Gold vs Crypto

Gold vs Crypto | Understanding the Differences

Do you find yourself thinking more and more about the future? Perhaps you’re just getting started in your career and hope to be able to retire early. Maybe you want to make sure your loved ones are financially secure for years to come. It could be that you’re approaching retirement and are worried about having enough money. Wherever you are right now in the journey of life, it can be difficult to know who to trust with your investment … but there’s one important fact to remember: You have CHOICES!

Understanding the differences between gold and cryptocurrencies is crucial for investors looking to diversify their portfolios. Gold has been used as a store of value for centuries and is considered a traditional safe-haven asset. It is a tangible metal with inherent value, and its price is primarily driven by supply and demand dynamics in global markets.

On the other hand, cryptocurrencies, such as Bitcoin and Ethereum, are digital assets that rely on blockchain technology for their creation and operation. Important note here is they are decentralized and not backed by any physical asset, and their prices are highly speculative and subject to extreme volatility.

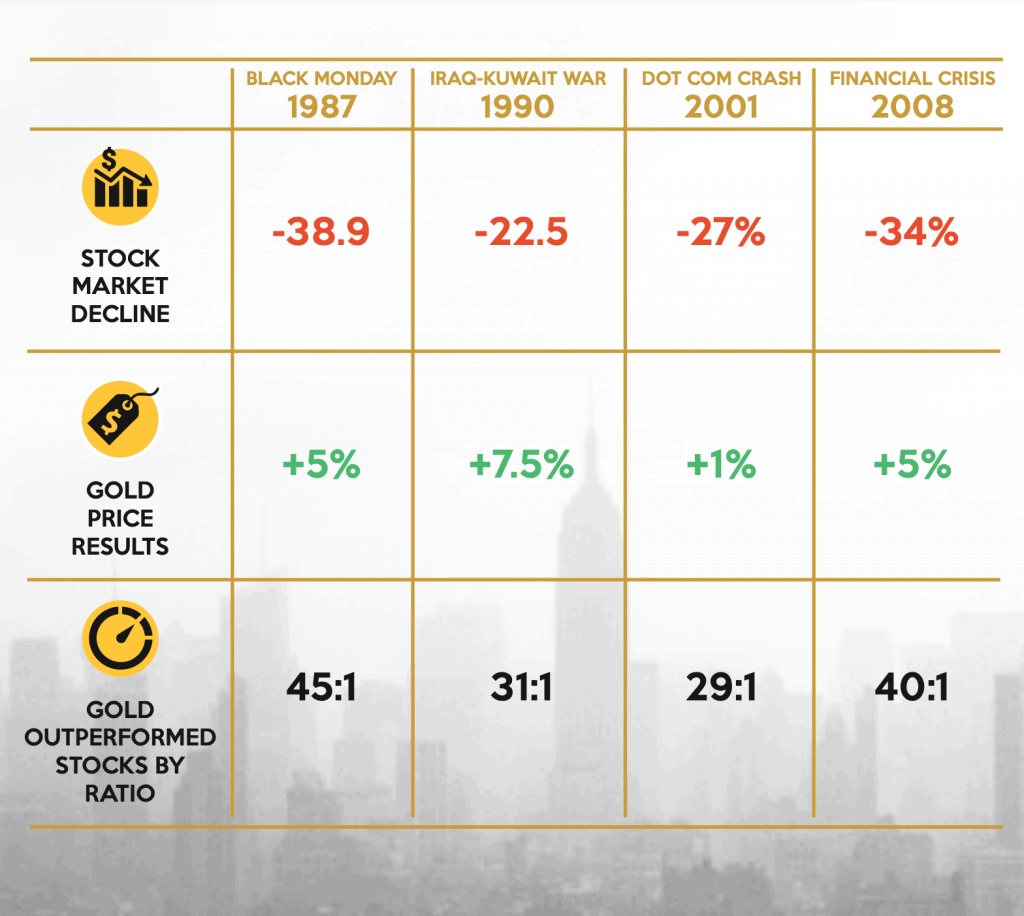

One of the key differences between gold and cryptocurrencies is their historical performance. Gold has a long-established track record of being a reliable store of value and a hedge against inflation. It has been used as a form of currency and a medium of exchange for centuries.

Gold prices tend to rise during times of economic uncertainty and serve as a stable investment option in times of market turbulence. On the other hand, cryptocurrencies are relatively new and have a short history of performance.

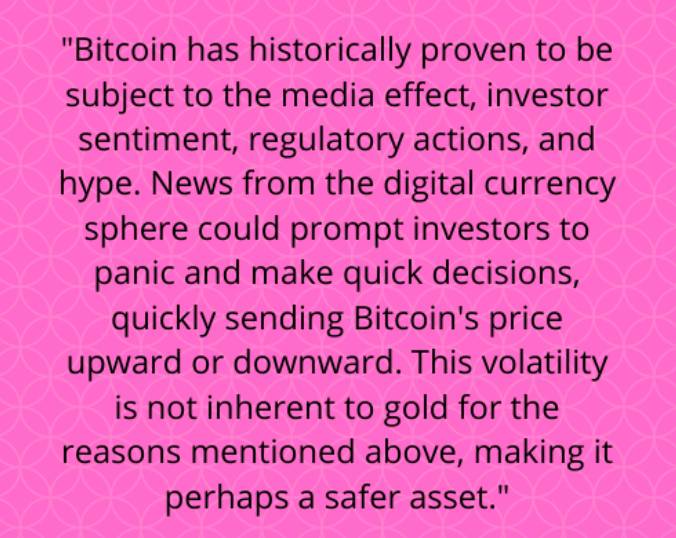

While they have shown significant growth potential, they are also known for their extreme price volatility, with rapid fluctuations that can result in substantial gains or losses within a short period.

Another difference between gold and cryptocurrencies is the issue of market volatility. Gold prices are generally more stable compared to cryptocurrencies. Gold has a well-established global market with significant liquidity, and its prices are influenced by various factors such as global economic conditions, geopolitical events, and supply and demand dynamics.

On the other hand, the cryptocurrency market is highly speculative and often subject to sharp price swings driven by market sentiment, regulatory changes, and technological developments. The lack of regulation and oversight in the cryptocurrency market can make it more susceptible to sudden and unpredictable price fluctuations, which can pose higher risks for investors.

Comparing Historical Performance

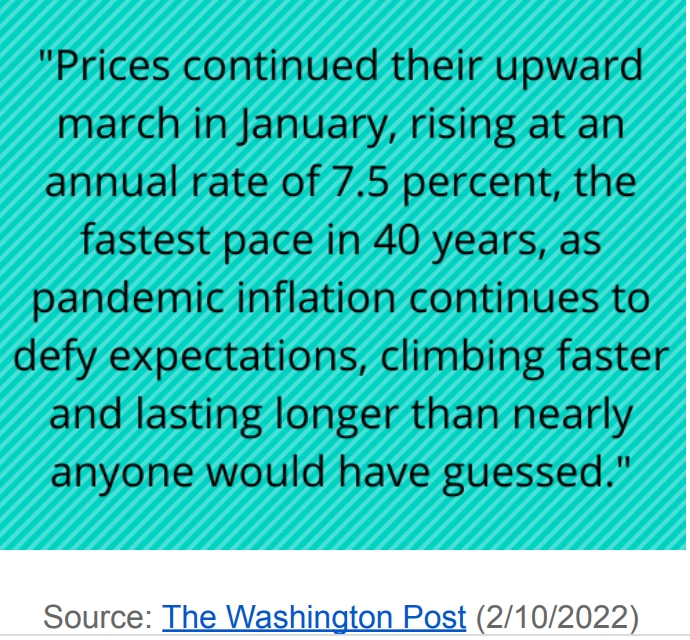

Understanding the differences between gold and cryptocurrencies requires evaluating their role as inflation hedges. Gold has been traditionally considered a reliable hedge against inflation due to its intrinsic value and historical track record. As the purchasing power of fiat currencies decreases during inflationary periods, gold prices tend to rise, making it an attractive option for investors looking to protect their wealth.

On the other hand, cryptocurrencies do not have the same long-term historical data to establish them as proven inflation hedges. While some proponents argue that cryptocurrencies can serve as a hedge against inflation due to their finite supply and decentralized nature, their price volatility and lack of widespread adoption as a medium of exchange make it a more speculative option.

Gone are the days of simply sinking money into the stock market and hoping for the best.

You are no longer expected to rely on elected officials and central banks to protect the value of

your investments. And it’s a good thing, because big-spending politicians seem to be doing their best to make sure paper money is worth less and less over time.

International turmoil is making matters even worse by contributing to the highest rate of inflation since the early 1980s. It all adds up to the fact that a dollar now has significantly less purchasing power than it did a few short months ago. That means dollar-based investments are particularly risky these days.

Gold vs Crypto, which one is right for you?

While there are several major differences between investing in gold and investing in crypto, they

share one important feature: Both commodities can give you protection from the wild

fluctuations of paper currency.

After learning more about each option, you might decide that one makes more sense for your situation than the other. Or you could decide that it would be prudent to invest in gold and crypto to diversify your portfolio as much as possible.

Here’s how they stack up against each other in some important categories:

Price Fluctuation

Let’s be clear: both gold and cryptocurrency have a track record of increasing in value year over

year. Nevertheless, some investors have a higher tolerance for risk than others. For that reason, it is helpful to note that the value of cryptocurrencies like Bitcoin are more likely to experience more dramatic ups and downs than gold.

Source: Investopedia (1/5/2022)

Although the price of crypto can be much more volatile than gold, there is also the potential of

higher short-term gains. As an investor, you should be realistic about how much risk you are willing to take before deciding whether gold or crypto makes the most sense. Alternatively, it might be wise to invest in both to hedge your bets against market fluctuations.

Gold and Crypto Regulations

One benefit that both gold and crypto have in common is their inherent safeguards against

being stolen or counterfeited. This is due in large part to the regulations surrounding how each commodity is produced and sold.

There are some major differences in the way each one is regulated, though. Since gold has been a valuable resource for thousands of years, there is a system in place to allow for safe and secure investments. Dealing with an authorized broker is one way to protect any such transaction.

Conclusion

Understanding the differences between gold and cryptocurrencies is essential for investors to make informed decisions. While gold has a long-established history as a reliable store of value and hedge against inflation, cryptocurrencies are relatively new and highly speculative assets with unique risks and opportunities.

Factors such as historical performance, market volatility, accessibility and portability, and role as inflation hedges should be carefully considered when comparing gold and cryptocurrencies in the context of investment.

Concerned that inflation is eating away at your regular IRA?

Are you looking to invest in a Gold and Silver IRA in 2025? With the right approach, investing in a Gold IRA can help you safeguard your retirement savings and achieve your financial goals. With so many companies out there offering these services, it can be hard to know which ones are the best. That’s why we’ve compiled a list of the top 5 best Gold and Silver IRA companies for 2023 based on our expert reviews on each of them.

Read our expert reviews on the top 5 Gold Investment companies below…

Top 3 Best Gold and Silver IRA Companies for 2025 | Expert Reviews

To learn more about Physical Gold and Silver IRA Investments you can read our Noble Gold expert review here.

Learn everything you need to know about Gold and Silver IRA Storage Options and Gold and Silver IRA Tax Implications by reading our Birch Gold Group in-depth review here.

You can learn more about Gold and Silver IRA investment strategies and the benefits of having a gold and silver IRA by reading our comprehensive insider guide on AHG here.

For just a brief summary of our top 3, visit our overview here.

It’s important for investors to conduct thorough research and seek professional advice before making any investment decisions.