Precious Metals IRA Rollover

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

Investing In Gold With Your 401(k)

Precious Metals IRA Rollover accounts can be great tools to reduce your taxes and grow your retirement savings, but they usually leave a lot to be desired in terms of investment options.

TABLE OF CONTENTS

1) Can you use a 401(k) to buy gold?

2) Can you roll over a 401(k) to gold without penalty?

3) How do I buy gold with my 401(k)?

4) What are the contribution limits for a 401(k)?

5) What’s the difference between gold proof and bullion coins?

6) Why should I invest in gold for my retirement?

7) How do you keep your gold safe in your 401(k) or IRA?

8) What if I’m not eligible to rollover my 401(k)

If you aim to secure your future with a robust retirement portfolio while still enjoying the tax advantages of a 401(k), you’ve probably taken a look at the various options that an individual retirement account (IRA) can offer. Physical gold emerges as an attractive choice.

While you can’t invest in physical gold directly in almost any employer-sponsored 401(k), you can still rollover your account into an IRA and enjoy the best of both worlds: tax-deductible contributions to your retirement account as well as a robust set of investment options.

Can you use a 401(k) to buy gold?

When it comes to asset choices, employer-sponsored 401(k)s are limited in what they bring to the table. Depending on how your employer has chosen to set up your plan, the funds in your 401(k) can be used to buy limited quantities and types of assets, and these will often be of questionable value.

Employer-sponsored 401(k)s offer an assortment of pre-selected stocks, mutual funds and bonds, and sometimes emphasize investments in the company’s own stocks. However, as these are all paper assets, they are vulnerable to a slew of risks. For example, if an employer encourages its employees to invest in company stock but then goes bankrupt, employees can lose a significant portion of their retirement. Even if you invest in other options, all of the other paper assets that your 401(k) offers are likely subject to the same ongoing stock volatility.

Needless to say, gold isn’t subject to the whims of any single company or even the global market. It’s an asset for the present and future that can help contribute towards financial security, regardless of what happens to other assets in your retirement account.

What does your 401(k) allow you to invest in?

Since an employer-sponsored 401(k) plan won’t let you invest directly into physical gold, you need to find a different way to diversify your retirement portfolio into precious metals.

This comes in the form of a rollover process, during which Birch Gold Group first helps you set up a Precious Metals IRA and then move the funds from the 401(k) into your new account. From there, you can purchase gold and other precious metals while reaping the numerous benefits that a tax-deferred retirement account gives.

Can you roll over a 401(k) to gold without penalty?

You can carry out a 401(k) rollover to precious metals without penalty, as long as you are careful about the details of the transaction.

There are three main scenarios that can arise when you’re moving funds from a 401(k):

- Direct transfer or rollover – No penalty. If you directly transfer your 401(k) from its custodian to the custodian of your Gold IRA, you are exempt from paying both the 10% IRS-imposed penalty as well as income taxes on that transferred amount. The key here is to not take direct possession of the money or assets in your retirement account. This is the simplest way to carry out a 401(k) rollover to a Gold IRA without penalty.

- Indirect transfer or rollover – No penalty (within 60 days). You can roll your funds over from your 401(k) into your new Gold IRA by first receiving the funds directly, which you can then redeposit. Within 60 days of initiating the release of funds from your 401(k), you’ll need to place the entire amount of your 401(k) distribution into your IRA in order to avoid both the 10% IRS-imposed penalty as well as income taxes on it. Some people choose this route because they want to effectively execute a 60-day loan of their funds; however, this can rapidly become expensive if you miss the deadlines.

- Withdrawal – Possible penalty. Any withdrawal of funds before turning 59 ½ years of age incurs an IRS-imposed penalty of 10% in addition to income taxes. Even after turning 59 ½, you will need to pay income taxes since your contributions were effectively deferred compensation.

There are a few exceptions to the early withdrawal rule:

- Estate withdrawals – If you die and your estate takes withdrawals from your 401(k), they will not be subject to the IRS’ 10% penalty.

- Disability – If you become permanently disabled, you will not be subject to the 10% penalty.

- Leave employer after turning 55 – If you leave the employer with whom you started the 401(k) in the same year that you turn 55 or after that point, you will not have to pay the penalty on your withdrawals.

Our IRA Specialists are on-hand to help you review your existing retirement plans—including your 401(k)—and help you navigate the rollover process, so that you can roll over your 401(k) without penalty.

How do I buy gold with my 401(k)?

To purchase gold with the funds from a 401(k), you will first need to set up a Precious Metals IRA. Our Precious Metals Specialists are here to assist you with this process and make the rollover as smooth as possible.

Precious Metals IRAs require a qualified custodian who will manage the administrative tasks of the retirement account for you. We work with several industry-leading professionals in this field to ensure that our customers are neither bogged down by paperwork nor encumbered by annual account management.

We’ve boiled down the purchase of gold with a 401(k) to a simple three-step process:

1. Reviewing the account and ensuring eligibility. One of our IRA Specialists will take a look at your 401(k) to help you understand if you are eligible to roll the funds over, as well as to assist with all of the paperwork necessary. We’ll do our best to answer any questions you may have in detail, and we’ll be with you at each step of the rollover process.

2. Opening a Precious Metals IRA and rolling over the 401(k) funds into it. Once we’ve covered the eligibility and you’ve decided on the amount you’d like to transfer, it’s time to open your self-directed individual retirement account with a custodian. Assuming that your current 401(k) is eligible for a rollover, the transfer of funds from one account to another will not incur any taxes or penalties.

3. Buying gold and other precious metals. Once your Precious Metals IRA is up and running and filled with the funds from your 401(k), it’s time to choose the precious metals that you’d like to purchase. Your Precious Metals Specialist at Birch Gold Group can advise you when it comes to the differences between the metals and help guide you towards making the right choice based on your needs, desires and situation. Our qualified custodian will also handle the logistical side of things, and once your purchase has been placed, your metals will be secured in a certified depository.

What are the contribution limits for a 401(k)? and how do they affect my self-directed IRA?

You can continue making contributions to your traditional gold IRA account until you reach the age of 70.5. After that, only Roth IRA contributions are allowed. Withdrawals are also tied to your age. Though you can technically withdraw funds from your account at any time, doing so before age 59.5 will mean a 10% penalty.

At age 72, you’ll also need to start taking required minimum distributions. Every year, the IRS revisits the contribution limits for 401(k)s—and potentially other retirement vehicles—for the upcoming year. This can result in changes. And as of November 2021, it did.

In 2021, the IRS made several key adjustments to the 401(k) contribution limits for the 2022 tax year.

- For employees—The contribution limit for individual employees is $19,500 (2021) and increasing to $20,500 (2022). In the event that an employee has multiple 401(k) accounts, this contribution limit is valid for the total contributions across all accounts, and includes both contributions to traditional and after-tax contributions to Roth 401(k) accounts.

- For employers—The contribution limit for employers is calculated along with employee contributions. For 2021, this combined contribution limit is $58,000, with a limit of $64,500 in the event of catch-up contribution (more about that in a moment). For 2022, the combined contribution limit is $61,000, with a limit of $67,500 if there is catch-up contribution eligibility.

- Catch-up contributions—Employees who are 50 years of age and older are allowed to make additional contributions to their 401(k) in order to accelerate their savings. The 2021 catch-up contribution limit is $6,500. In 2022, the catch-up contribution limit remains at $6,500.

When you work with a Precious Metals Specialist to review your existing retirement accounts and identify which ones you would like to rollover or transfer into your SDIRA, they will help you identify which ones are eligible to be moved.

An SDIRA could allow you to take these savings—such as your existing 401(k) accounts—and reallocate them into a wider range of assets than a conventional IRA, diversifying your retirement.

What’s the difference between gold proof and bullion coins?

You’ve no doubt gathered that there’s a lot more to physical precious metals investment than American Eagle coins.

Let’s have a look at some of the various kinds of metals you can add to your retirement account:

- Gold and silver bullion coins: These are the most liquid investment option. Gold and silver bullion coins are valued based on fineness and weight, and make for a versatile investment that follows current spot gold and silver prices. Popular examples of these coins include gold and silver American Eagles, gold American Buffalos, and gold and silver Canadian Twin Maples.

- Gold and silver proof coins: The main difference between these and bullion coins is that the proof coins are minted in limited quantity, and often with higher production standards, which adds another dimension to the value past just the metal content. The rarity and uniqueness are factors that can increase the value of the coins significantly past the spot price of the metals. Popular examples of these coins are gold and silver Proof American Eagles.

Besides gold and silver coins, Birch Gold Group also offers platinum and palladium investment options, along with bars made from any of the four metals. Each of the metals holds exceptional value for purposes of investment, manufacturing and collection, and we can help explain how they differ from one another and what they’re used for so you can make the best decision for your retirement savings.

Why should I invest in gold for my retirement?

Assets and currencies come and go, but precious metals stick around. It’s one of the best retirement investments you can make to withstand economic turmoil, inflation, and catastrophic world events. Further, the United States Securities and Exchange Commission advises diversified retirement investments as being a safe way to manage financial risks and attain financial security after retirement.

Once you’ve opened a Individual Retirement Account, you’re exposed to numerous benefits, not the least of which is a diversified future.

Gold investment value

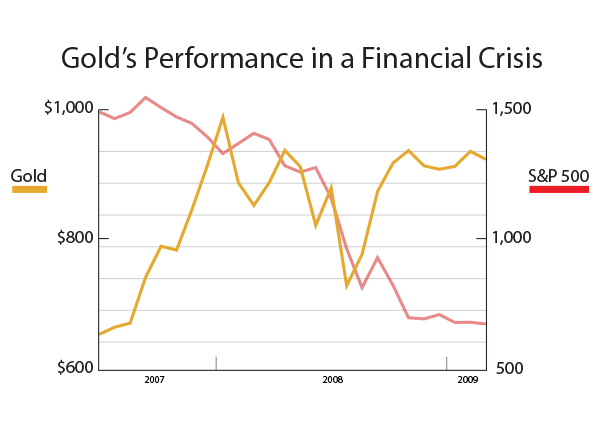

During times of political instability, recessions, and economic uncertainty, single-minded investors, entrepreneurs, retirees and business owners have turned to investments in gold as a safe option.

The the most compelling reason to own gold and silver but especially gold and it tends to perform best when it seems like the economy and the financial system are coming unglued. For example, during the 1970s, when the S&P 500 rose by just 22% – which is well below the rate of inflation for the decade – gold increased from an average price of $36 an ounce in 1970 to an average of $615 in 1980.

That’s a gain of more than 1,700%! During the entire decade, which was marked by economic, financial, political, and geopolitical stress, gold reaffirmed its safe haven status.

It can be used to hedge against currency devaluation or inflation.Along with other precious metals, gold has a finite supply, which is why the U.S. government once used it to set the dollar’s value. Long before they got the idea, gold and silver were used as currency and to form precious objects like fine jewelry; not much has changed through the present day.

Gold and silver will still be a highly-valuable asset a decade or five down the line: can you say the same for stocks, bonds and fiat currencies?

Diversification and risk management. Once you have opened a Precious Metals IRA, you’ll have the option to include many mainstream and alternative assets in it—and even roll over an existing IRA. As these other assets fluctuate up and down (or even perish), gold will remain as a hedge that can help to protect your retirement from market crashes, global crises and any other economic malady that may arise.

Further, the United States Securities and Exchange Commission advises diversified retirement investments as being a safe way to manage financial risks and attain financial security after retirement.

Inflation. WGC indicates that world events like the Ukraine invasion and soaring inflation continue to drive gold demand and price. Since the gold standard was abandoned, money printing has reached unprecedented levels. Governments may print out as much money as they need, debasing their currencies in the process. As prices go up, the value of each dollar in your 401(k) shrinks little by little. A Gold IRA could shield you from this effect, preventing wealth erosion no matter what the latest head of the Federal Reserve comes up with.

72% of gold used in the United States is for jewelry and electronics, while 51% of silver is used in electronics, photography, and jewelry and silverware.

Unlike paper money, which has no intrinsic value, or use in non-monetary activity, both gold and silver are important for their economic and technological applications.

Tax benefits. Once you’ve handled the paperwork with our custodian, you’ll be in possession of a self-directed IRA that carries all the retirement benefits we’ve come to like, such as tax-deferred growth.

How do you keep your gold safe in your 401(k) or IRA?

Working with qualified, trusted professionals with a track record of adhering to financial laws and regulations is critical in order to protect your retirement accounts. With us, you don’t have to have any second thoughts about where your gold is, who’s handling it and whether you’ve missed out on some paperwork details that the IRS won’t be happy about down the line. We will walk you every step of the way, and we work with the industry’s leading custodians and depositories.

Our qualified custodian handles the legal and administrative side of managing your Precious Metals IRA in order to ensure that everything goes smoothly. With minor input on your part focused around whether to keep the assets or buy more, you won’t have to give a moment’s thought about yearly audits, reports and filings, nor will you have to keep constant track of changes in laws. The custodian handles all the red tape regarding your IRA and ensures that you avoid the pitfalls that have caused many to lose their hard-earned retirement savings.

We’re also here to handle the acquisition of your precious metals while you make the financial decisions. After we help you purchase the metals that you wish, they will be secured in one of the two high-security companies we work with: the Delaware Depository or Brink’s Global Services. After it’s stored in the vaults, the gold within your IRA will be in full compliance with the IRS at all times, and the insurance policies and security measures of the two security services will cement the issue of safety.

What if I’m not eligible to rollover my 401(k) or have additional questions?

Many people think that if they’re still working for the employer with whom they set up their 401(k), they can’t rollover the funds from that account to a Precious Metals IRA. While that is often the case, you may be surprised to learn that there are many exceptions that could allow you to move some or all funds while you’re still with the same employer.

Read our Birch Gold IRA review 2022