What can gold do for you?

What can gold do for you? Well if you have you been to the supermarket lately or gone out to a restaurant, of filled up your tank with gas you probably have noticed that a dollar doesn’t go as far as it did just a few short months ago.

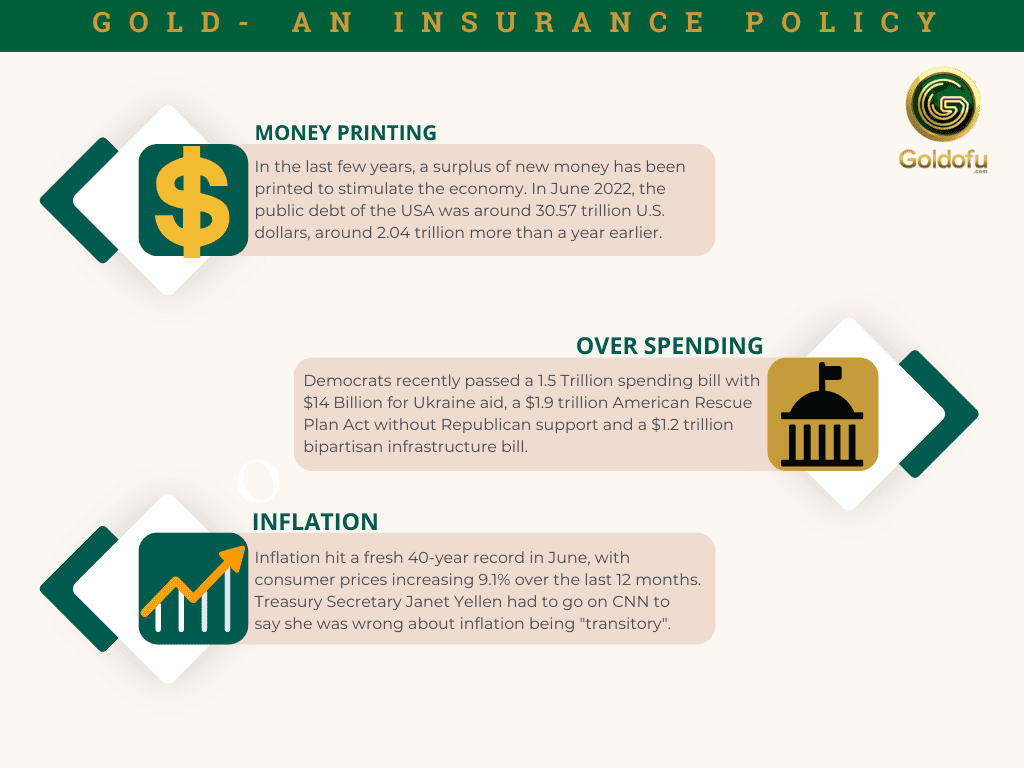

The BAD NEWS about rampant inflation is that it is likely to get MUCH WORSE before it gets better. Why? The short answer: It’s complicated. Prices for all types of goods and services have been trending upward throughout the Biden administration as deficits soar and domestic spending shows no signs of slowing down.

The current crisis in Ukraine is only exacerbating the situation with oil and other critical imports almost guaranteed to become more expensive.

As bad as things might seem right now, though, there is some GOOD NEWS! You have the power to do something about it! Even though you had nothing to do with the current crisis and have no control over the policies that have caused it, you do have an opportunity to protect your assets against a reckless, big-spending federal government.

Is it the right time to consider investing in GOLD?

There’s a reason this precious metal has been the standard for currency around the world for thousands of years. Gold doesn’t care who’s in the White House. It isn’t easily manipulated by deficit spending or international turmoil. It has historically outperformed the stock market in times of economic uncertainty. Most importantly, a central bank can’t simply print more gold like it can with paper currency.

Unfortunately, the U.S. dollar hasn’t been backed by actual gold for more than 50 years. We can easily see the results of this decision when the stock market tanked during the 1970s and again in the late 2000s, leading Americans to invest heavily in gold. Today, the dollar is facing new and even more frightening threats.

After the COVID-19 pandemic gave lawmakers the green light for TRILLIONS of dollars in new domestic spending, President Joe Biden continued to push for even more debt as part of a wide-ranging infrastructure plan.

While we can argue over whether this spending was necessary, one thing is clear: we’ll all pay for it eventually. Meanwhile, the value of the Russian ruble is in a freefall amid sanctions based on Vladimir Putin’s recent invasion of Ukraine.

Bad news about rampant inflation

Source: CNBC

Even though millions of ordinary Russians oppose the war, they are all bearing the cost of their leader’s actions. Americans are only fooling themselves if they believe nothing can threaten the value of the U.S. dollar.The bottom line is that no one knows what the future holds. If Democrats remain in power, an already unsustainable deficit is sure to only get higher.

The deficit for Fiscal Year 2020 was more than THREE TIMES higher than the previous year, and it’s only getting worse! (Source: Bipartisan Policy Center)

So why is gold different?

With a paper dollar standard, consumers must rely on the government to protect its value. Not only have such currencies failed repeatedly in nations around the world, but we all know that politicians aren’t doing enough to safeguard the U.S. dollar.

Meanwhile, central banks are heavily investing in gold as a safeguard against the dollar’s collapse – and you should be too!

Gold has intrinsic value and various uses in the booming tech and space industries – not to mention jewelry. For those reasons, it will never be a worthless commodity. As for those dollars in your wallet … who knows?

Conclusion: Even though gold prices have shot up due to geopolitical tension between Russia and Ukraine, experts have warned investors not to allocate more than 10-15% of their portfolio towards the precious metal.

Chirag Mehta, Senior Fund Manager, Alternative Investments, Quantum AMC said “While the Russia-Ukraine conflict will be in the headlines for some time now, investors must keep in mind that gold is not a tactical play.”

You owe it to yourself and your family to learn more about gold TODAY!