k rollover to a Precious metals IRA. With an account rollover there is no risk of triggering the 60-day IRS rule. Read our top 5 gold IRA company expert reviews here to discover how easy it is.

Conclusion

Are gold IRAs a good idea?

Round up…A Gold IRA often comes with higher fees than a traditional or Roth IRA that invests solely in stocks, bonds, and mutual funds. A gold IRA can serve as a good hedge against inflation but well worth considering that it is also concentrated in a single asset class.

Here are 11 of our top Frequently Asked Questions, visit our FAQ page here.